In the US inflation estimate for January, auto insurance premiums rose 20.6% year over year, while tenant and household insurance rose 6% annualized over just the last three months.

Across the developed world, insurers are exiting some areas and demanding higher premiums and deductibles in others; affordable insurance — often a condition of mortgage and vehicle debt — is getting harder to secure.

As individuals increasingly bear more and more financial risk, our ideas of what constitutes diversification and mitigation naturally change. At the same time, the companies and activities contributing to the chaos will be tapped to pay for the damage created via rising fees, taxes and damage awards. See The uninsurable world: what climate change is costing homeowners:

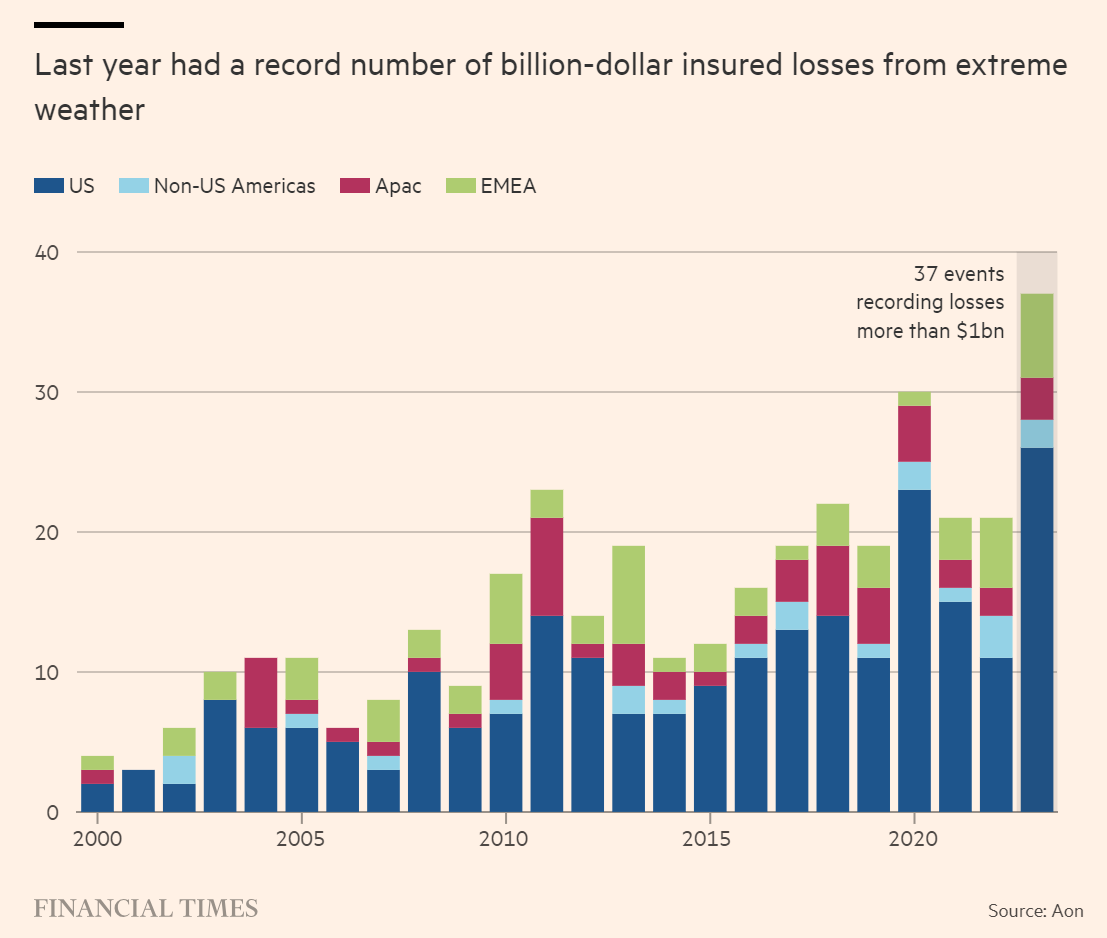

Last year saw a record-breaking number of natural catastrophes causing at least $1bn in insurance losses: 37 separate events, according to data from insurance broker Aon. That included 25 so-called severe convective storms, of which 21 were in the US. It is the growing weight of events such as storms and wildfires — and the broadening of the areas that are exposed to them — that is raising anxiety in the sector, and changing the way risk is viewed.