Target joined other major retailers and warned this morning that its profits will take a hit as it takes aggressive steps to eliminate excess inventory. See Target shares fall 8% as it expects squeezed profits from aggressive plan to get rid of unwanted inventory:

The retailer slashed its profit margin expectations for the fiscal second quarter to account for a wave of goods winding up deeply discounted or on the clearance rack…

Retailers from Walmart to Gap face a glut of inventory as inflation-pinched shoppers skip over categories that were popular during the first two years of the pandemic. Gap, for instance, said customers want party dresses and office clothes instead of the many fleece hoodies and active clothes the company has. Walmart said some families are making fewer discretionary purchases as the prices of gas and groceries rise. Abercrombie & Fitch and American Eagle Outfitters both reported a steep jump in inventory levels, up 46% and 45%, respectively, from a year ago from a mix of items not selling and supply chain delays easing.

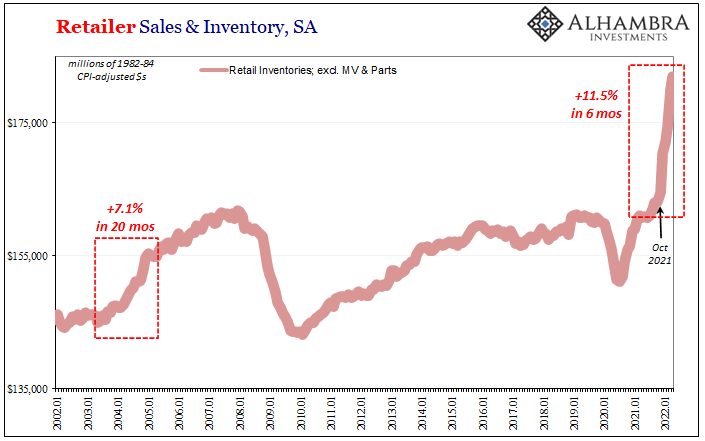

Alhambra Investment strategist Jeff Snider has been charting the record build in retail inventories. Ex motor vehicles and parts (below adjusted for inflation), inventories have surged 11.5% since last October and surpassed the previous record of a 7.1% build over 20 months from 2003 to 2005 (as the last US housing bubble and refi cash outs peaked).

This was the fastest and largest build of excess inventory in at least 30 years. Jeff Snider discusses these developments in this video clip.

The catalysts for this downshift are higher interest rates and the fact that consumers borrowed and bought all goods during the first two years of the pandemic. Now the masses are stuff-heavy and cash-light; pent-down demand is the predictable hangover.

US auto sales have fallen 25% year over year and home sales 27%. Previous such declines have only occurred in the context of recessions.

At the same time, rising operating costs, interest rates, and weaker demand are prompting many to list existing real estate for sale. A record supply of multi-and single-family new home construction will also help to tamp down prices—# lotsmoresupplyondeck.

That’s good because real personal disposable incomes have been flat or negative in each of the past nine months, and the University of Michigan consumer sentiment index hit an 11–year low in May, with consumer spending plans at lows seen in the proximity of past recessions.

As sales slump and inventories build, productivity is declining and layoffs are naturally starting to rise. As we move forward, it will be harder for many to meet their payments.

Liquidation is the next phase of this cycle, and it will help deflate the cost of living and bring deals for cash buyers. For those debt-heavy and cash-light, it’s going to be harsh.

For the first six months of this downcycle, equities, cryptos, most commodities, corporate debt and government bonds have sold off together. As the narrative moves from scarcity and inflation to surplus and disinflation, corporate profits will slump, and principal security will be in high demand. Cash and the highest-quality bonds are due to be the next hot commodities.