Eyes on the recessionary bear prize. Valuable investment opportunities are in the making.

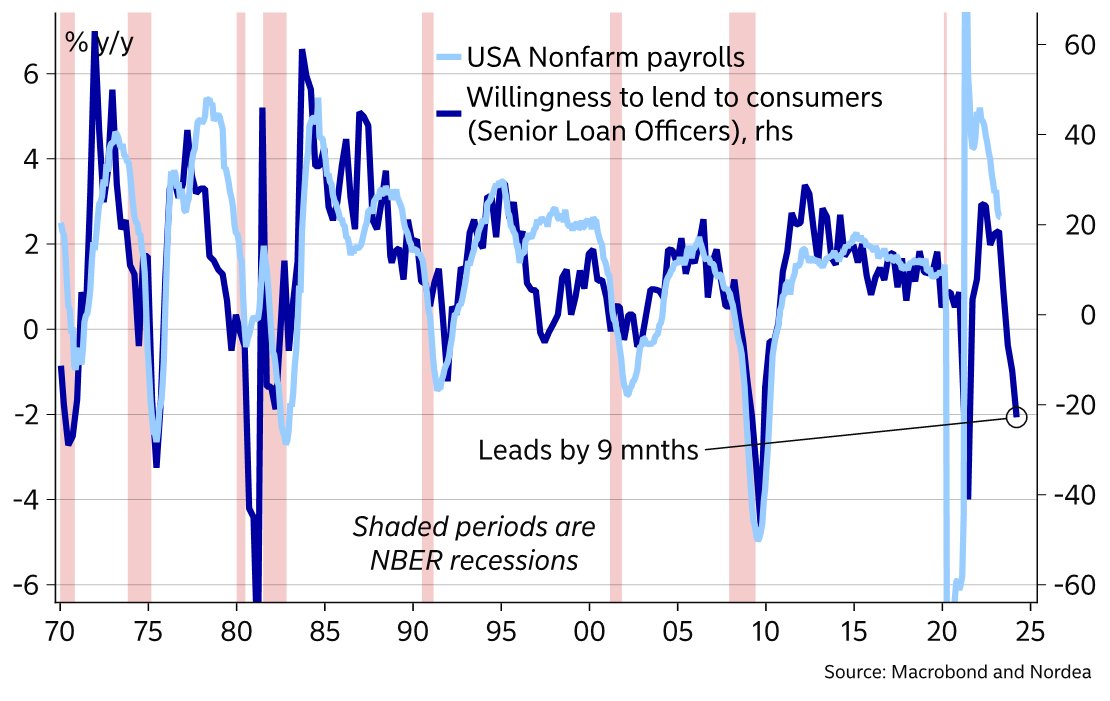

Peter Boockvar, Bleakley Financial Group CIO, joins ‘Squawk Box’ to discuss the results from the Fed’s quarterly Senior Loan Officer Opinion Survey, and why a recession is likely unavoidable. Here is a direct video link.

The chart below shows the Senior Loan Officers Survey (willingness t0 lend to consumers in dark blue) versus US nonfarm payrolls (light blue) and recessions (in pink) since 1970.

Next, we see that the ISM purchasing manager’s index (in yellow below since 1999 courtesy of ISABELNET.com) is leading corporate earnings (blue below) lower over at least the next 6 months.

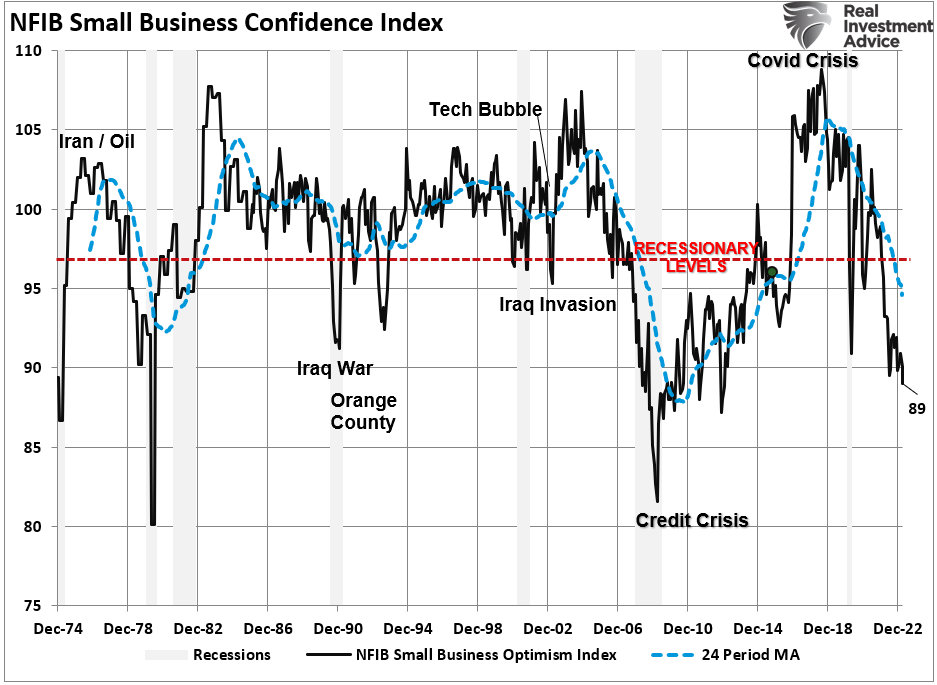

The NFIB Small Business Confidence Index now lower than during the pandemic shutdown, is at levels seen during past recessions (below since 1974 via Lance Roberts).

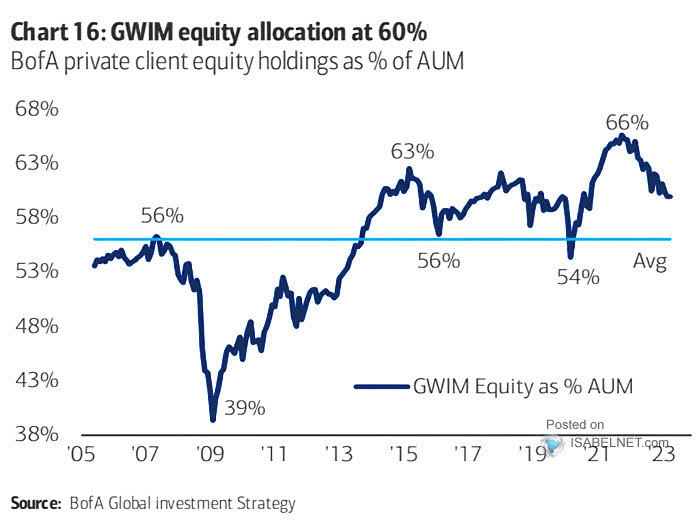

Lastly, we have the allocation to equities in retail portfolios (below since 2005 ). Down from the peak in 2022, but at 60%, still well above the 40% range typical of bear market bottoms. Most are still heavily risk-exposed, heading into a recessionary bear market. This is goin’ leave a mark for years to come.