After leaving base rates in the banking system at zero for two whole years (March 2020 to March 2022), the US Fed hiked yesterday for the third time in as many months, this time going a panicked .75– the first such single increase since 1994. It’s now expected that the Bank of Canada will follow suit on July 13 and a stream of hikes into 2023.

The two years of policy-enabled ‘free money’ (cheap credit and government largesse) helped fuel a consumption boom amid supply disruptions caused by the first global pandemic in 100 years. Fuel and food supplies were further stressed by Russia’s February 24 invasion of Ukraine. Together, these factors inflated the cost of housing and most goods to unsustainable levels.

Now, central banks are responding to public and political angst by aiming to ease inflationary forces through demand destruction (aka recession). Plunging asset prices and economic activity suggest they are starting to succeed. The first quarter US GDP growth was -1.5% and Q2 is now tracking at zero. Excess supply, disinflation and falling Treasury yields follow–inflation always falls during recessions.

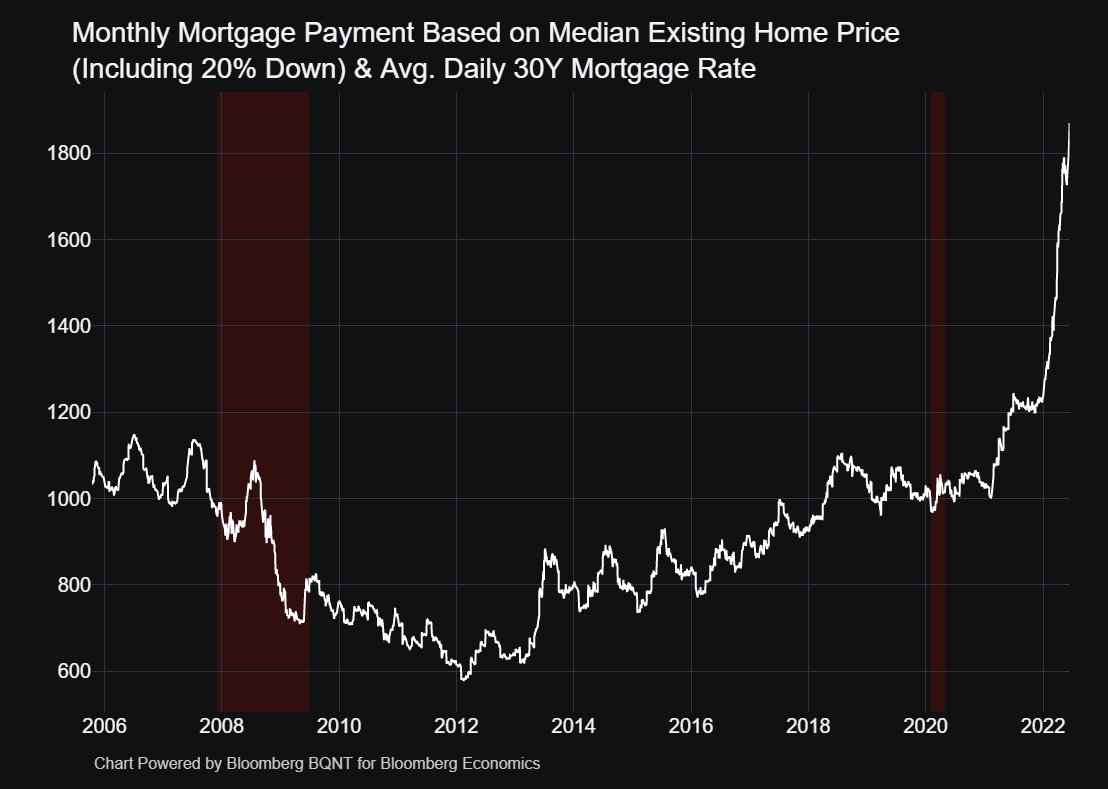

Lofty home prices plus sharply higher interest rates drove a 50% increase in America’s median monthly mortgage payment over the past six months (shown below, assuming a 20% downpayment). Even worse in Canada because Canadian median home prices came into this rate crunch an excruciating two times higher than America ($816,000 vs $375,000 in March 2022). The pain in shelter costs comes with a 50% leap in the median price of gasoline year to date and a 10% increase in average food costs, while the median average hourly wage has risen just 3.3%. Households cannot make these ends meet and with home prices starting to slump, the refi ATM is no longer cooperating. No wonder credit card usage has surged–the last of the lifelines for many. Layoffs are now beginning.

The pain in shelter costs comes with a 50% leap in the median price of gasoline year to date and a 10% increase in average food costs, while the median average hourly wage has risen just 3.3%. Households cannot make these ends meet and with home prices starting to slump, the refi ATM is no longer cooperating. No wonder credit card usage has surged–the last of the lifelines for many. Layoffs are now beginning.

The prior errors of too much slack are becoming a collective comeuppance—lots of pain to go ’round.

Danielle DiMartino-Booth offers an excellent summary in this segment. Here is a direct video link.