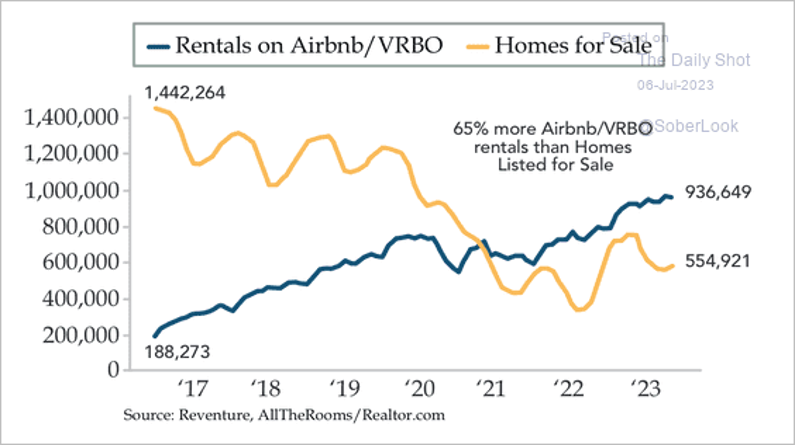

Nick Gerli, Reventure Consulting Founder and CEO, joins ‘Last Call’ to explain his recent viral tweet claiming AirBnB is seeing declining revenue in several major markets. Here is a direct video link.

Also, see Nick’s update on developments in the commercial property sector.

Commercial real estate values have already dropped 11% in the last year, with some properties selling for a 90% loss. This commercial real estate collapse is going to cause problems for the US Banking Sector.

The St Louis Fed notes similar data in Commercial Real Estate Market Pose Challenge To Banks:

Given the economic factors discussed earlier, it is likely that we’ll see continued stress in the commercial real estate market in the near term. While there are direct linkages to the commercial banking system—especially for community banks, many of whom have balance sheets with substantial CRE exposures—it is also important to note that the capital positions of most U.S. banks are much stronger than in past episodes where we’ve seen similar stresses. Bank supervisors will be particularly focused on CRE concentration risk, among other key risks, as we continue to see the impact of rising rates and a slowdown in domestic and global growth on our banking system.