Many homes for sale in our area north of Toronto are priced in the $2 million range–many have been on the market for months now. If we do some math, we can appreciate why.

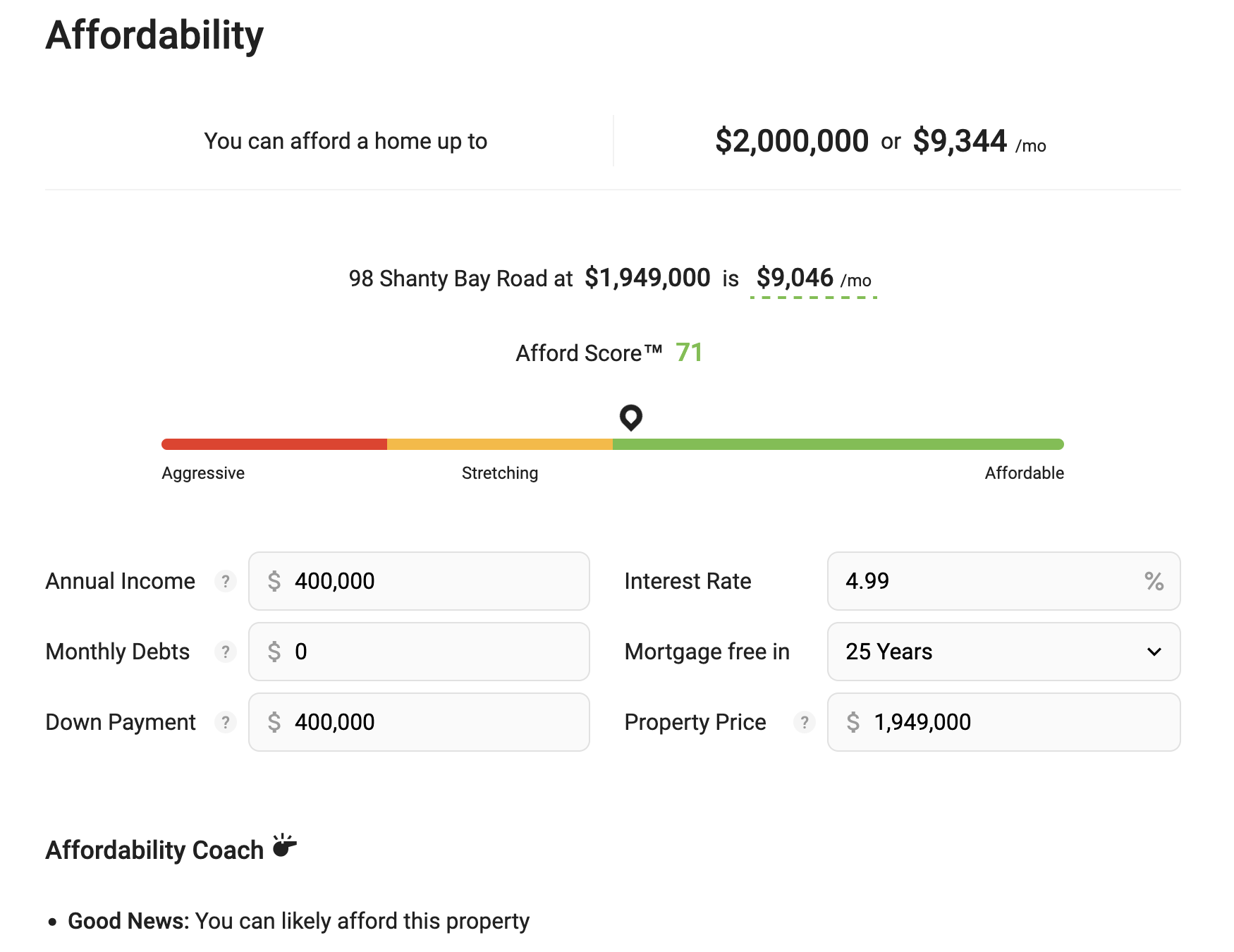

Online calculators allow us to model numbers. To buy a $2,000,000 home with 20% down (400k) at a mortgage rate of 4.99% over 25 years, one must have a household income of $400,000 and zero other debts. As shown below, the monthly mortgage payment would be $9,344, in addition to property taxes, utilities, repairs and maintenance–just for one’s shelter.

Only 514,450 Canadians had a per capita annual income of $200,000 or more in the latest data, according to Statista.

Only 514,450 Canadians had a per capita annual income of $200,000 or more in the latest data, according to Statista.

