So far in 2023, value-indiscriminate buyers are still pounding into the riskiest low-yielding assets with wild abandon.

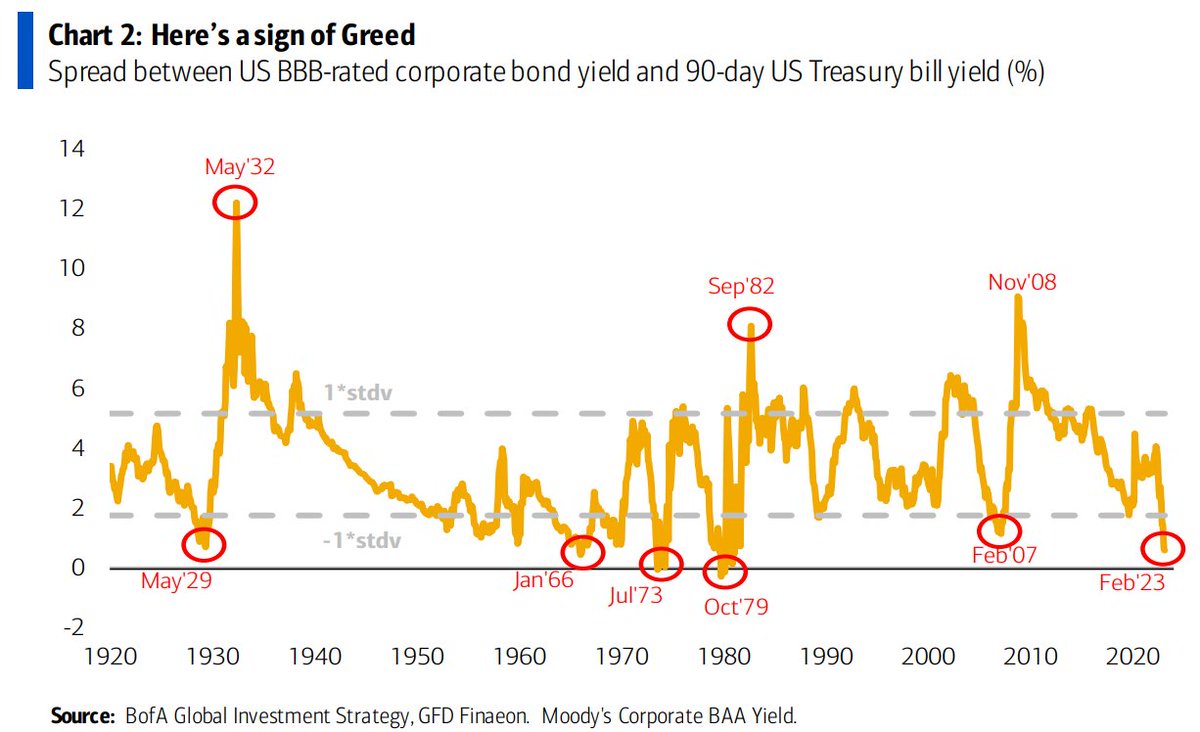

Take BBB-rated bonds-whose credit quality is just one level above “junk.” At past cycle bottoms (attractive investment opportunities), the US Fed had raised short-term rates enough that defaults spiked and BBB bond prices fell more than 20%–enough to push BBB yields 500 to 1200 basis points above cash-like 90-day Treasury yields. Fat yield spreads above risk-free rates are also known as an attractive reward for capital risk. As shown below, since 1920, this month, BBB bonds are yielding about 100 basis points above 90-day Treasury yields and in line with the most epic cycle tops in 2007, 1979, 1973, 1966, and 1929.

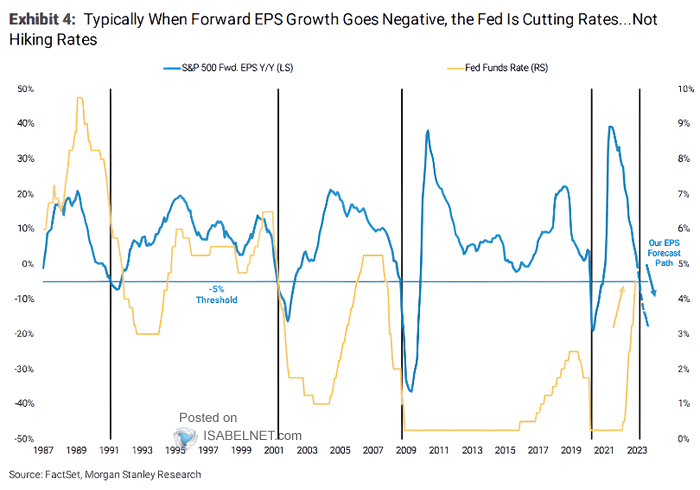

At the same time, year-over-year forward earnings per share growth (S&P EPS below in blue since 1987) has gone negative in 2023 as in the recessions of 2020, 2008, 2001 and 1991 (black lines below courtesy of ISABELNET.com). In each of these prior instances, stock prices went on to experience a much-deserved liquidation sale as momentum shifted from positive to negative earnings growth.

Despite the losses since late 2021, white-knuckle gambling to the death remains a popular pastime. This warns that risk markets remain near a cycle top. An attractive buying opportunity is not yet in sight. In the meantime, the highest cash-like yields since 2007 are paying us to wait.