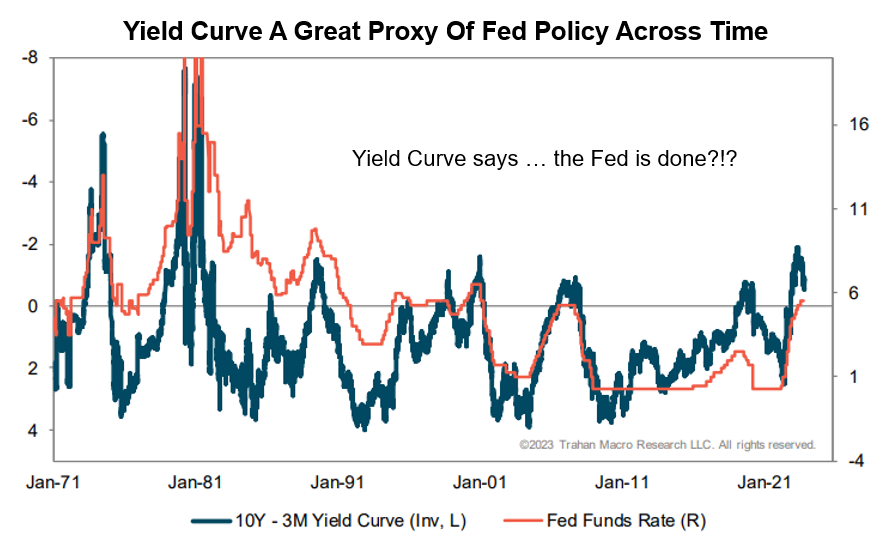

The average time from a yield curve inversion (long-interest rates below short) to the onset of recession has been ten months historically, ranging from 11 to 22 months. October marks the eighteenth month of curve inversion this cycle. Moreover, since June, the yield spread has been flattening out. As we start this trading week, the US 10-year is just 59 basis points lower than the 3-month Treasury rate and 61 bps below the US Fed Funds rate.

Yield curve re-steepening has preceded the onset of past recessions with a lag of zero to nine months. As noted by Francois Trahan, re-steepening suggests the Fed has done more than enough, and a more extended period of inversion tends to correlate with a longer period of recession.

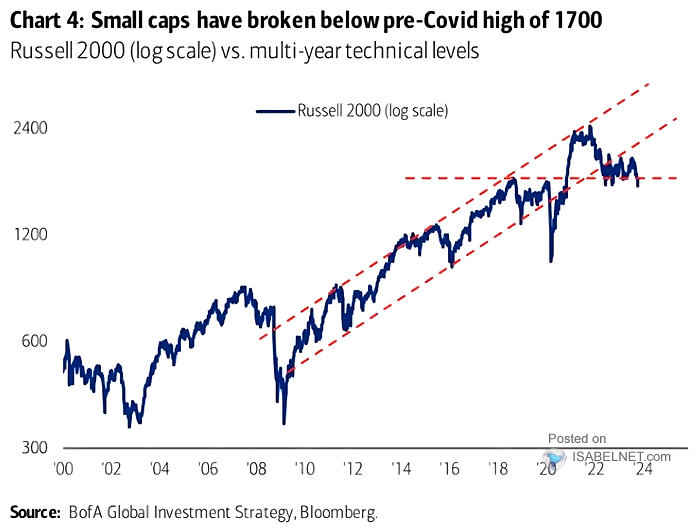

Economically sensitive small-cap companies are reflecting financial gravity. The Russell 2000 is now 33% below its November 2021 high and has gone nowhere for five years (below since 2000, courtesy of ISABELNET.com).

Economically sensitive small-cap companies are reflecting financial gravity. The Russell 2000 is now 33% below its November 2021 high and has gone nowhere for five years (below since 2000, courtesy of ISABELNET.com).

Other stock markets are at risk of following suit. Canada’s TSX is today just 5% above its pre-COVID February 2020 peak of 44 months ago. Financials have been leading down, and that’s never bullish.

Other stock markets are at risk of following suit. Canada’s TSX is today just 5% above its pre-COVID February 2020 peak of 44 months ago. Financials have been leading down, and that’s never bullish.

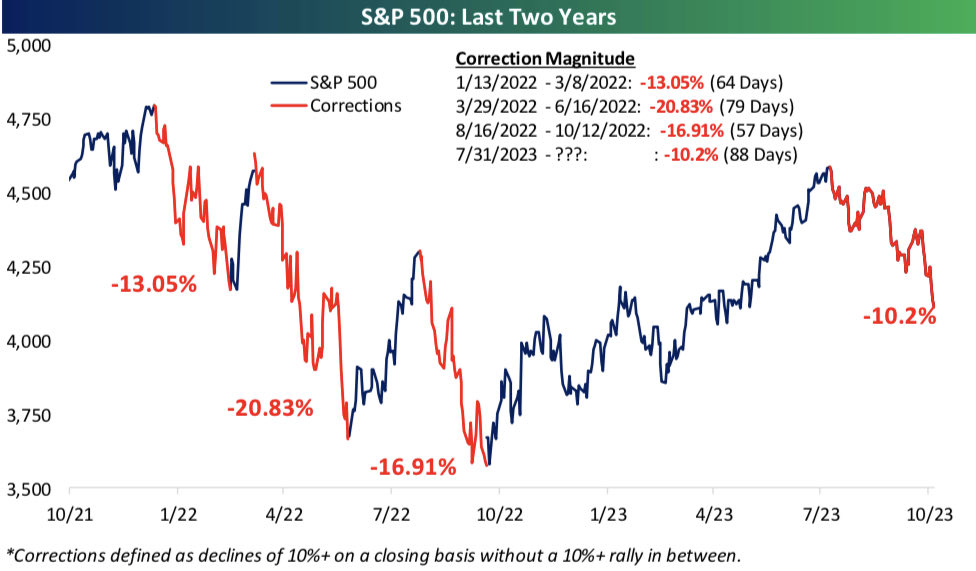

The large-cap S&P 500 index has been buoyed by its whopping 25% weight in the seven most expensive tech stocks to date, but even so, the S&P is -12% since December 2021 and flat since May 2021–29 months and counting. The chart below from Bespoke shows the S&P drawdowns and rebounds within the 2-year bear market to date. After a ten percent drop, buy-the-dippers could drive another bounce. Anything is possible in the near term, but the longer bear markets grind on, the more financial and psychological harm they inflict as liquidity and patience run low. Remember, the Fed hasn’t even started to ease yet.

After a ten percent drop, buy-the-dippers could drive another bounce. Anything is possible in the near term, but the longer bear markets grind on, the more financial and psychological harm they inflict as liquidity and patience run low. Remember, the Fed hasn’t even started to ease yet.

If the last Fed hike was in July, we are three months into the pause. Since 1969, the pause time between the last Fed hike and the first rate cut has been zero to 14 months. In each case, recessions began at or shortly after the first rate cut, with the stock market not bottoming until 13 to 33 months after the last Fed hike.