Building off of their analysis in Part 1 of this interview, David Rosenberg & Stephanie Pomboy continue explaining why a recession looms dead ahead, one likely to be accompanied by serious downward corrections in stocks, bonds (except long-dated US Treasurys), real estate and many other assets. Here is a direct video link.

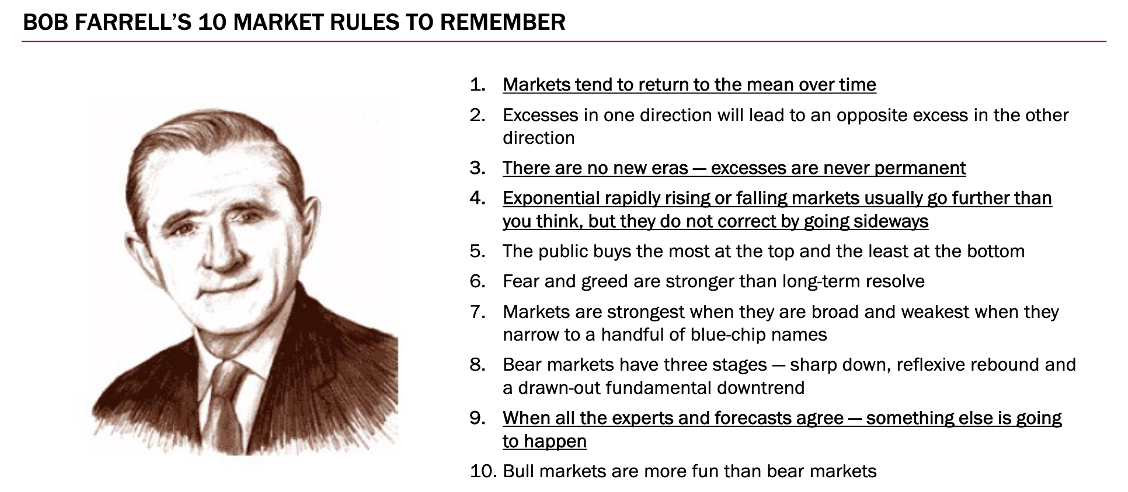

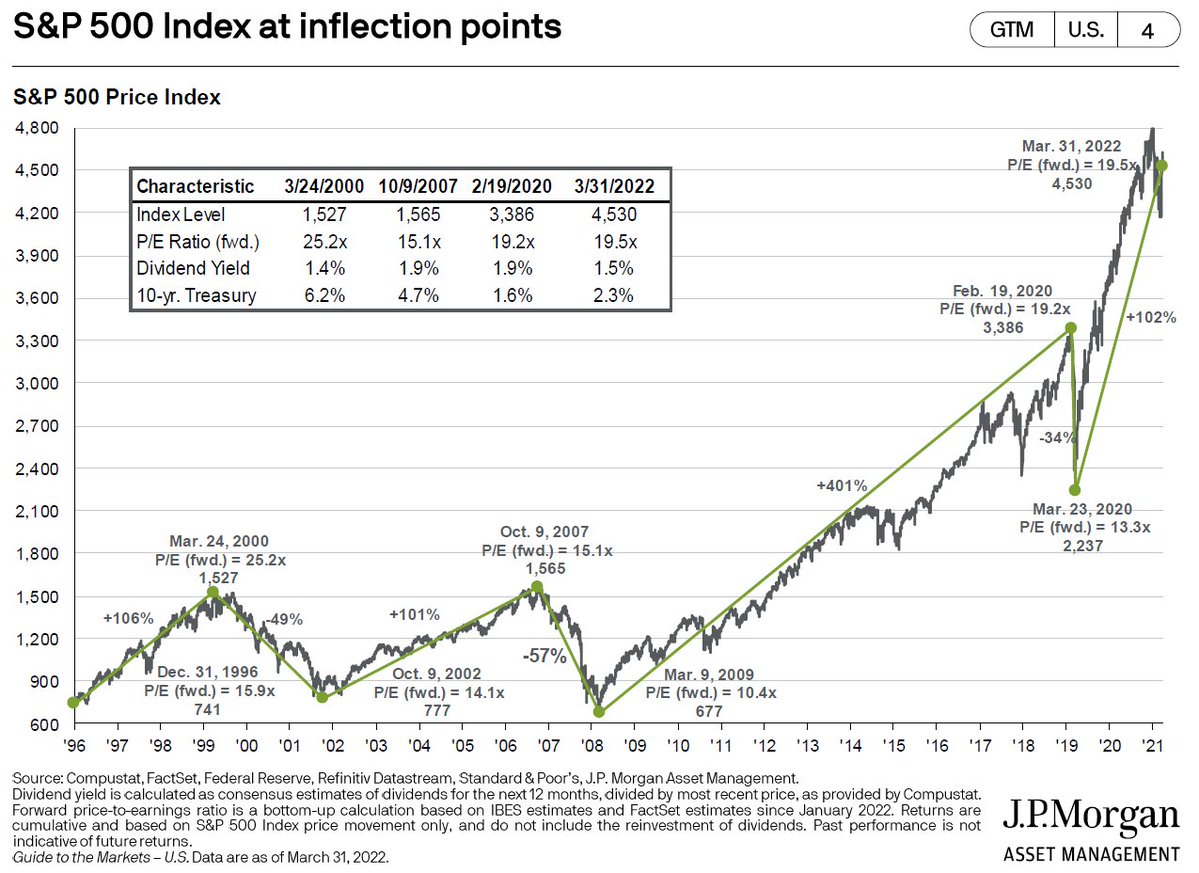

If you’ve not yet watched Part 1, you can do so here. For your reference, we include Bob Farrell’s time-tested ten market truisms below, as well as a big picture chart of the S&P 500 since 1996. The 1500 area of the 2000 and 2007 cycle peaks (from 4400 now) would be a historically ‘normal’ retest area. Believe it or not.