Citing Fed Chair Powell’s recent inflation alarm, Goldman Sachs is predicting the U.S. central bank will hike policy rates half a percent at both its May and June meetings. The last time the U.S. Fed hiked by half a percent was May 2000, and the recession began ten months later. By the May 2000 hike, the Dow Jones Index had already topped in December 1999, the tech-heavy NASDAQ in March 2000. S&P 500 and resource-concentrated TSX peaks followed in August before all tumbled 47%+ over the next two years. The Fed was back to slashing rates with an emergency .50% cut by January 2001.

As usual, the bond market has pre-empted the Fed this cycle too. Treasury prices have already dropped to price in the seven planned rate hikes over the next nine months. In the process, financial conditions have tightened sharply, and a highly levered world is taking the rate of change hard.

Even though the highest risk corporate bonds have so far fallen less than Treasuries, their yields (borrowing costs for the companies) jumped above 6% yesterday from 3.5% in January 2021. See U.S. companies forced to pay up to borrow through debt markets.

With bank credit contracting for many months, public companies have relied on indiscriminate investor flows for financing. Now it’s not just more loans that are harder to find. The ongoing bear market in stocks has dampened equity investor appetite too, so far, by wiping 31% off the average company share in the Russell 3000 index — one of the broadest U.S. stock market gauges. Refinitiv data confirms that cash raised by companies through equity sales has fallen 88% year over year–the slowest start to a year since 2009 during the great financial crisis. A cash crunch is spreading, and this cycle, there are more zombie companies–who must borrow to stay afloat–than ever.

Higher rates and safe-haven appeal boost the U.S. dollar, and emerging markets are wobbling as their currencies fall, borrowing costs rise, and slower global growth cuts demand for their exports. See: Will the Fed sink emerging markets (again)?

The yield on the 10–year Treasury bond is now an enticing full percent more than the S&P 500 dividend yield. Unlike bonds, stocks offer no return of principal nor guaranteed income stream. And after the latest bear market bounce, the downside for stocks continues to be breathtaking. Here’s a top-down view of the S&P 500 over the past year, followed by the NASDAQ composite beneath it since 1997 (both courtesy of my partner Cory Venable).

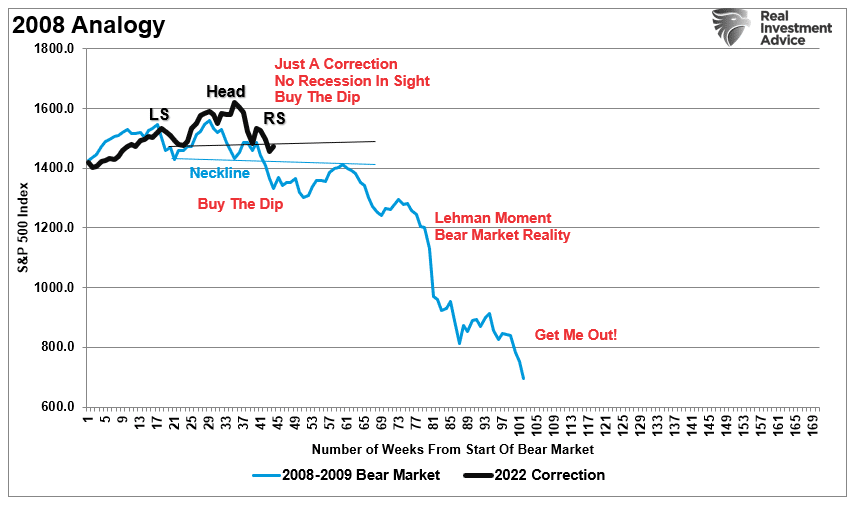

And lastly, here’s a little noodle burner comparison from Lance Roberts of the S&P 500 in 2008 (in blue) versus the 2022 correction to date (in black). What’s your risk management plan?