Yesterday, the Bank of Canada announced it would hold its key interest rate at 5%, the highest since 2007. At the press conference, Governor Macklem confirmed that policy discussions considered how long rates should stay at present levels but added, “It’s still too early to consider lowering the policy interest rate.”

The main cause for concern remains unaffordable housing and fear that lowering policy rates could revive speculative behaviour and push housing further beyond the reach of most households; see, The Bank of Canada worries that a rate cut now could overheat the housing market.

The bad news is that shelter costs—nearly a third of the consumer price index—keep jumping as pandemic-era loans renew. Roughly 20% of Canadian mortgages are up for renewal in 2024, and more than that in 2025.

Mortgage interest costs are already up over 27% since 2022. Across the country in the fourth quarter, the average monthly payment on renewed mortgages increased by $457. In Ontario and B.C., the average increase was more than $680 per month.

Rents nationally have risen just under 8%, and CMHC data shows that turnover rents (where old tenants vacate and new tenants move in) rose more than 25% in the most populated cities over the past 12 months as landlords boost asking rents.

At the same time, the benchmark average home sale price in Canada is down more than 17% from its peak in 2022, and new mortgage and refinancing activity has shrunk. Many who bought or refinanced during the pandemic frenzy are underwater.

Naturally, more households are falling behind on payments. Equifax Canada data shows mortgage delinquencies nationally (payments more than 90 days late) leapt 52.3% year-over-year in the final quarter of 2023, +135.2% in Ontario, 62.2% in B.C. and above pre-pandemic levels in both cities. See, Number of households missing mortgage payments soars alongside consumer, business insolvencies.

It’s not just mortgages; national delinquency rates for non-mortgage debt also rose 28.9%, with more and more debtors admitting insolvency. The latest Office of the Superintendent of Bankruptcy data shows that consumer insolvency filings increased 23.5% nationally in January and 30.4% in Ontario.

No wonder Canadian lenders keep increasing their profit-crimping loan loss provisions. More to come. In the latest earnings reports, three Big 5 Canadian banks reported a significant share of negatively amortizing mortgages (T.D. 13%, CIBC 14%, BMO 15%), where payments are not high enough to cover interest costs, so the balance owed is growing monthly.

As consumers struggle to make ends meet, financial strain is contagious; Canadian business insolvencies rose 48.8% in January, the highest since 2006 (shown below).

