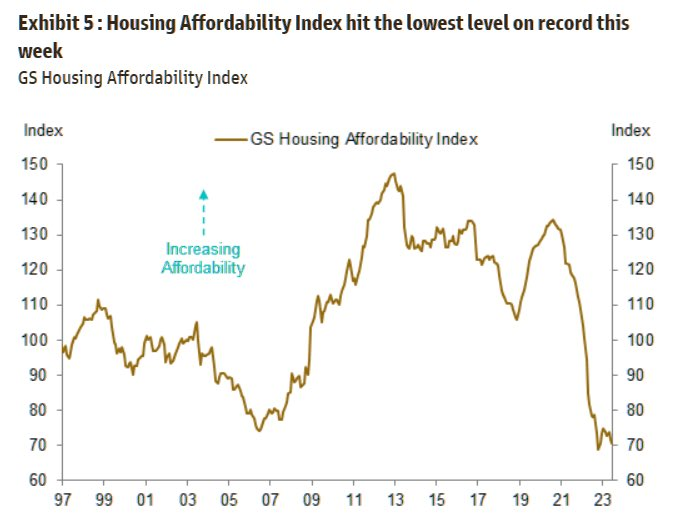

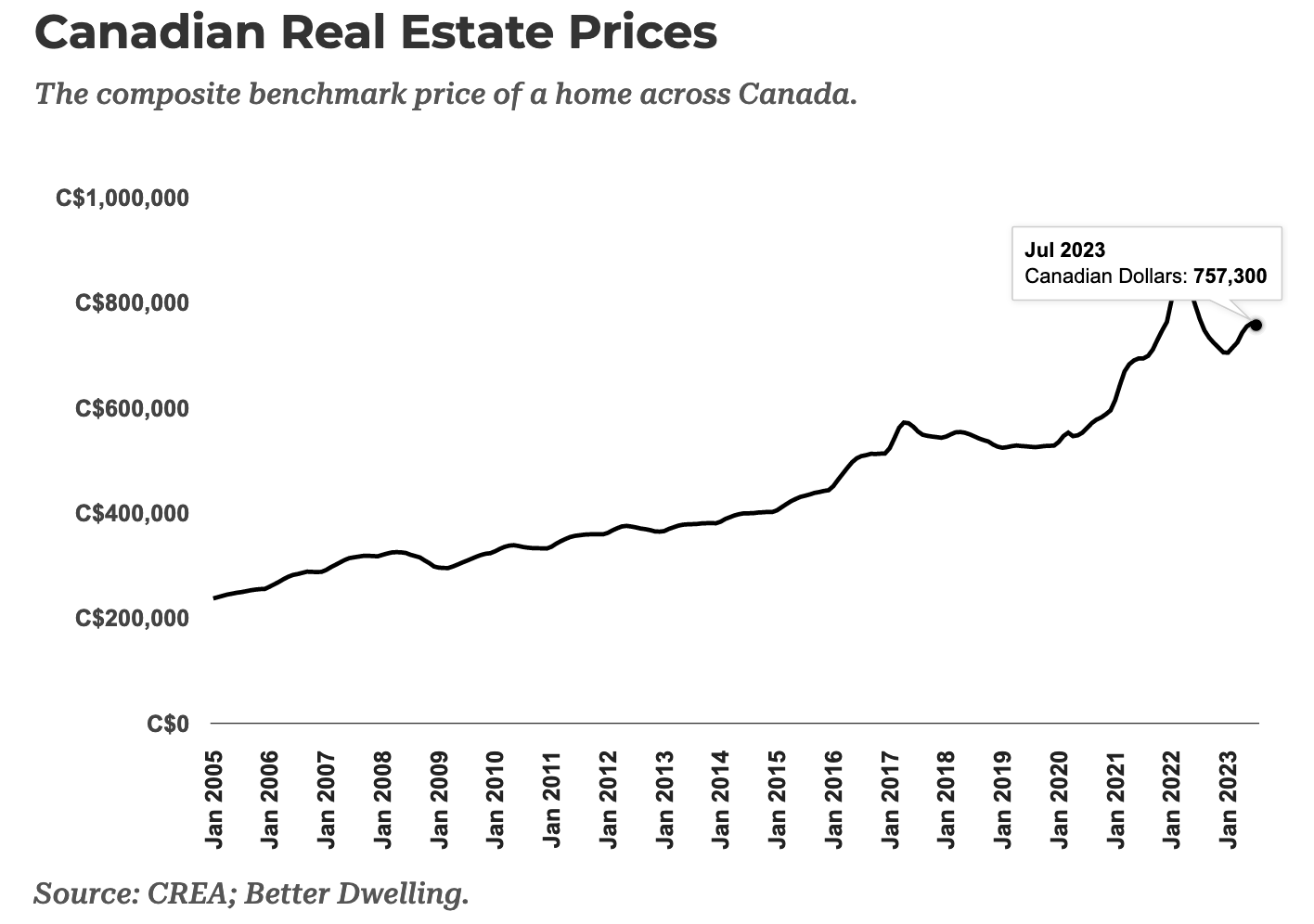

Today’s home affordability is the lowest on record, thanks to elevated prices and the highest mortgage rates in 23 years (US home affordability index below since 1997 courtesy of Goldman Sachs). Not to mention leaping insurance, utilities, property taxes, maintenance, and interest costs on the many other debt types. These are tough times for the masses.  In March 2022, the popular 5-year Canadian fixed mortgage rate was under 3%, and the median Canadian home price peaked at $855,800. In July 2023, the benchmark price of a Canadian home was $757,300 (chart below since 2005, courtesy of Better Dwelling), and 5-year fixed mortgage rates were above 5.5 %. The combination of sky-high prices and historically average interest rates puts the median Canadian home price some 32% above the borrowing capacity of the median household income (Oxford Economics).

In March 2022, the popular 5-year Canadian fixed mortgage rate was under 3%, and the median Canadian home price peaked at $855,800. In July 2023, the benchmark price of a Canadian home was $757,300 (chart below since 2005, courtesy of Better Dwelling), and 5-year fixed mortgage rates were above 5.5 %. The combination of sky-high prices and historically average interest rates puts the median Canadian home price some 32% above the borrowing capacity of the median household income (Oxford Economics).

There’s much discussion of late about China’s heightened financial fragility because 70% of Chinese household net worth is based on real estate, which is now deflating. A 2022 Ipsos poll found that 77% of total household assets in Canada were based on real estate.

There’s much discussion of late about China’s heightened financial fragility because 70% of Chinese household net worth is based on real estate, which is now deflating. A 2022 Ipsos poll found that 77% of total household assets in Canada were based on real estate.

