As household savings and cash flow have been increasingly needed for basic necessities like food, fuel and housing, the economically-sensitive household spending intentions on durable goods have tumbled to the lowest level since the double-dip recession of 1980-81. One of the most impactful sectors here, auto sales fell to a 13.33 million annualized rate in March, down 30% from their cycle peak last April (shown below).

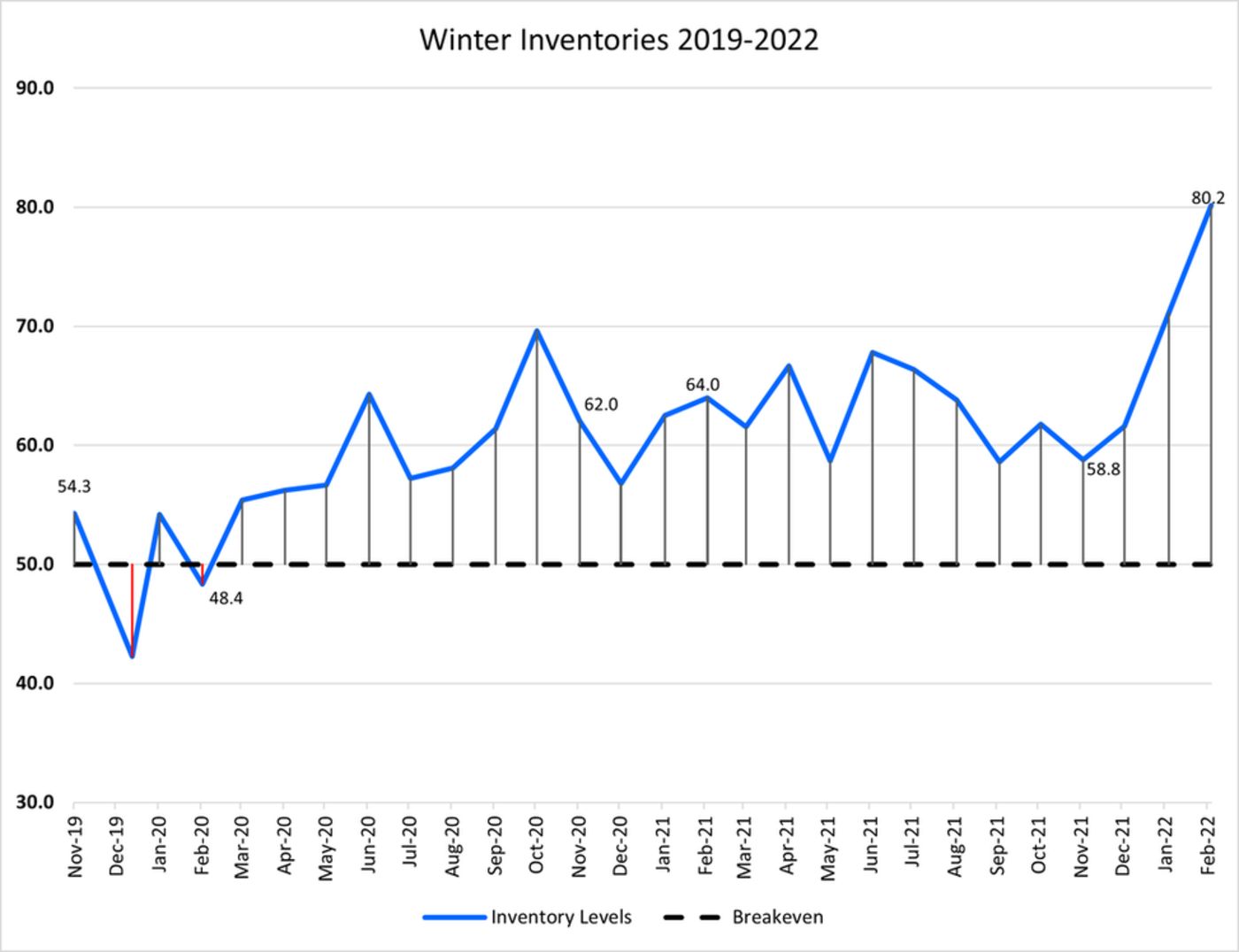

At the same time, importers of durable goods, stressed by supply chain disruptions during the pandemic, over-ordered goods in anticipation of a continuation in elevated demand. This has helped to push inventories (logistics managers index below) to a record high above 80 as of February data. Inventory overbuilds typically lead to deflationary liquidation cycles and economic weakness as prices get marked down to clear.

Inventory overbuilds typically lead to deflationary liquidation cycles and economic weakness as prices get marked down to clear.

The transportation sector also ramped up its fleets for hire since 2020. In the chart below, forty-two-year transport vetran Craig Fuller shows that trucks in the market recently surpassed freight volume as they have at other cycle tops. (blue= trucks in the market; green = truckload volume).

Craig doesn’t think this time is different, as he explained on Twitter last week:

I’ve heard in every cycle all the reasons that “this time is different.” It never is. The trucking market always over builds and then crashes. Always. Buckle up – its going to be a tough ride from here. End.

— Craig Fuller 🛩🚛🇺🇦 (@FreightAlley) March 29, 2022