Canada’s housing market continued to weaken for the third month in June, with an average selling price of $665,850, down 18.5% from a record $816,720 in February 2022.

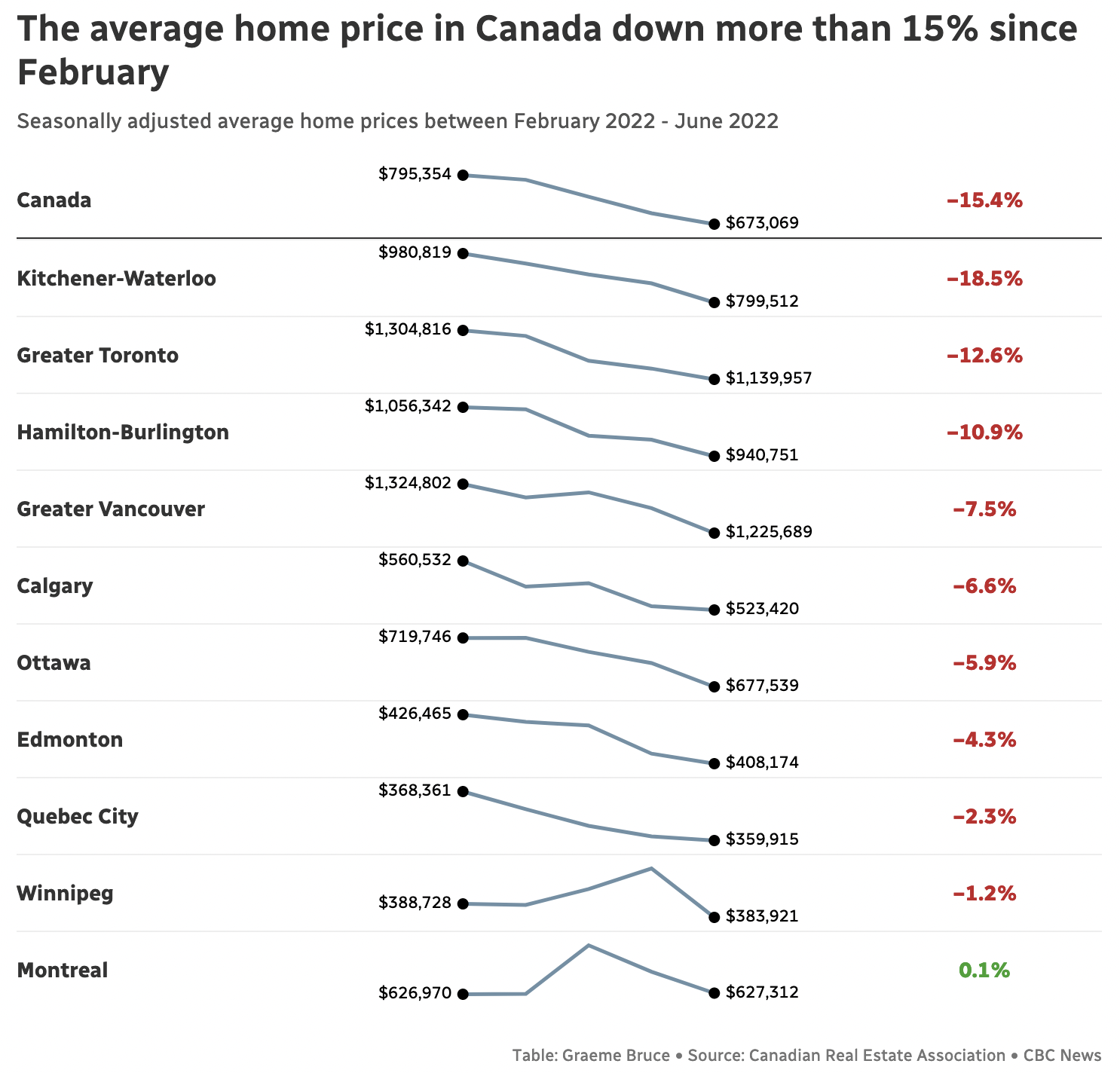

Sharply higher interest rates and some of the world’s most unaffordable home prices have shrunk the pool of able and willing buyers even as Canadian unemployment remains near cycle lows. The volume of home sales nationally was down 5.6% in June and nearly 25% year over year (CREA). The supply of new listings increased 4.1% from May to June. See Canadian home prices spiral down in June:

Home prices tumbled across the country, especially in the B.C. Interior and throughout Ontario, including cottage country and smaller cities, where property values had almost doubled over the first two years of the pandemic. In Ontario, the home price index for the Kawartha Lakes region fell almost 11 percent from May to June, while Woodstock-Ingersoll, Simcoe and London each lost more than 5 per cent over the same period.

The seasonally adjusted home price change nationally and in the largest cities appears in the table below. Even so, after freakish gains from June 2021 to February 2022, the average selling price last month was just -1.8% from a year ago #barelystarted. See Pace of real estate slump quickens, with sales and average prices down from last year.