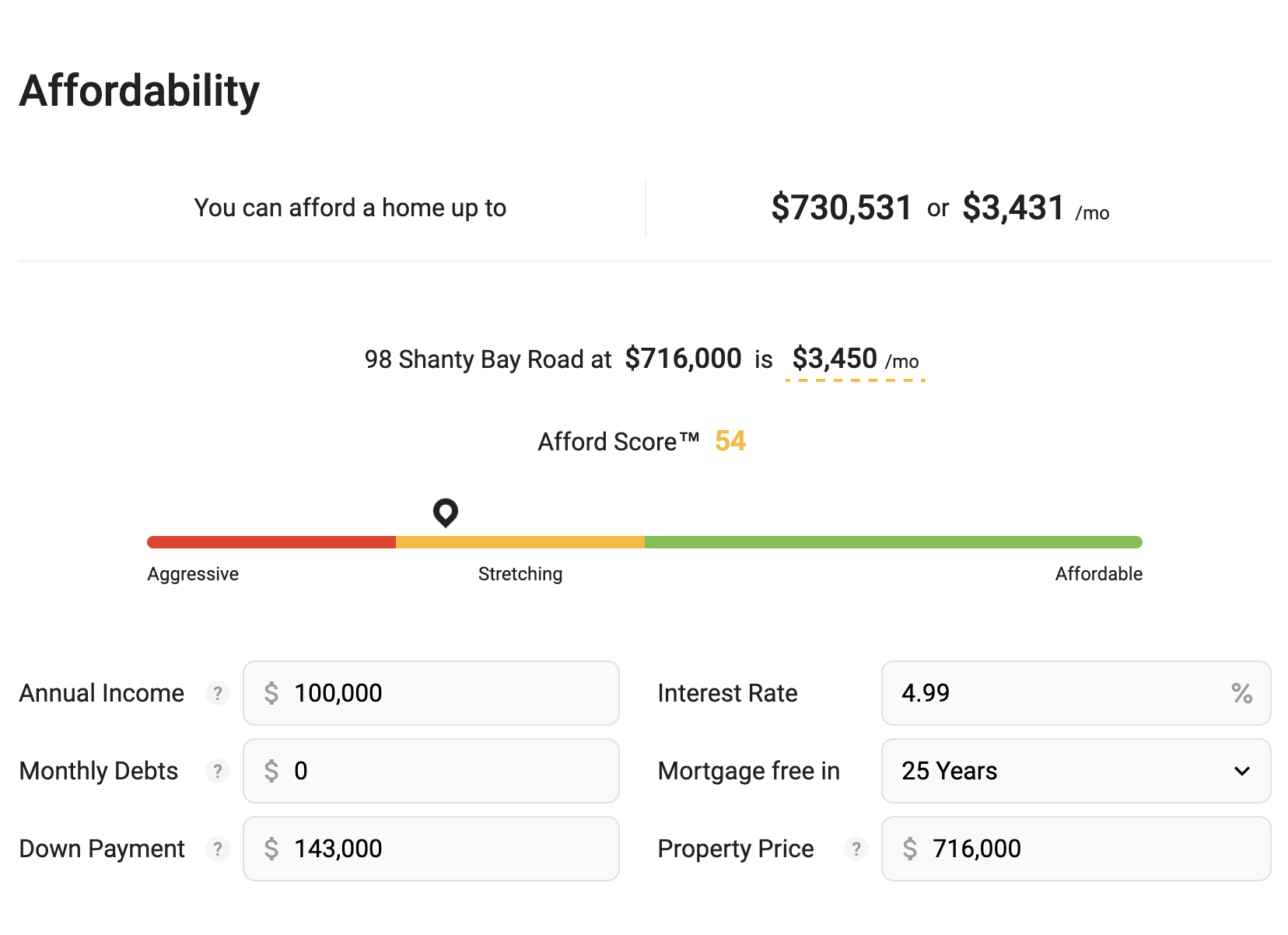

In April, the average Canadian home price was $716,000–the cost of an entry-level starter home in the most populated areas. To qualify for a conventional mortgage on the average Canadian starter home with 20% down ($143,000), one would need an annual household income of $100,000 with zero other debts (as shown below). The monthly mortgage payment would be $3,431 in addition to property taxes, utilities, repairs and maintenance–just for one’s shelter.

Less than 8% of Canadians (3 million out of 40 million) had a per capita annual income of $100,000 or more, according to Statista, and most of them are already carrying both mortgage and non-mortgage debt.

Less than 8% of Canadians (3 million out of 40 million) had a per capita annual income of $100,000 or more, according to Statista, and most of them are already carrying both mortgage and non-mortgage debt.

Who can afford to buy a home today in Canada? Very few.