Subprime loan delinquency rates are higher than the 2008 recession levels today, with unemployment still near all-time lows and the layoff cycle just beginning…

Danielle DiMartino Booth, CEO and chief strategist of Quill Intelligence, joins Jack Farley to ring the alarm bell about the housing and auto markets, which by her reading of the data are quickly deteriorating. Booth notes that while the credit quality of mortgages remain high, the mortgage origination market itself falling sharply and, because of a “biblical” quantity of single-family houses about to hit the market, Booth expects housing prices to continue to fall. Booth argues that the car loan market is in even worse condition, as car note defaults mount, the car values plummet and the jubilee-like monetary conditions of 2020 and 2021 wither away. Here is a direct video link.

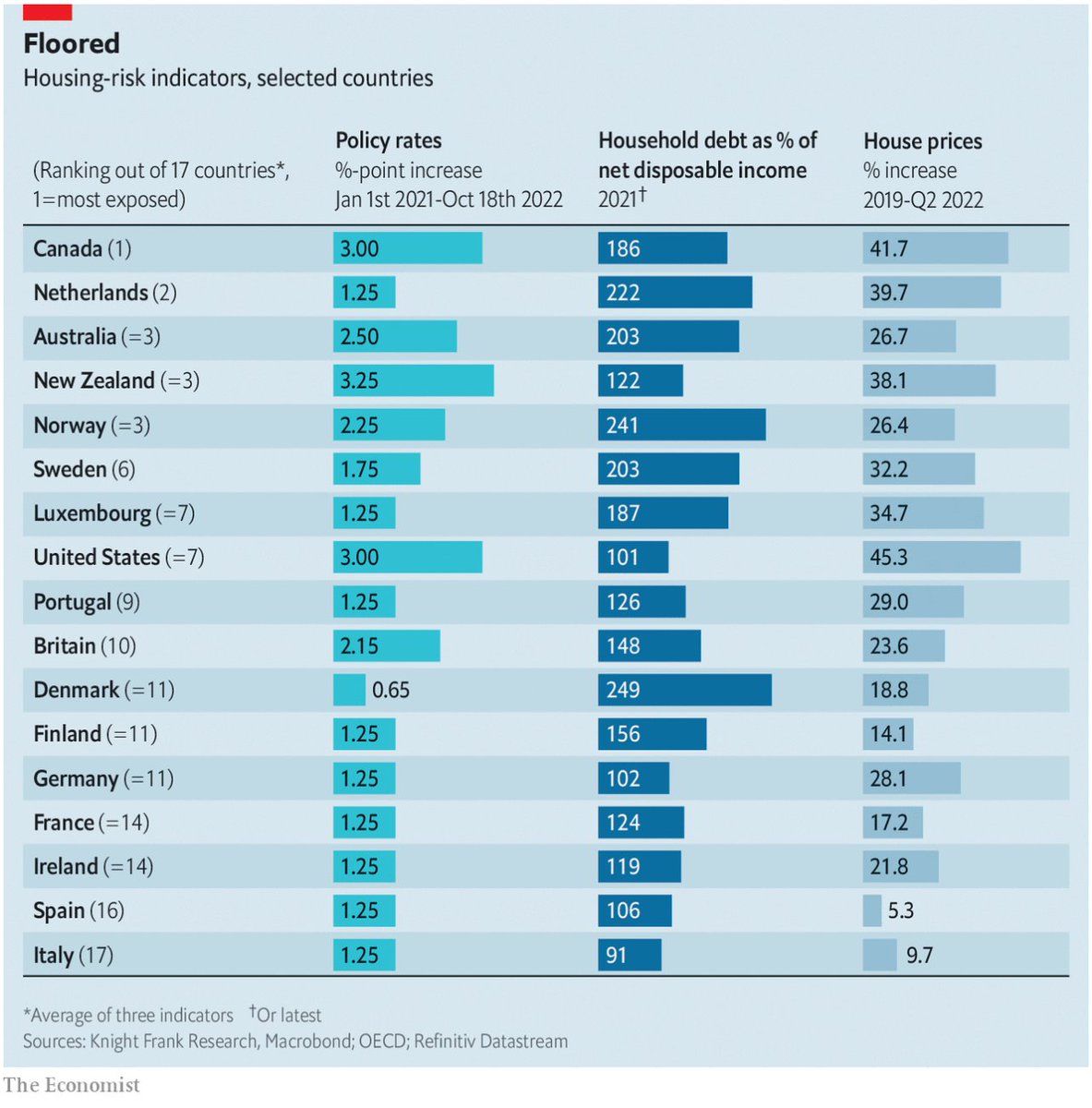

Further to this discussion, as shown below, Canada is top of housing-risk downside globally.

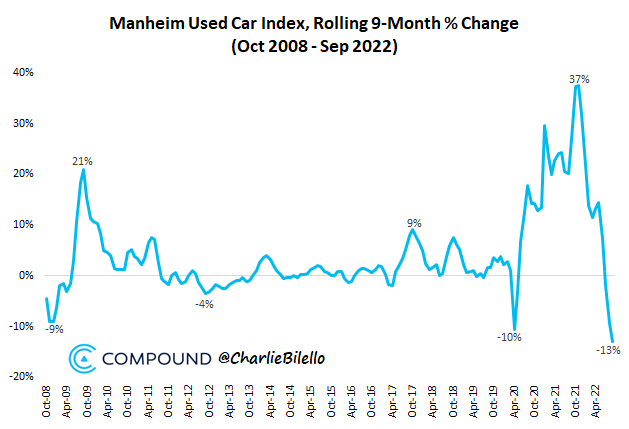

What goes up above average comes down more than average (mean reversion folks!) Below we have used car prices since October 2008.And here’s Canada tech star Shopify from the most expensive company in the TSX index last November to -82% since (adjusted for 10-1 stock split).

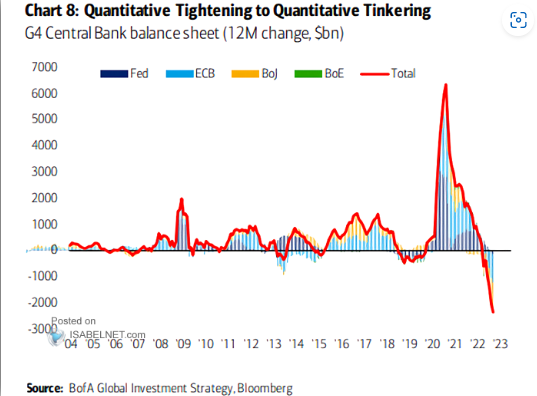

While central banks have vowed relentless rate hikes (caveat: until something big breaks) as shown below, they have just barely started quantitative tightening (QT) in 2022. For public optics sake central banks may well pause QT before they stop hiking rates. Risk markets are likely to rally on news of slower monetary tightening (less QT/smaller rate hikes), but historically, market bottoms do not come until 70% through recessions when the next rate cutting cycle is nearing an end.