This morning, weaker-than-expected US job creation in November adds to the growing list of negative economic surprises globally and reinforces the expectation that the Bank of Canada today and the US Fed next Wednesday will make no rate changes for the fifth consecutive meeting.

Before this morning’s data, the futures market was pricing in 120 basis points of Fed rate cuts in 2024 (shown below courtesy of Bloomberg)–the odds they begin in the first quarter just rose. Government bond prices have been moving higher across the board.

Canada’s 10-year Treasury yield is down a whopping 100bps since October 3rd and at 3.28%, is back to where it was six months ago. Rising Treasury prices help lower interest rates on new credit while hurting speculators still holding near-record short contracts against 10-year Treasuries (CBOT). As these shorts move to cover, their buying pressure should further boost government bond prices and help lower interest rates.

Canada’s 10-year Treasury yield is down a whopping 100bps since October 3rd and at 3.28%, is back to where it was six months ago. Rising Treasury prices help lower interest rates on new credit while hurting speculators still holding near-record short contracts against 10-year Treasuries (CBOT). As these shorts move to cover, their buying pressure should further boost government bond prices and help lower interest rates.

Oil (WTIC) has slumped under $71 a barrel- the lowest since last June- despite the recent extension of OPEC+ production cuts.

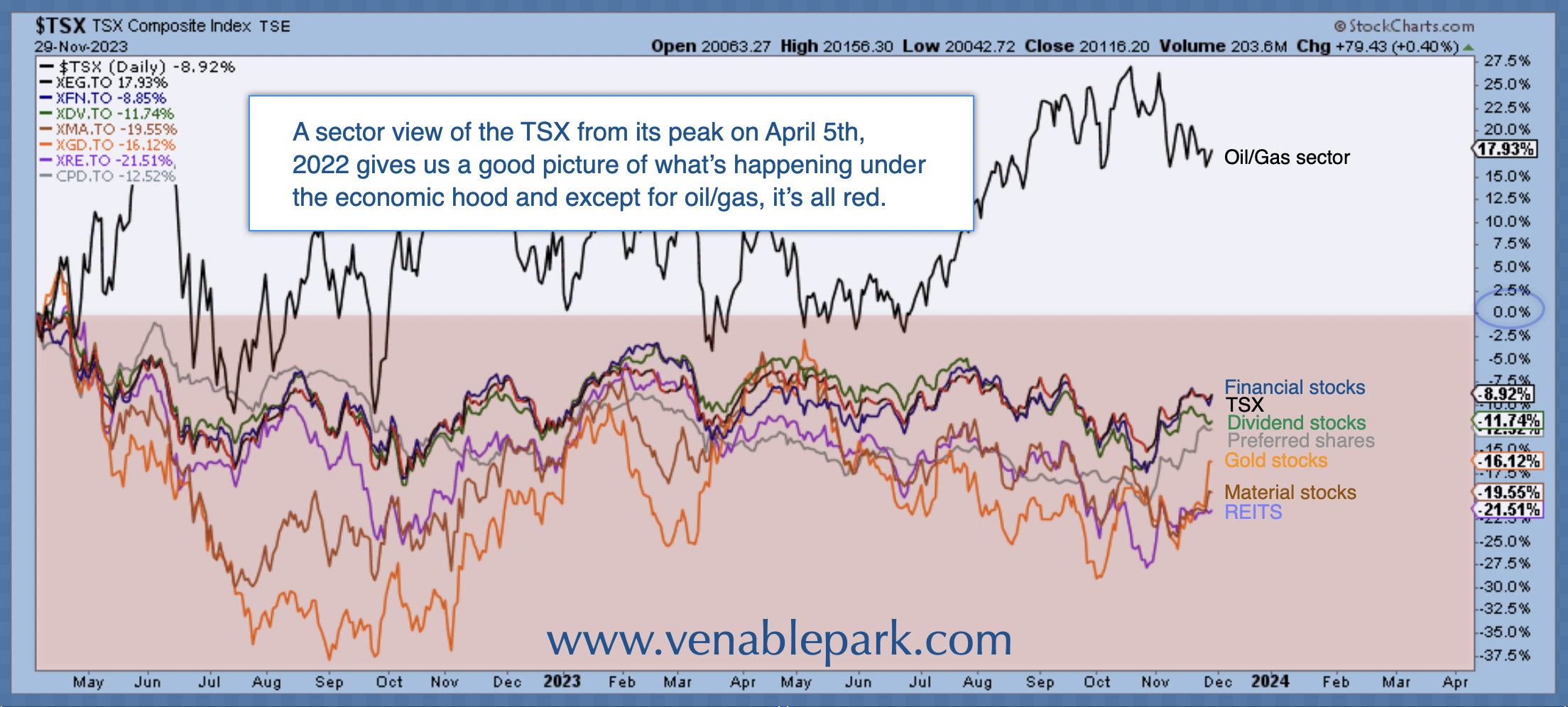

Shares in the oil and gas sector (XEG) comprise nearly 20% of Canada’s TSX and are -10% since October 19 and flat year-over-year. We watch with interest because oil and gas companies–late-cycle performers–are the only sector that has propped up the broad TSX index since April of 2022. As shown below, courtesy of my partner Cory Venable, all other sectors have lost ground (see red band), including materials (XMA) and gold producers (XGD), despite another rebound in bullion prices year-to-date. We expect oil and gas companies to follow the rest down as oil demand slumps and stockpiles mount.

