The policy-inspired and behaviour-driven ‘everything bubble’ is fulfilling its destiny, morphing into the everything bust.

Cryptocurrency grand-daddy Bitcoin is off 70%, and others in the space are faring worse. Two trillion in sketchy market valuation has been vaporized in the crypto space alone. The much-hyped Purpose Bitcoin ETF, Canada’s first crypto ETF touted as an “innovation” “helping” people get into the crypto space, is -71% since November.

Another $10 trillion in market cap has been deleted with the S&P 500’s 22% tumble. The NASDAQ is -32% in seven months, and we might be halfway through this bear market. Large-cap stocks typically don’t bottom until the economy is in the latter third of a recession, the US central bank is back to easing monetary conditions, and the US 10-year Treasury Bond has rallied enough that its yield falls an average of 160 basis points from the high (hat tip: Rosenberg Research). Today, a recession has not yet been recognized, and central banks are still racing to outdo each other with the most aggressive tightening efforts in decades.

For the first four months of this year, so-called value companies were holding up better than growth names, but since April, both are tumbling together. Likewise, bonds of all credit grades have seen the most negative price action since 1940.

Initially, attention was mostly on rising rate expectations with little focus on the relative resources of borrowers. As risk-seeking appetite persisted, high-risk corporate bonds sold off less than investment grade and government treasuries into April. This is short-sighted because government bond yields set interest rates in the economy, and their sharp repricing is now hitting hard. In just one shocking wallop: 30-year US mortgage rates hit 6.28% this week, from 5.5% last week and 2.9% one year ago. Budget-blowing for borrowers.

With cheap money evaporating, the realization is spreading that governments have taxation ability and the deepest resources while companies and households will have more trouble refinancing debts and meeting payments. See the WSJ.com The Fed Pricked The Everything Bubble:

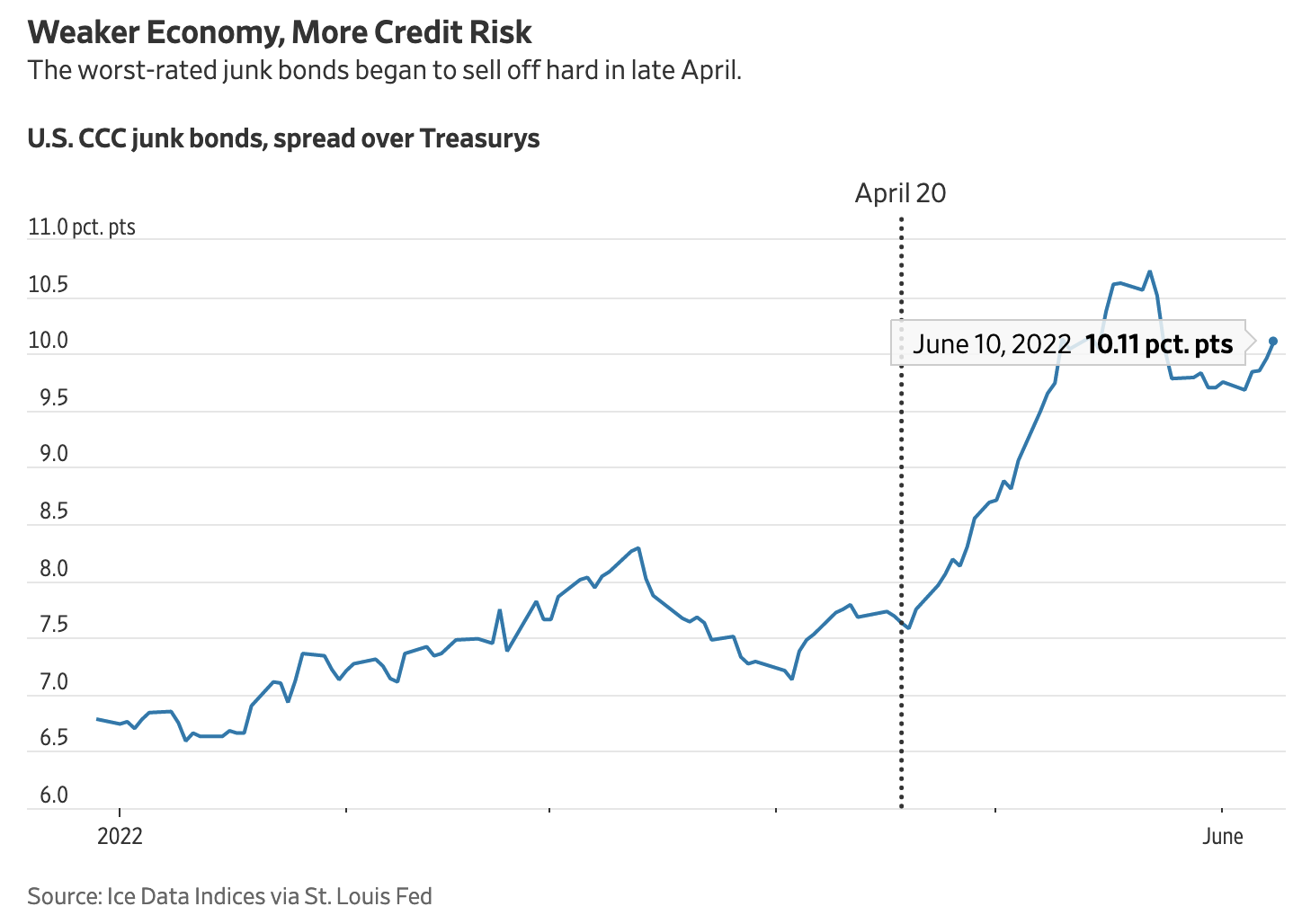

Until late April, the weakest junk bonds, those rated CCC, had fallen mostly in line with Treasurys. It was only last month that they sold off much more than safe government bonds, as fears rose that Fed tightening would create trouble in the economy.

Since April, as shown above, the weakest public corporations (CCC credits) have seen their borrowing costs leap from 7% to more than 10% above treasuries–a 30% increase in two months.

When money is virtually free for borrowers and near-nil yielding for investors, many people do dumb stuff with it. But when rates rise sharply, the riskiest bets blow up, and investors get reminded that capital options are far from equal.

Return of principal matters most in the end; only bonds are obliged to return it, and borrowers’ ability to do so varies greatly. Credit quality is the next big theme for markets to reprice.