This segment is a worthwhile discussion on global credit markets, credit creation, what they are telling us about the global economy and why China cannot sustain global demand this time.

Economist Danielle DiMartino Booth does a virtual interview with Alfonso Peccatiello. Alfonso Peccatiello is a former Head of a $20 bn Investment Portfolio at a large bank and a passionate global macro investor. Here is a direct video link.

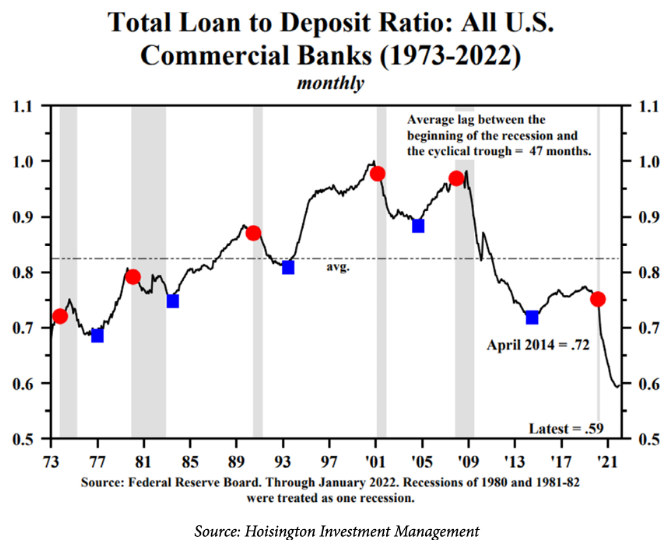

Below is Lacy Hunt’s chart of the U.S. loan to deposit ratio since 1973 (courtesy of John Mauldin) with the start of past recessions (marked with red dots) and the cyclical trough in credit creation (in blue), an average of 47 months later. The latest reading in loans to deposits is the lowest of the last 50 years and has seen no recovery since the 2020 recession began 24 months ago. This historically informative indicator suggests that while the 2020 recession was interrupted by pandemic emergency support, the downturn continues as credit cliffs follow credit highs.