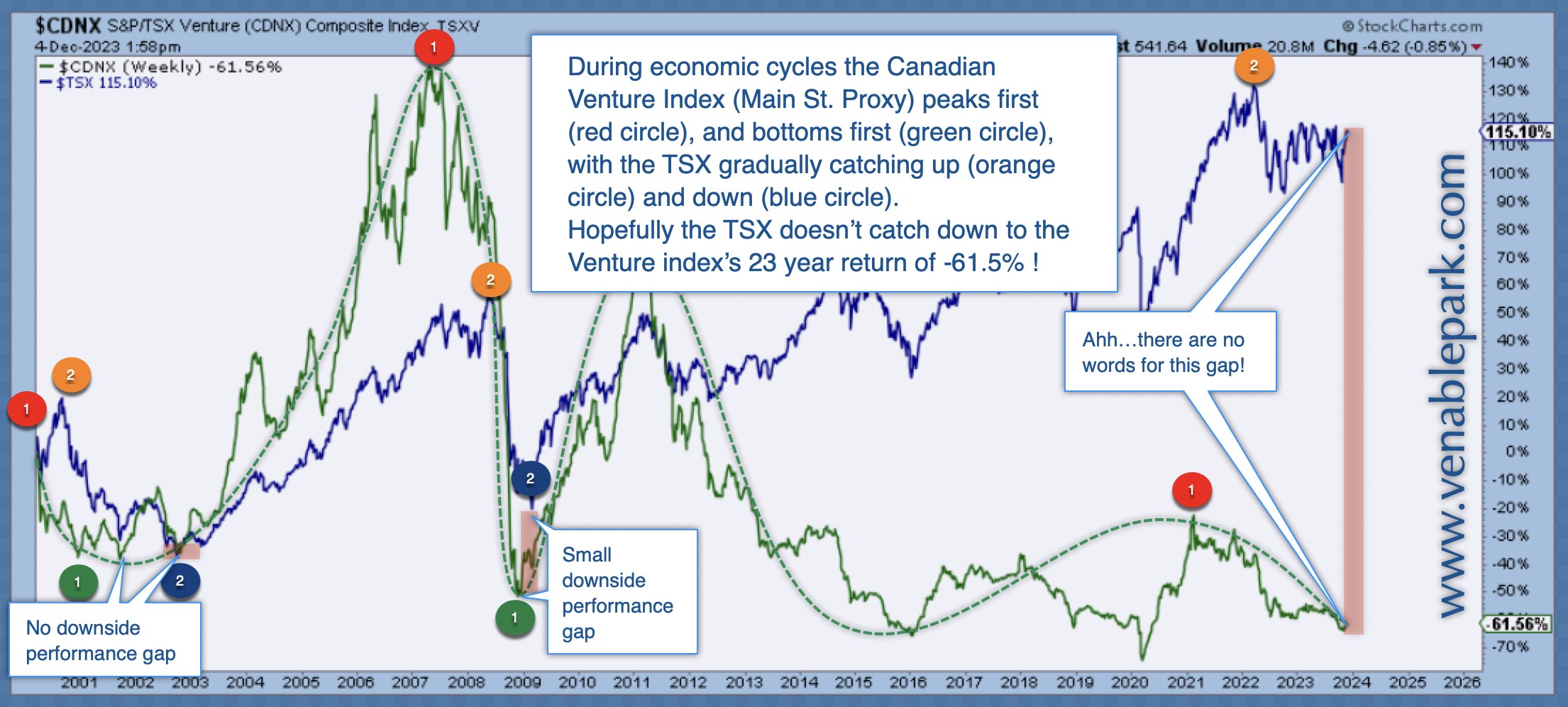

Canada has long been known as a resource-centric economy. Traditionally, the small-cap-junior-mining-heavy TSX Venture Index (CDNX in green below since 2000, courtesy of Cory Venable) has moved in correlation with the large-cap TSX index (in blue). That changed around 2012, however, when the world economy turned down again, and central banks turned to the monetary magic of Quantitative Easing and zero-interest policies to stimulate asset prices. This helped boost profits for the financial and real estate sectors (which comprise more than 30% of the broad TSX) while other sectors struggled.

The garish gap between the Venture Exchange Index price today (-61% since 2000) and still-elevated TSX (in blue) suggests magnified downside risk for the broad Canadian stock market as financials and real estate catch down in the post-bubble pay-back cycle.