As we await the next rate hike from the US Fed, some big picture is worth considering.

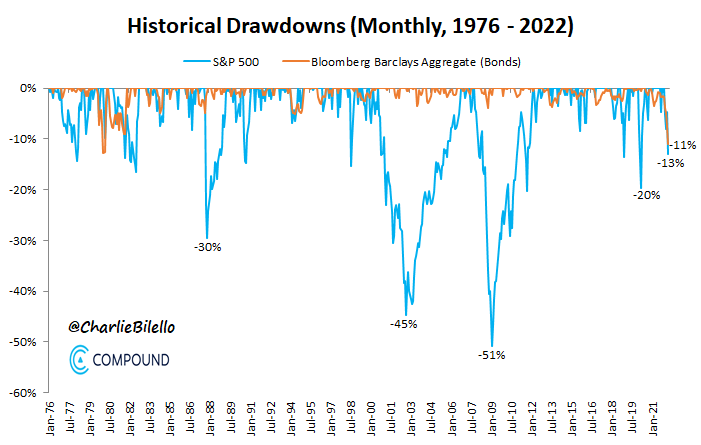

As shown below, courtesy of Charlie Bilello, year to date has been the most negative start for stocks (S&P 500) and bonds (aggregate index of investment-grade bonds) together since at least 1976, and the first time that both have lost more than 10% at the same time.  Moreover, while the -11% decline for bonds (yellow below) has already been the worst on record, it bears mentioning that the -13% for large-cap stocks (blue line) is just a fraction of the total index drawdown seen in the recessions and bear markets of 2020, 2007-9, 2000-02 and 1987-88. Beyond the broad S&P benchmark, 45% of NASDAQ 100 stocks are already off more than 50%, which only happened as part of the larger-than-historically-average bear markets of 2000-02 and 2008-09.

Moreover, while the -11% decline for bonds (yellow below) has already been the worst on record, it bears mentioning that the -13% for large-cap stocks (blue line) is just a fraction of the total index drawdown seen in the recessions and bear markets of 2020, 2007-9, 2000-02 and 1987-88. Beyond the broad S&P benchmark, 45% of NASDAQ 100 stocks are already off more than 50%, which only happened as part of the larger-than-historically-average bear markets of 2000-02 and 2008-09.

The last eight times the S&P 500 was down in a calendar year, bonds finished the year up as higher interest rates slowed consumption and inflation. The question is: will this time be different?

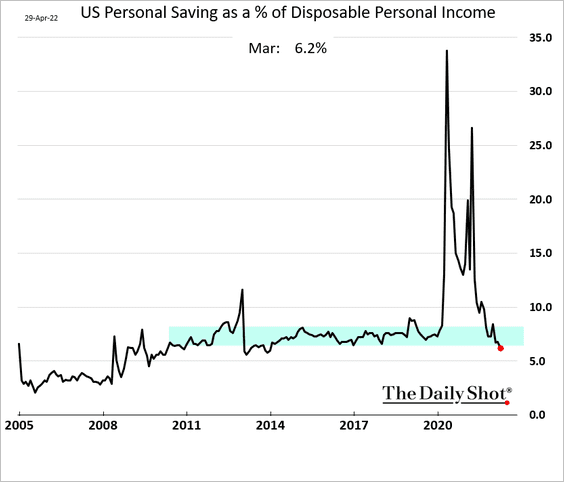

So far, the Universit y of Michigan’s April consumer sentiment poll found the percentage of households still bullish on the stock market at a high 56.6% and those bullish on bonds tied for an all-time low of just 3% (Rosenberg Research). At the same time, cash levels and personal savings as a percentage of disposable income (on the left since 2005, courtesy of The Daily Shot) have fallen back to pre-pandemic lows. The liquidity crunch and capitulation selling for ‘weak hands’ has barely begun. And they’re not holding bonds.

y of Michigan’s April consumer sentiment poll found the percentage of households still bullish on the stock market at a high 56.6% and those bullish on bonds tied for an all-time low of just 3% (Rosenberg Research). At the same time, cash levels and personal savings as a percentage of disposable income (on the left since 2005, courtesy of The Daily Shot) have fallen back to pre-pandemic lows. The liquidity crunch and capitulation selling for ‘weak hands’ has barely begun. And they’re not holding bonds.