As Canadian Rogers customers experienced a national service outage last Friday, the loss of phone, internet, and some banking services underscored the limitations of virtual systems and currencies when power or internet access becomes unavailable. Having some physical cash in the currency we pay our bills has always been a good idea.

Meanwhile, cryptos are landing a predictable punch in the face. While most digital tokens have lost 70 to 100% of their market price since November, account holders at the leading cryptocurrency exchange Coinbase complain that they cannot withdraw dollar proceeds after crypto sales. Liquidity-not. Customer options are limited since the crypto space remains largely unregulated.

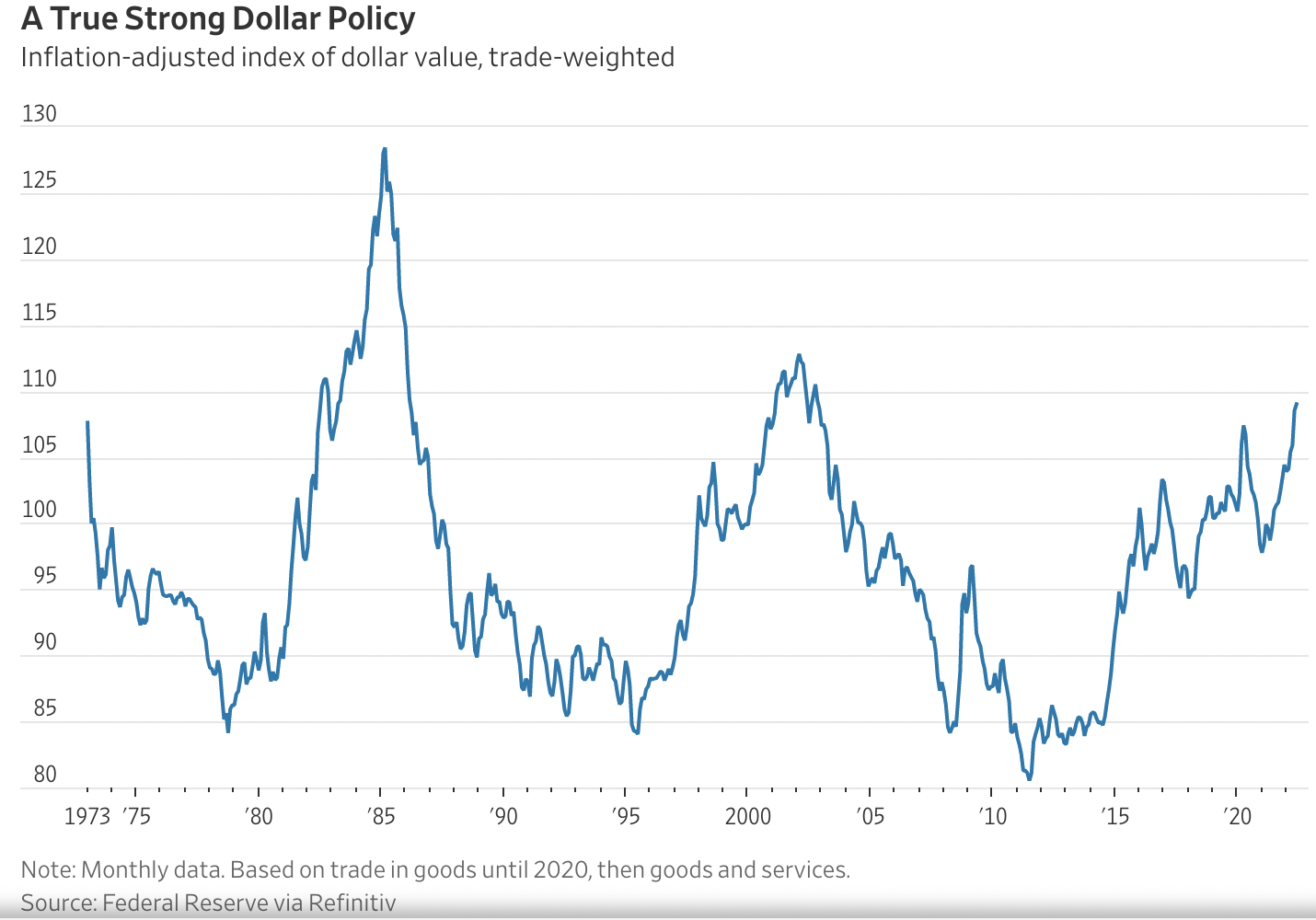

At the same time, the US dollar index (DXY below-against a basket of global trade currencies since 1980) touched a new 20-year high yesterday at 108–a level not seen since July 2002.

The greenback is now around parity with the euro for the first time since 2002 and the strongest against the yen since 1998; see Strong Dollar Wins the Inflation Battle in New Spin on Currency Wars:

The greenback is now around parity with the euro for the first time since 2002 and the strongest against the yen since 1998; see Strong Dollar Wins the Inflation Battle in New Spin on Currency Wars:

Adjusted for inflation, the dollar has been stronger when weighted against the country’s trading partners only twice, in 2002 and 1985. (Charted below since 1973.)

With the US central bank tightening monetary conditions the most in decades, US treasury yields are relatively higher than most developed countries. The surging USD magnifies the cost of critical commodities (priced in USD) and US debt repayments for international consumers and debtors while weighing on the 40% of S&P 500 sales generated outside of America. As pointed out by Morgan Stanley, every year-on-year percentage increase in the DXY is approximately a 0.5x hit to EPS growth. Hence, the 16% increase in the USD index level since last July translates to an 8% decline in S&P 500 EPS growth (from currency alone). Coming off double-digit earnings growth during the pandemic, earnings per share are ripe for markdowns–mind the “E” in consensus P/E assessments.

USD is hovering at 1.30 CAD for the third time since May. As shown below by my partner Cory Venable, the greenback’s relative strength this year (despite the surge in oil prices) reminds of similar flight-to-safety cycles in 2008-09, 2015-16, and 2017 to March 2020.

As economic weakness and financial turmoil spread in 2022, slumping commodity demand and teetering home prices present a perfect storm for highly leveraged Canada. A push back into the 1.40s per USD remains our base case (circled in the green box above).

The weaker loonie will make some Canadian exports more attractive, but orders tend to shrink in recessions. Meanwhile, liquidity problems, bank runs, bursting asset bubbles, and domestic unrest suggest China’s unlikely to buy up the global slack this time as it did in 2008 and 2011. Indeed, excessive stockpiles suggest they could even be net sellers; see China’s Steel Industry Sounds the Alarm over Crisis Conditions.

The recovery from recession this cycle may be slower than most can imagine.