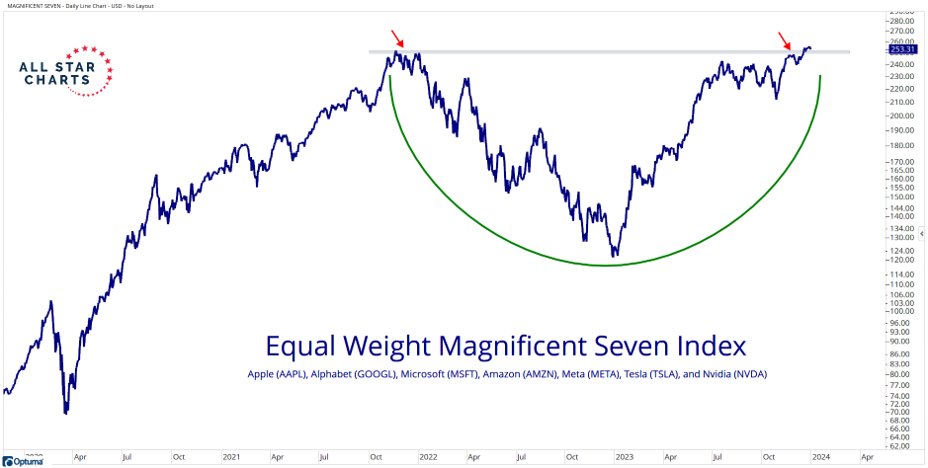

Assets bid up by irrational amounts eventually end up on clearance sale. Always. This is something to remember with the seven most expensive tech companies ending 2023 at their October 2021 price peaks (chart shown below, courtesy of All Star Charts), even while the Fed funds rate has moved from .25 to 5.5% and earnings estimates are falling. Sure, this handful of stock all-stars have spent two years going nowhere with tons of volatility, but who cares?

Permabulls are emboldened. The CNN Fear and Greed sentiment index is back in the extreme greed zone. Lessons learned: zero.

Permabulls are emboldened. The CNN Fear and Greed sentiment index is back in the extreme greed zone. Lessons learned: zero.

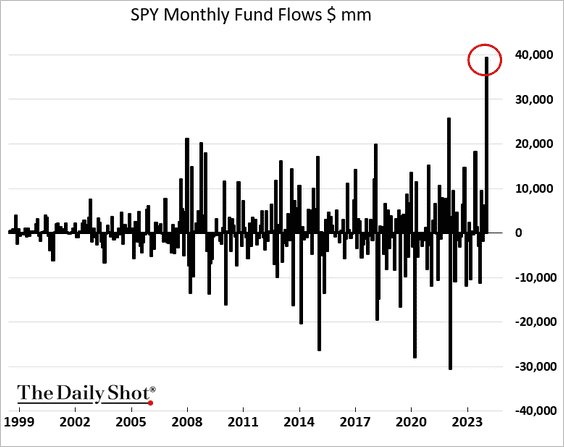

Making up a record 31% of the S&P 500 and 45% of the Nasdaq market capitalizations, the ten most expensive tech companies attracted trend-following flows into the bloated S&P 500–a CAPE above 30x in December–by the highest dollar amount on record (chart below since 1999, courtesy of The Daily Shot).

Rebounds in the few have masked ongoing price weakness in the majority.

Rebounds in the few have masked ongoing price weakness in the majority.

