Worthwhile discussion in this segment in terms of the bear market progress and sentiment to date and the value of cash in softening portfolio declines and preserving liquidity.

Even though both the stocks and bonds have had a dismal start to the year, most investors aren’t panicking yet. Instead, there’s a lot of talk about the bottom being near. And hope that much of the recent losses can be regained. That kind of optimism isn’t seen in a real bear market, cautions seasoned financial advisor Ted Oakley, Managing Partner & founder of Oxbow Advisors. In a true bear market – which he sees as likely to arrive as the year progresses – pessimism rules. It gets to the point where no one thinks stocks can ever go up again. We’re far from that kind of capitulation in sentiment right now. Here is a direct video link.

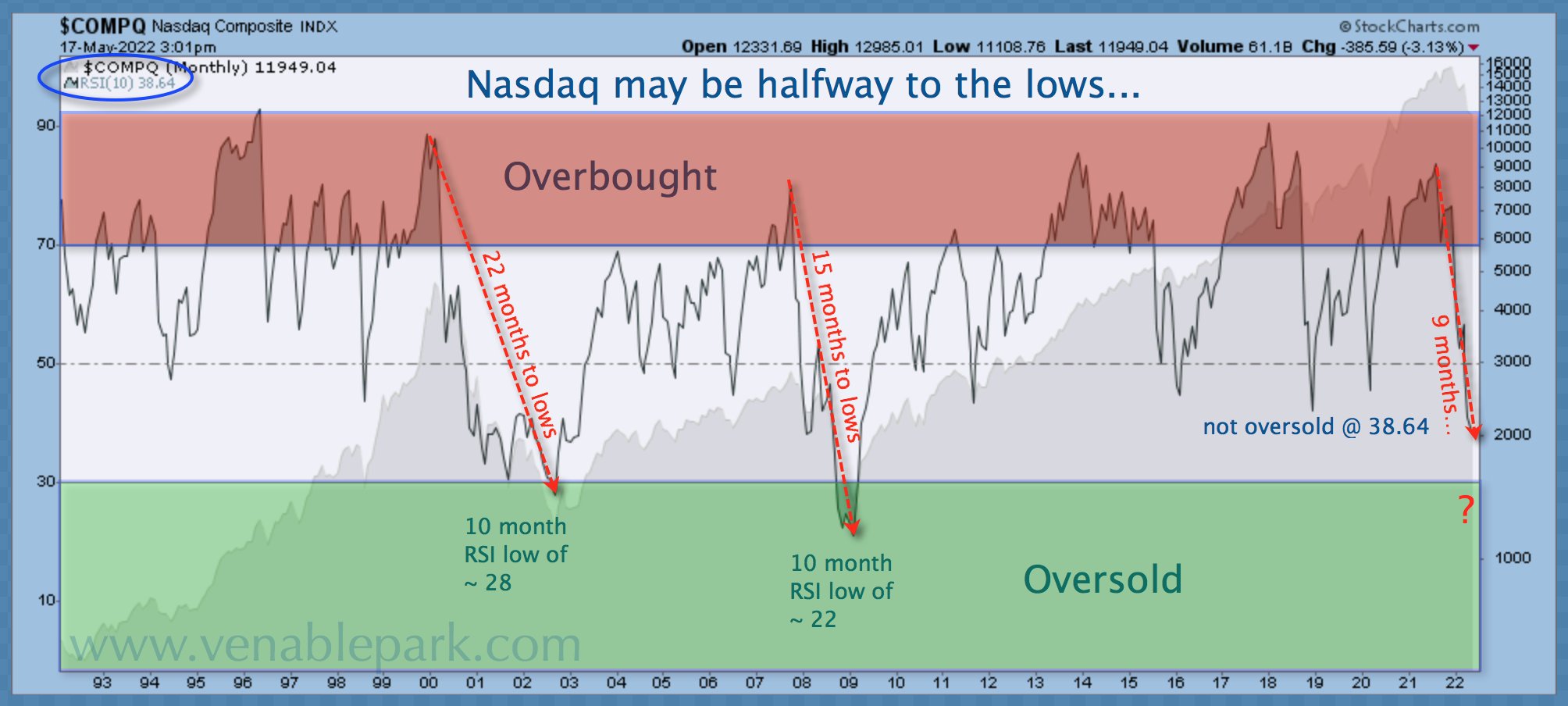

My partner Cory Venable’s latest analysis of the NASDAQ’s 10-month relative strength indicator since 1992 (below) suggests that the 25% decline to date may be the midpoint of the ultimate loss this cycle. Not nearly oversold yet.