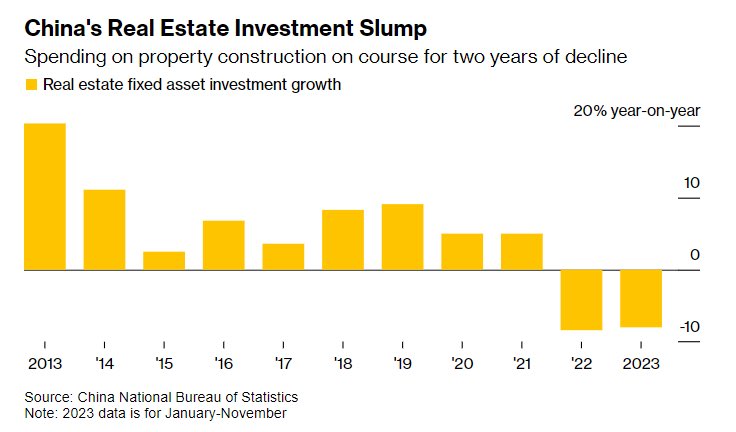

As real estate prices go, so goes capital investment (yellow bars below since 2013 in China) and employment in economies that become heavily leveraged on the sector. Bubbles are fun on the way up but pretty devastating on the way down. China’s real estate slump is heading into year three. Canada is following a similar pattern as weak sales and falling prices sour sentiment and increase financial stress. Worldwide, media and financial “advice” are mostly directed by sell-side investment banks and firms designed to keep the masses buying regardless of risk-return prospects.

Worldwide, media and financial “advice” are mostly directed by sell-side investment banks and firms designed to keep the masses buying regardless of risk-return prospects.

From the zenith of China hype in July 2007, China’s Shanghai composite stock index is -48% and -18% since the latest cycle high in October 2021. A few Chinese financial analysts have been trying to warn the public about contagion risks as the property-led bust continues. Apparently, they are being silenced. This happens in the West, too, but it’s a little more subtle here. See Prominent Chinese Analysts Starting to Disappear from Social Media:

Some of China’s most prominent analysts have been subjected to social media restrictions that appear designed to restrict their ability to comment on the country’s ailing stock markets and struggling economy.

At least six analysts are unable to upload new posts or gain new followers on popular social networking platforms, according to their account pages reviewed by CNN.

One of them is Liu Jipeng, an advisor to the Chinese government, who recently asked retail investors in the country to refrain from investing in the stock market. He has not posted on social media since early December and users can no longer follow his accounts.