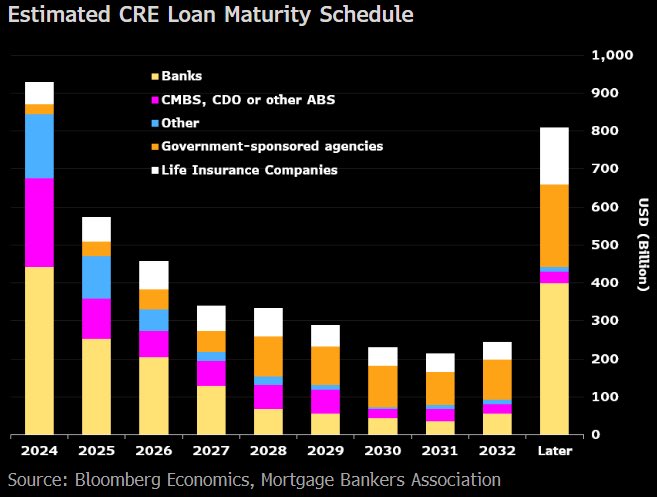

2024 is a big year for commercial real estate refinancing (US loans maturing by year graphed below, via Liz Ann Saunders). Interest rates, insurance, taxes and ongoing maintenance costs are on the rise as occupancy rates decline. Investors who bought and held when prices were high are now selling at huge discounts to cut their negative carry and risk exposure; see Office Tower deal for $1 Reveals Anxiety Among Longtime Buyers:

Interest rates, insurance, taxes and ongoing maintenance costs are on the rise as occupancy rates decline. Investors who bought and held when prices were high are now selling at huge discounts to cut their negative carry and risk exposure; see Office Tower deal for $1 Reveals Anxiety Among Longtime Buyers:

Canadian pension funds have been among the world’s most prolific buyers of real estate, starting a revolution that inspired retirement plans around the globe to emulate them. Now the largest of them is taking steps to limit its exposure to the most-beleaguered property type — office buildings.

Canada Pension Plan Investment Board has done three deals at discounted prices, selling its interests in a pair of Vancouver towers, a business park in Southern California and a redevelopment project in Manhattan, with the New York stake offloaded for the eyebrow-raising price of just $1. The worry is those deals may set an example for other major investors seeking a way out of the turmoil too.

As usual, those who profited during the boom phase are now raising the alarm and seeking ‘help’ from governments as mean reversion spreads.

John Fish, Real Estate Roundtable Chairman and Suffolk Founder, Chairman and CEO, dives into the main concerns facing commercial real estate and why he believes the mood on the ground is “sombre.”