Some 65%+ of households in Canada and the US own real estate. While the most affluent 10% own 89% of the stock market (in some form), the bottom 90% own 55% of all real estate.

Being the lion’s share of household net worth, what happens in the housing sector is the most significant driver of consumer spending and economic growth.

Daily changes in bond prices define their yields and set the base for commercial and consumer mortgage rates. For this reason, real estate is one of the first sectors to respond as interest rates change for new loans and those coming up for renewal.

Below-average interest rates in 2020-2021 helped realty prices go parabolic into early 2022. Followed by a rapid rate increase during the second quarter this year, housing became the least affordable (and unsustainable) since the cycle top in 1989. Not surprisingly, home sales have collapsed over the past five months amid the sharpest price declines since 1989.

US mortgage applications fell to a 22-year low in August, down 62% year over year. Equity withdrawals from the home ATM also closed: refinancings were down 82% year over year.

The average home sale price in Canada during July was 17% lower than in February and -5% year over year, with similar trends unfolding in America and China (the world’s two largest economies).

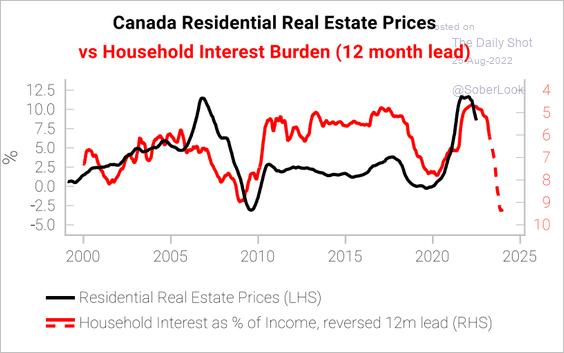

As shown below, since 2000, the change in interest costs as a percentage of household income has historically led residential prices by 12 months and suggests that home prices should continue to fall over the next year (at least).

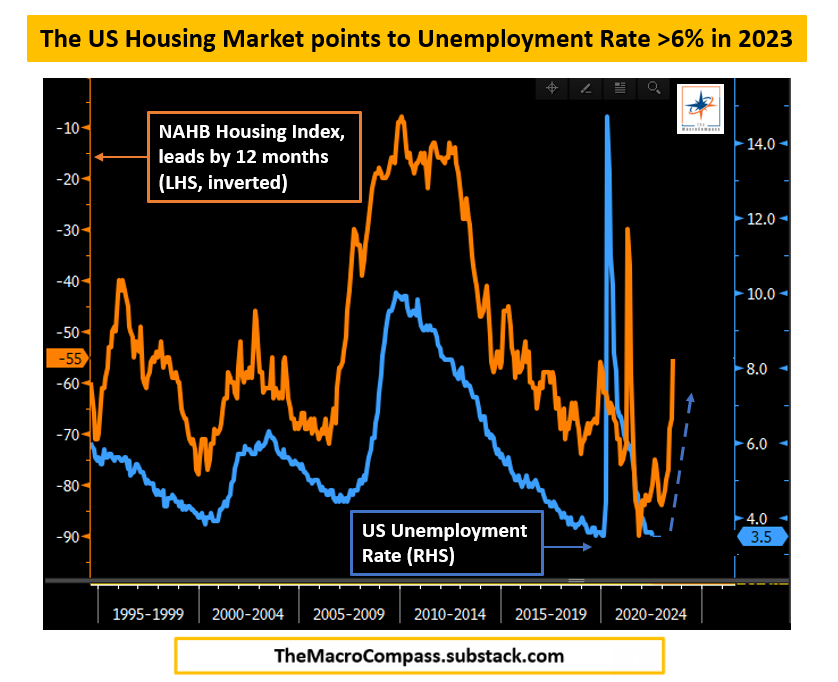

The good news is that shelter costs make up 32% of the consumer price index (CPI), so falling home prices are a disinflationary force with a 12-month lag. The bad news (shown below, since 1995) is that housing also leads the unemployment rate and suggests rising job losses over the next year. Historically, the deepest recessions and financial market dislocations have coincided with housing downcycles. The evidence is very clear.

The segment below offers a helpful overview of the latest US data.

The housing market is tipping into correction before our eyes. Home sales are dropping nearly 50% in certain markets. Listings inventory is ballooning. Price reductions are spiking.

Perhaps this is all as should be expected when mortgage rates double in the span of a single year. But this is only just the beginning warns housing analyst Nick Gerli. He expects the price corrections to get much deeper as we head into 2023. Here is a direct video link.