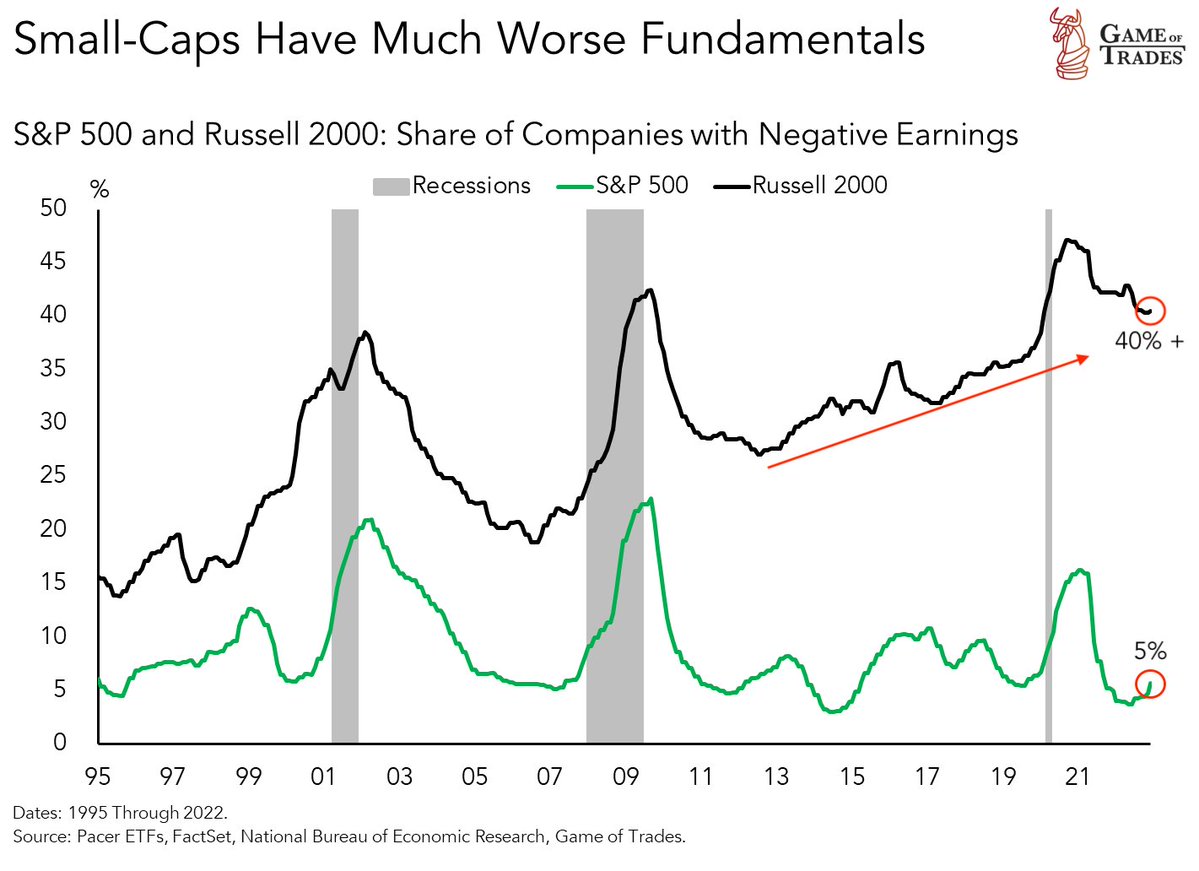

Even though many companies borrowed long when interest rates were at 5000-year lows during 2020-21, the level of debt matters and forty percent of Russell 2000 companies had negative earnings in 2023–alarmingly high in a non-recession year. The negative earnings share was half that amount heading into the 2001 and 2008 recessions, and then it doubled (see grey bars below since 1995, courtesy of Game of Trades). Credit spreads on publicly-traded ‘hi-yield’ debt started 2024 at a complacent 321 basis points over similar-dated Treasury bonds–much too low for the capital risk inherent. Past bear markets have not bottomed until high-yield spreads have widened to more than 7oo basis points, with junk bond prices dropping with equities.

Large-cap companies are typically more financially stable but still saw a tripling of the negative earnings share during past recessions. The S&P 500 money-losing share at 5% today (in green below) is due to move up from cycle lows.  After spiking on hopes for rate cut miracles in 2024, the S&P 600 small-cap stock index (in green below since mid-2021, courtesy of my partner Cory Venable) ended 2023 still -9% from the October 2021 top. Late cycle tech out-performance in the 2008 top (circled in the inset box below) resolved with the S&P 500 following small-cap stocks into a halving.

After spiking on hopes for rate cut miracles in 2024, the S&P 600 small-cap stock index (in green below since mid-2021, courtesy of my partner Cory Venable) ended 2023 still -9% from the October 2021 top. Late cycle tech out-performance in the 2008 top (circled in the inset box below) resolved with the S&P 500 following small-cap stocks into a halving. Often, January clocks stock market gains following tax-loss selling in December. But after manic buying last month, this year might be different. Yesterday’s -1.6% was the worst annual start for the tech-centric Nasdaq since 2016, and economically sensitive small caps, transports, and commodities all followed lower.

Often, January clocks stock market gains following tax-loss selling in December. But after manic buying last month, this year might be different. Yesterday’s -1.6% was the worst annual start for the tech-centric Nasdaq since 2016, and economically sensitive small caps, transports, and commodities all followed lower.