A decade of near-zero policy rates allowed banks to boost profits by paying next to nothing on customer deposits from 2011-2021. Then, everything changed.

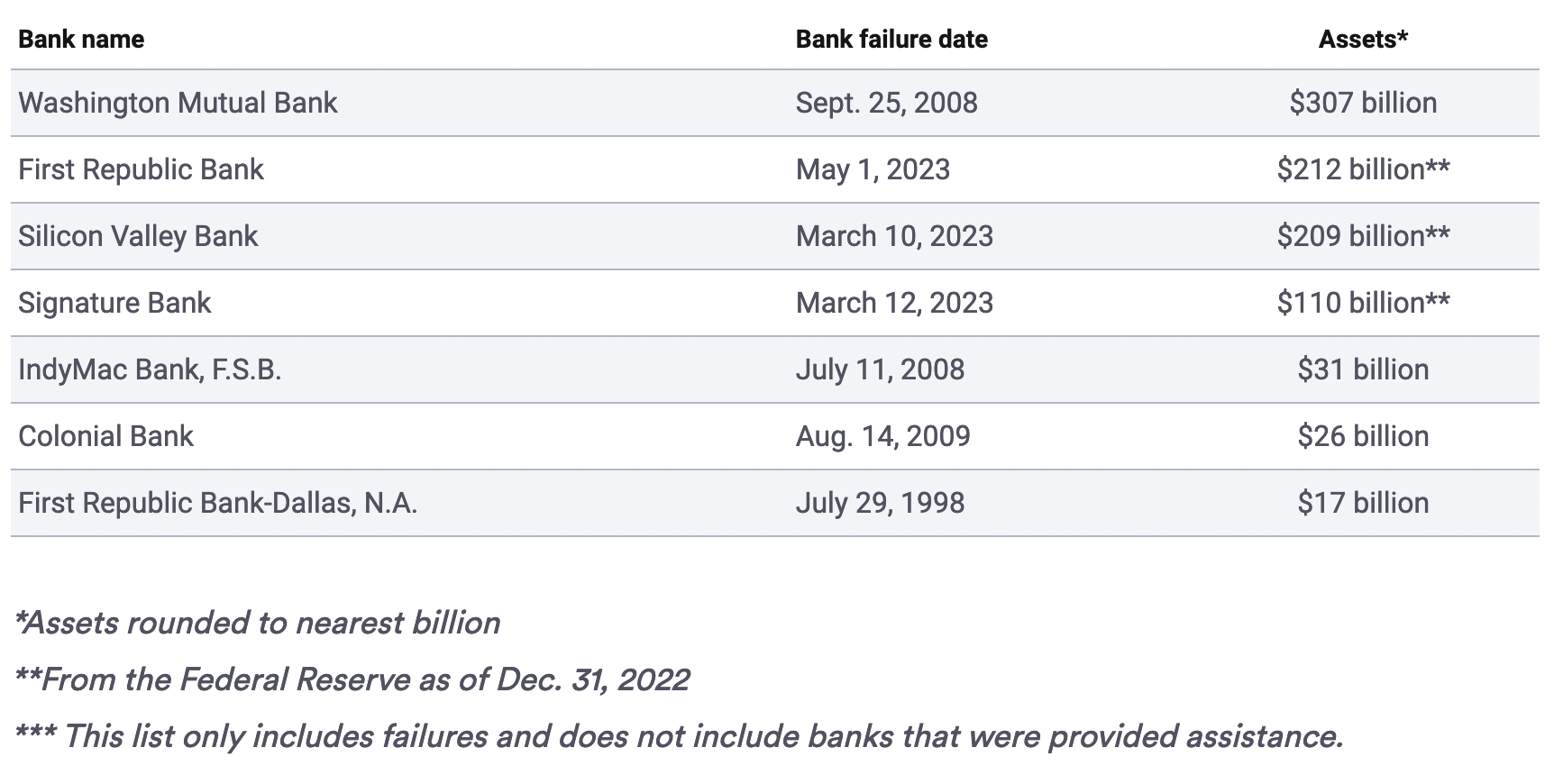

Below is a list of the largest seven US bank failures by asset size courtesy of BankRate.com. Suddenly and all at once, three of the four largest have happened over the last two months. See the WSJ: Why First Republic Bank Collapsed for valuable insight.

Central bank policies are evident in both leaping bank assets to 2022 and the record failures now unfolding—no free lunch. See, Too much Fed liquidity has led to a whack-a-mole world of problems:

While the decision by the FDIC to cover uninsured deposits remains controversial, enhanced deposit insurance, funded by higher fees, may become necessary for a period of time. It is not the fault of savers that the banking system is drowning in excess deposits. Savers, in aggregate, are captive victims of the Fed’s dogmatic “ample reserves regime”. Until it winds down this misguided experiment, global policymakers will continue their scramble to create new special programs, acronyms and emergency facilities to manage the whack-a-mole world of complications it has produced.