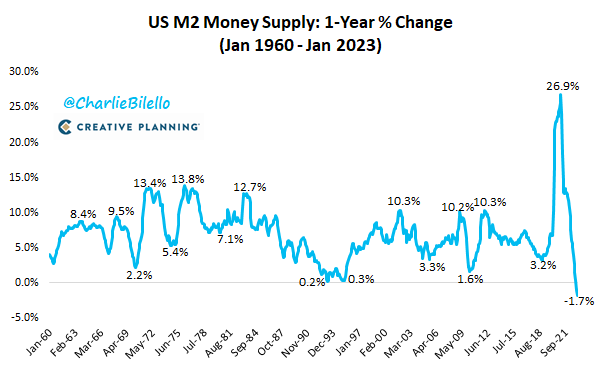

The US Money Supply has contracted 1.7% over the last 12 months (graphed below, courtesy of Charlie Bilello)–the largest year-over-year decline on record (data back to 1959). Many other countries, like Canada, have seen a similar trend. This massive liquidity reversal is a formidable headwind for asset markets globally over the next few quarters.

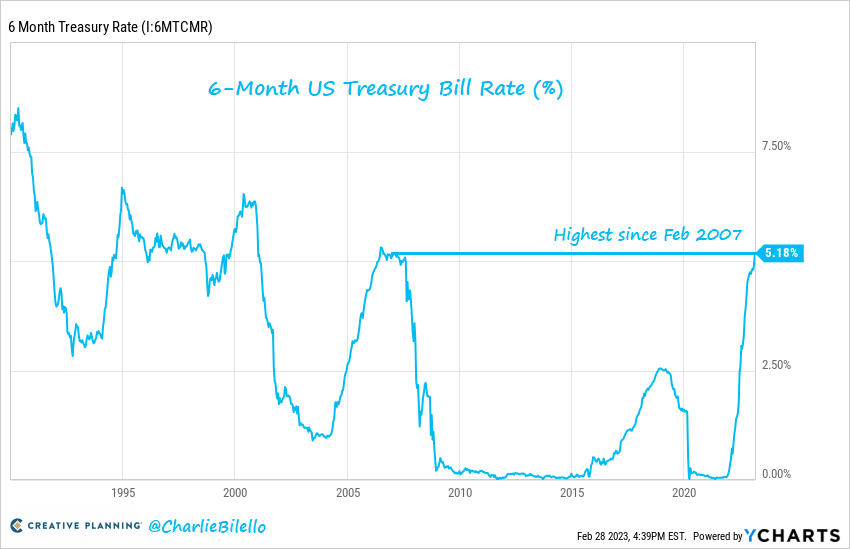

At the same time, interest rates have exploded, with the 6-month US Treasury yield moving to 5.18%–the highest level since February 2007. As shown below, this yield was at 0.69% one year ago and 0.05% two years ago. Let those numbers sink in for a moment.

This rate of change was previously unimaginable, and for the indebted and consumption-dependent economies like Canada and America, it’s a veritable horror show. But for those with savings and no debt, the income jump on guaranteed deposits is yield-boosting manna from heaven. Respect for capital is back.