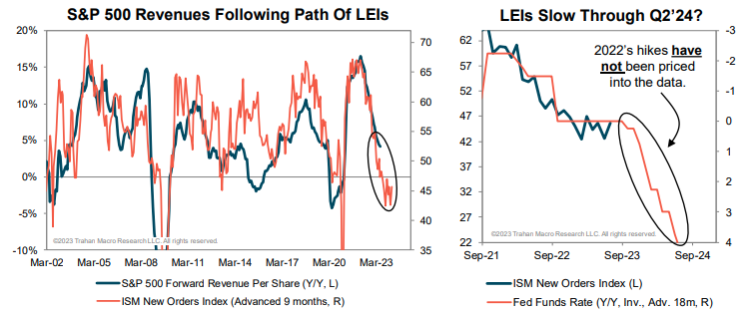

The year-over-year leap in the Fed Funds Rate (inverted on the lower right in orange) is leading ISM new orders down (green line on the lower right). ISM new orders (lower left, in orange, since 2002) lead corporate revenues (green). The chart below, courtesy of Francois Trahan, suggests the trends in motion. Jubilant corporate bond and stock prices are, so far, whistling past the broad and persistent decline in new orders and other leading economic indicators.

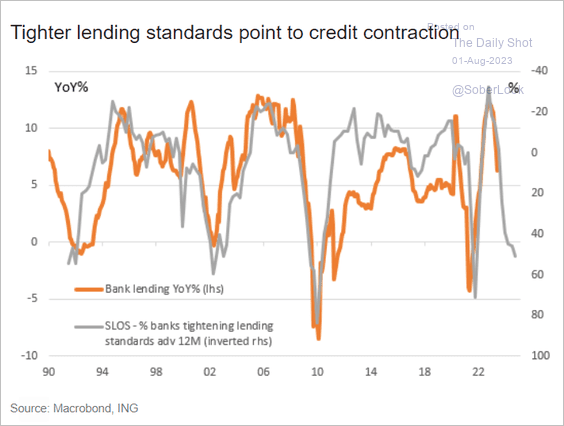

Meanwhile, the percentage of banks reporting tighter lending standards (inverted in grey below since 1990) is the highest since past recessions and is leading bank lending (in orange) lower from here.

Meanwhile, the percentage of banks reporting tighter lending standards (inverted in grey below since 1990) is the highest since past recessions and is leading bank lending (in orange) lower from here.

Danielle DiMartino Booth discusses these factors and more in the clips below.

Danielle DiMartino Booth discusses these factors and more in the clips below.

Danielle DiMartino Booth, CEO and chief strategist for QI Research, and former advisor to the Dallas Fed, joins BNN Bloomberg to discuss her view on the Fed’s path forward. DiMartino Booth says the economy is pointing towards a recession, however, investors are ignoring the signs as the stock market continues to climb. Here is a direct video link.

Danielle DiMartino Booth, CEO of QI Research, discusses the drivers of consumer spending, the possibility of more layoffs coming, and investment implications. Here is a direct video link.