The sharpest monetary contraction in decades (US M2 below since 1960) has hit highly leveraged people and sectors like a meteorite from outer space.

After twelve years of TINA reaching for yield and levered gambling, a new financial mantra is sweeping the land: survival. Real estate investors are increasingly responding to the math of higher rates by mailing keys back to lenders; see Brookfield defaults on more office mortgage debt.

Changes in monetary conditions move with long and variable lags. In a world of short attention spans, most are underappreciating the multi-year nature of real estate downturns and their large knock-on effects. The segment below illuminates further.

Patrick Carroll, Carroll Founder and CEO, joins ‘Squawk on the Street’ to discuss signs of weakness in the housing market, the commercial real estate crisis, and the repurposing office buildings as more people work remotely. Here is a direct video link.

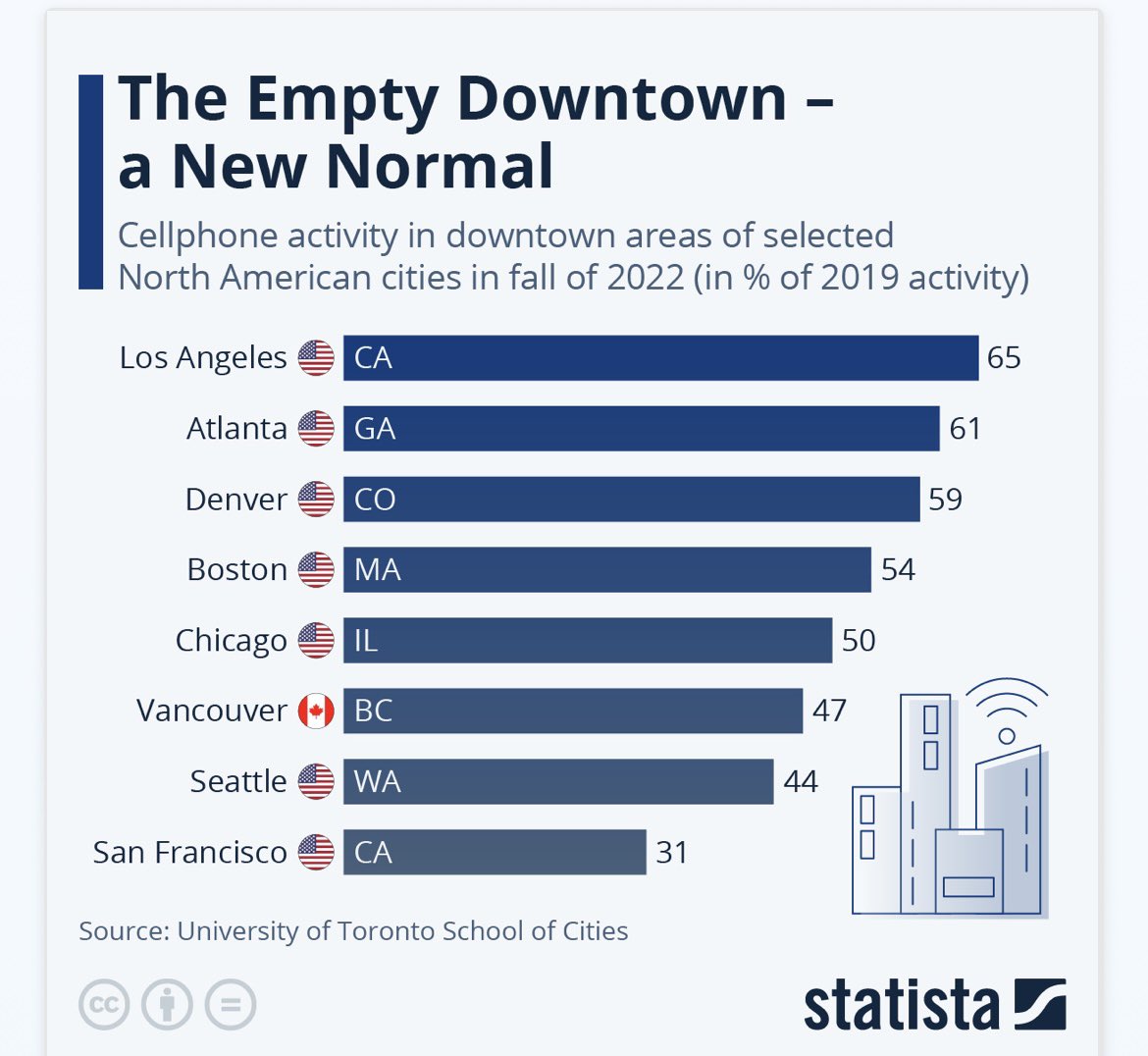

The Statista chart below of cellphone activity in the fall of 2022 in major urban centers as a percentage of the activity in the fall of 2019 further confirms a trend that has legs well beyond the pandemic.