There’s now much talk of home prices “crashing,” but few were ringing alarm bells as they leapt 50% over the prior two years. Housing has always been a cycle driven primarily by credit. Because the latest boom went on longer than average, most people stopped thinking of housing as a cycle, which was an error. We are now in the much-deserved (and needed) correction phase, and historical precedents suggest downsizing the bloated sector, and prices should continue for years, not months.

Here is a direct video link.

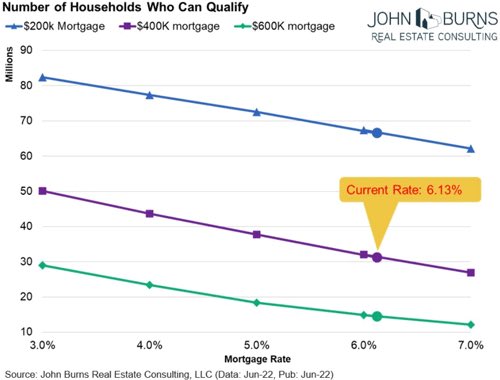

The chart below, courtesy of John Burns, captures the impact of rising mortgage rates well. With the US 30-year mortgage rate rising from 3% to 6% year-to-date, some 18 million US households can no longer qualify for a $400,000 mortgage–a 36% reduction in demand. Similar impacts are felt in Canada, where the median mortgage balance nationally at the end of 2021 was more than 358K, closer to 500k in Ontario and BC.

Sorry folks, but the dream that a hoped-for 431,645 new Canadian immigrants this year can somehow pick up the economic and housing market slack for millions of Canadians who have to curtail spending is unrealistic.