Canada entered the 2008-09 recession with moderately priced housing because it had primarily flatlined over the preceding decade. Mainly because of that, Canadians were much less indebted than their American counterparts in 2008, and thus, the Canadian economy fared relatively better than others during the global credit crisis. Canadian household debt to disposable income was less than 140% in 2008 versus 185% in 2023. Canadian household debt amounted to 75% of Canadian GDP in 2008 versus 103% today.

In 2023, some 77% of Canadian homeowners have a mortgage, and the average balance is north of $350k. Those under age 55 owe the bulk of the $2.8 trillion in household debt outstanding ($2.11 trillion of which is mortgage debt).

Sixty-three percent of homeowners with a mortgage say they are financially stressed today, compared with 59% of renters. This is particularly troubling since Canada’s official unemployment rate is just 5.5% and is destined to move higher in the months ahead.

The existing average rate on 5+ year fixed mortgages in Canada is 2.79% versus 5.99% on offer today. As fixed terms come up for renewal, a doubling interest expense will be difficult for most to absorb.

On the upside, these conditions suggest that more properties will be listed for sale, and more that have been held off the market for occasional use or vacation rentals will be seeking full-time tenants. These factors should help to bring prices lower over the coming months and possibly years.

In the meantime, the segment below looks at the present math for Americans. Things are not better in Canada.

The average American says they need to earn $233,000 a year to be financially comfortable. But in 2021, American workers on average made only $75,203 annually. With well over half of Americans living paycheck to paycheck, many are struggling to meet some of their modest financial goals. 72% of Americans said they currently weren’t financial secure, and more than a quarter of Americans said they’ll likely never be. So how did it become so difficult to be financially secure in America and what can you do about it? Here is a direct video link.