Insolvency trustees are the financial undertakers. They endured a bear market when easy credit enabled extend and pretend habits for the masses. Now the undertakers are entering a boom time as their phones “ring off the hook.”

Hoyes, Michalos published Canadian stats through the end of May and included this chart.

Other trustee firms are also feeling the love.

Other trustee firms are also feeling the love.

Bryan Gelman, president of Albert Gelman Inc., joins BNN Bloomberg to give his perspective on rising business insolvencies in Canada. He says the rate of insolvencies he is seeing at his firm is the most in 20 years. Here is a direct video link.

As Charles St-Arnaud, chief economist with Alberta Central, explained on BNN this week, it’s early days in this trend as insolvencies tend to peak 12 months after the start of a recession. See Insolvencies on the rise amid interest rate squeeze: Former Bank of Canada economist:

“What’s starting to be concerning is the trend; Insolvencies are very much a lagging indicator of the economic cycle. Usually, they tend to peak 12 months after the start of a recession. We still haven’t started a recession. The question is, when are they going to peak, and how bad will it be?”

While Canadian financial shares are off an average of 17% since peaking in February 2022, it’s important to understand that a recession-style default cycle is not yet priced in. CIBC Asset Management Portfolio Manager Natalie Taylor explained this month:

The biggest source of earnings variability for banks during a recession is the increase in credit costs, Taylor said, which can spike to two to three times the current levels.

Previous downturns have led to an average decline of 15% to 20% in bank earnings, she said, compared to the mid-single-digit decline embedded in consensus estimates.

With financial shares making up more than 30% of Canada’s TSX stock index, the downside for Canadian equity portfolios is more significant than most appreciate.

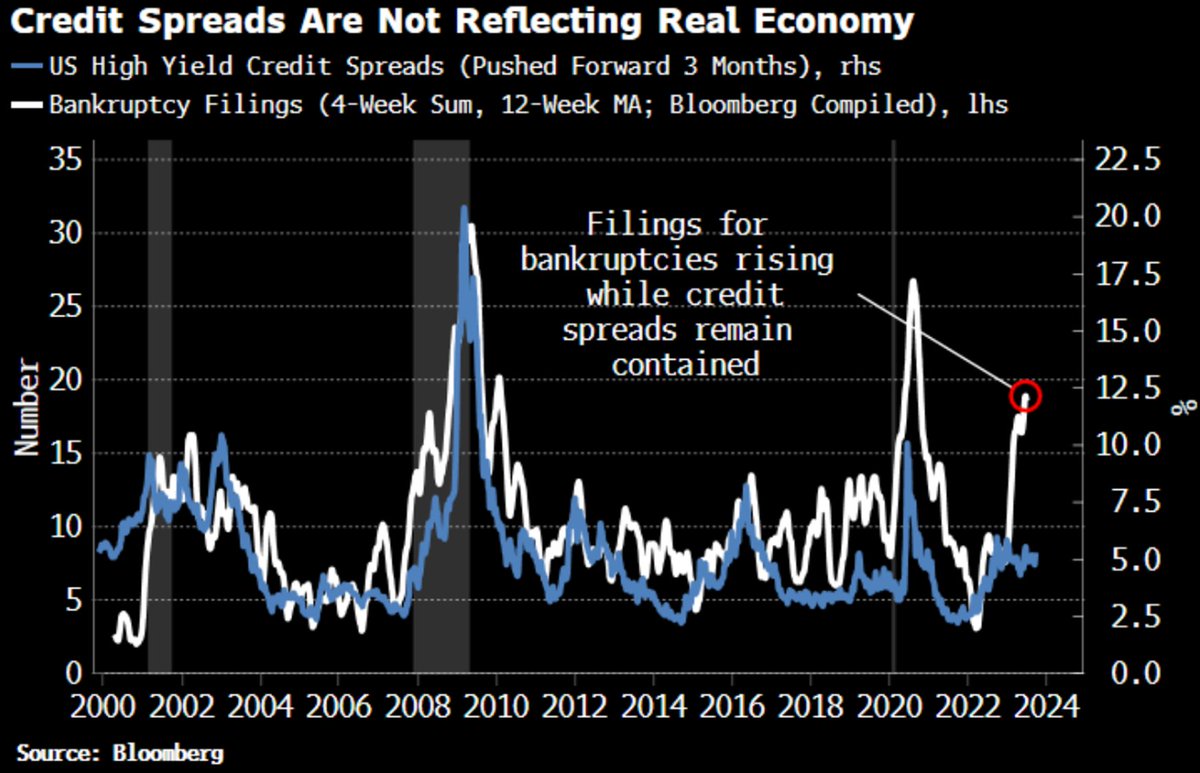

Small business optimism is the lowest since 2008, but distress is also evident in publicly traded companies. By the end of May, there were 286 public US company bankruptcy filings in 2023 (white line below since 2000)–the worst first five months since 2010 (as lagging bankruptcies were peaking after the 2008-09 recession).

As with bank shares, the unfolding credit crunch is not yet priced in. Credit spreads for higher-risk debt remain too low (blue line below) and are destined to catch up with insolvency trends in the months ahead (junk bond prices have further falling to do).