Our September 2021 client letter “Shifting Foundations” examined the default of China’s second-largest property developer, Evergrande, and the implications of a real estate bust leading to a slump in the Chinese and global economy. You can read the entire letter at this link. Here’s a taste:

Insolvency problems in China’s real estate sector sent shock waves through global markets in September. Evergrande, one of China’s largest property developers and 122nd among the 500 largest companies globally by revenue,skipped payments to foreign investors on their U.S.dollar-denominated bonds this month. So far, the company’s shares and bonds have fallen about 80% year to date, but there’s a larger story here.

After the U.S. credit bubble burst and the global economy slumped in 2008, China (like Canada, Australia, and some other export-dependent countries) focused on domestic property development to stimulate its economy. Funding came partly through China’s state-owned banks and partly from international investors fueled by ultra-loose monetary policy in the west. Billions flowed to Chinese property developers and, according to Moody’s Analytics, the sector now makes up most of the Asia high-yield bond market.

Since then, other property developers, including China’s largest, Country Garden, have defaulted on debt obligations, too. Last month, Country Garden management stated it expects the property market will remain weak in 2024, and the company could face more “severe” challenges. The video below offers more insight.

Country Garden, once seen as one of China’s most stable property developers, is now struggling financially, leaving the future of unfinished megadevelopments like Malaysia’s Forest City in doubt. Here’s how overbuilding, and a streak of bad luck, have left China’s real-estate developers in the red. Here is a direct video link.

Home buying sentiment has tumbled with business confidence since 2021 as prices continue to fall–more than two years and counting. Of the 70 Chinese cities in the NBS home price data, 62 reported a drop in home prices in December at the fastest pace in nine months. For the home resale market, prices fell year-on-year for the seventh month in tier-one, tier-two and tier-three cities.

Chinese authorities have repeatedly tried propping up the sector by increasing the central bank’s lending facilities to support property and infrastructure projects, cutting bank reserve requirements and lowering policy rates. Beijing and Shanghai also relaxed their home purchase restrictions in mid-December, reducing the minimum down payment ratio for first and second homes.

Still, according to the latest IMF (International Monetary Fund) report on China, “fundamental demand for new housing” is to fall 35% to 55% due to a decline in new urban households and a large inventory of unfinished or vacant properties.

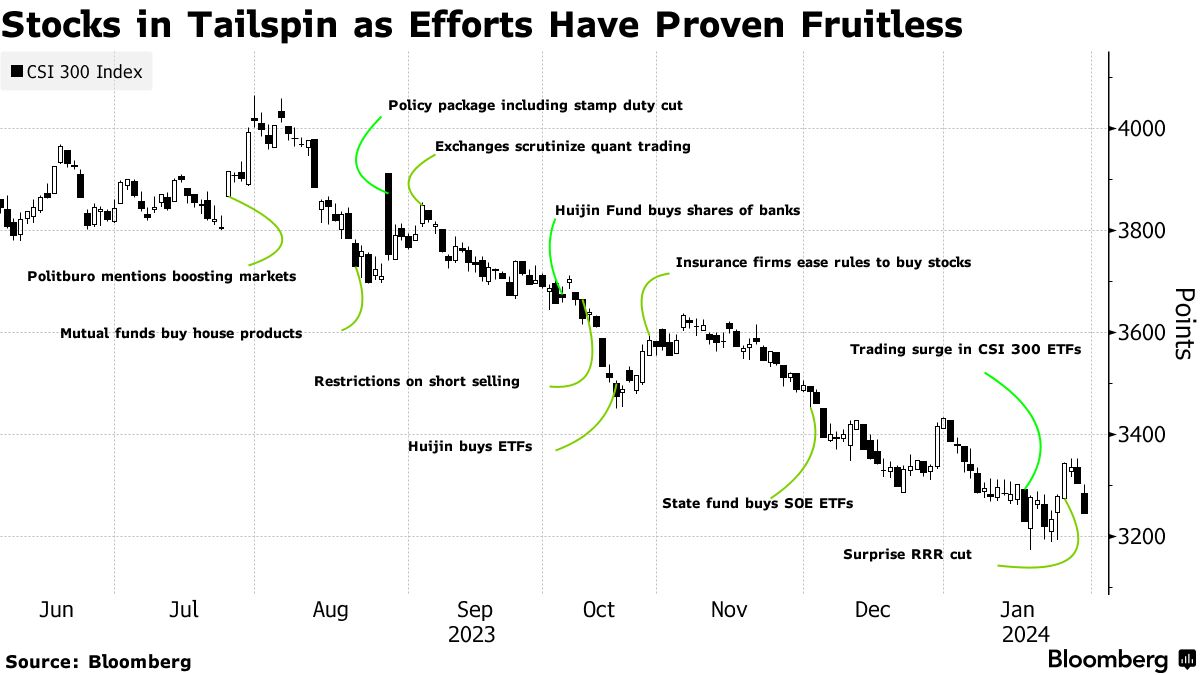

None of this has helped boost stock market sentiment, where prices have plunged despite the government stepping in to buy stocks. China’s benchmark CSI 300 is -40% over the past three years and more than -5% year to date. See, China moves to boost bank lending in a broad effort to prop up growth:

Monetary policy easing, cash injections and government buying of stocks have done little to fuel a rebound as investors eye a host of problems, including an aging population and worries that the property market no longer offers growth.

There are lessons here for Canada and other countries where debt abuse and rampant speculation fueled asset bubbles during the ‘free money’ era (2009-2022). Now, we are in the give-back phase, and it’s common for down cycles to last several years before prices find a final bottom. In the process, those who looked ”genius” in the boom phase are typically laid low once more, while those who maintained discipline and cash live to prosper. No lunch is free.