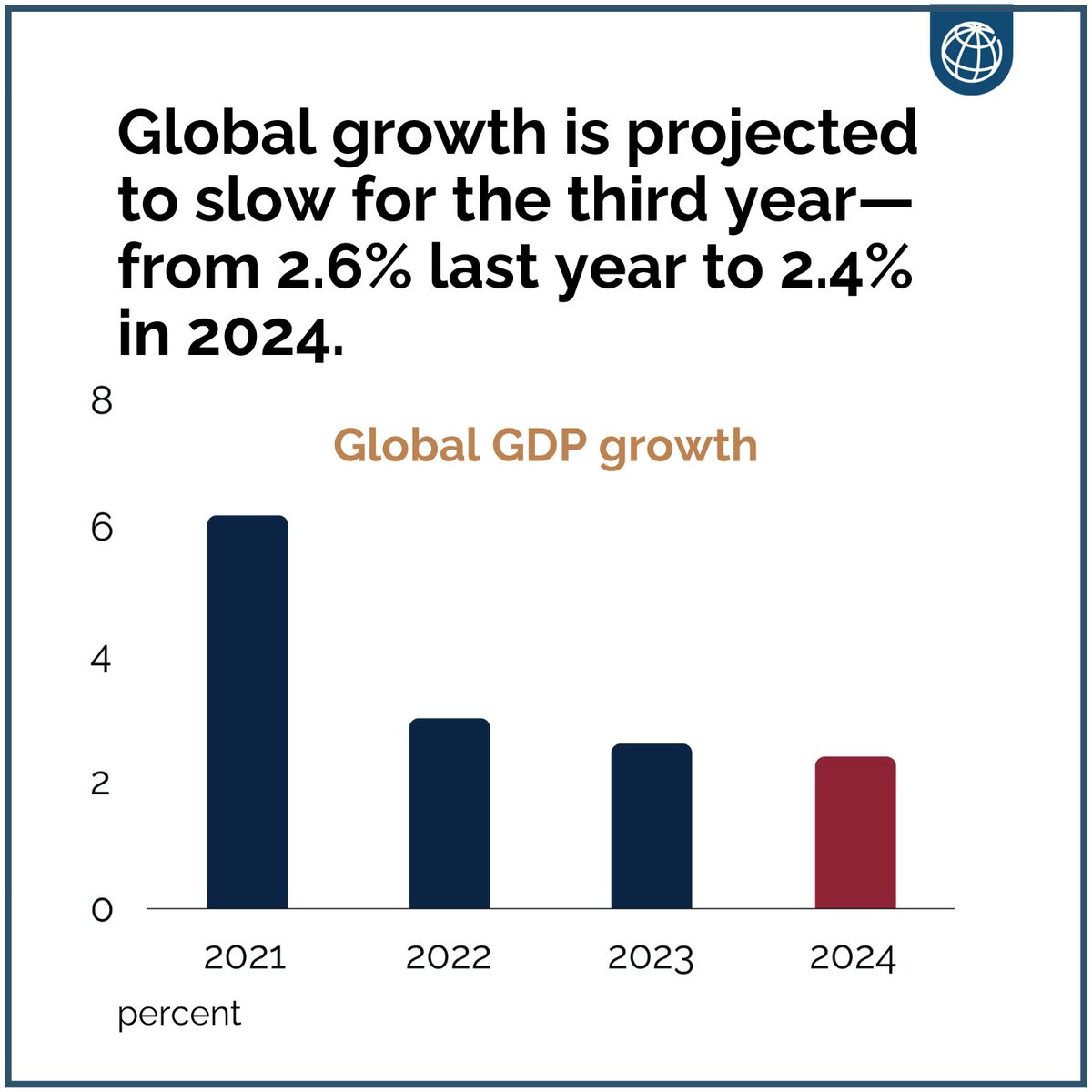

Four G7 economies (Japan, the U.K., France, and Germany) had already entered technical recessions last quarter. The outlook for 2024 is weaker; the World Bank’s latest 2024 Global Growth estimate fell to 2.4% from 2.6% last year compared with a 3.15% average rate in the 2010s. Global growth rates of less than 3% have historically been considered recession-grade. This is the lay of the land.

Four G7 economies (Japan, the U.K., France, and Germany) had already entered technical recessions last quarter. The outlook for 2024 is weaker; the World Bank’s latest 2024 Global Growth estimate fell to 2.4% from 2.6% last year compared with a 3.15% average rate in the 2010s. Global growth rates of less than 3% have historically been considered recession-grade. This is the lay of the land.

While some stock prices have continued to levitate, the ‘Magnificient Seven’ is no longer firing on all cylinders. Apple, sub $170, -15% since December, is at the same level as December 2021, while Tesla, sub $175, -57% since November 2021, is at the same level as November 2020.

While some stock prices have continued to levitate, the ‘Magnificient Seven’ is no longer firing on all cylinders. Apple, sub $170, -15% since December, is at the same level as December 2021, while Tesla, sub $175, -57% since November 2021, is at the same level as November 2020.

As ‘FOMO’ capital piled in, Mag 7 market pricing deliriously doubled in 17 months (September 2022 to February 2024), and the tech sector ballooned to 30% of the S&P 500 market capitalization (while driving just 7% of US GDP).

In the process, the price multiple for the S&P 500 rose to 25x forward normalized earnings, 67% higher than the 15x norm since 1987 (blue line on the lower left, courtesy of Bank of America). Paying so much means dividend yields are sub-1.5%, capital risks are high, and reward prospects are just 3% annualized over the next decade—the lowest since 2021 and 2000 before that (see arrow on lower right). Government bonds offer much more attractive risk-reward prospects, and institutional flows buy them, while retail portfolios miss the boat. Canada’s 10-year Treasury price has quietly risen 12.5% since October 2023. Treasury markets know rate cuts will come eventually, but too late to rescue many individuals and the economy from an epic cycle of destructive financial choices.

Government bonds offer much more attractive risk-reward prospects, and institutional flows buy them, while retail portfolios miss the boat. Canada’s 10-year Treasury price has quietly risen 12.5% since October 2023. Treasury markets know rate cuts will come eventually, but too late to rescue many individuals and the economy from an epic cycle of destructive financial choices.