Yesterday, the US Fed paused for the fifth consecutive meeting since July 2023. Holding its overnight rate at 5.25 to 5.5%, the Fed expects that rising unemployment will prompt it to ease policy rates later this year. At the same time, Chair Powell intends to continue reducing the Fed’s balance sheet (QT), withdrawing liquidity from financial markets.

This morning, the Bank of England issued a similar outlook, holding at 5.25%, and the Swiss Central Bank reacted to spreading economic weakness by cutting its overnight rate by 25 basis points (bps) to 1.5%.

The Bank of Canada (BOC) is sitting tight at 5%, afraid that easing will further inflame shelter inflation, even as Canada’s Consumer Price Index fell below a 3% annualized rate in January and February. With GDP per capita contracting at a 2% annualized rate (fourth quarter of 2022 to Q4 2023) and Canadian unemployment at 5.9% (90 bps above March 2023 low) and expected to rise, the odds of a 25 bp cut at the BOC’s April 10 meeting is a coin toss. The Canadian dollar has tumbled against the greenback year-to-date, and further weakness is our base case.

It’s typical for risk assets to rally when central banks pause rate-hiking efforts and finally start easing policy. But eventually, the reason they start easing: rising unemployment, credit defaults, and slowing economic activity come to dominate headlines and thwart soft landing hopes.

Higher interest rates and yields are better for savers but net negative in highly indebted economies. Since the Fed began tightening in March 2022, the overall aggregate net income gain is $280 billion, compared with a total interest expense increase of $420 billion.

In the process, credit delinquencies are leaping, and business insolvencies are up 36% year over year. Even though yield spreads for publicly traded companies have fallen to less than 300 bps over Treasuries (more risk-blind exuberance), the average interest expense ratio for S&P 500 companies has climbed to 7.7%, compared with 7% at the cycle high in 2007.

Three trillion in non-mortgage debt rolls over this year alone. The average interest cost increase for new terms is 26%. Bank credit is contracting for households and businesses. Where offered, a 5-year prime Canadian commercial mortgage rate is a sobering 9%.

The average historical gain for the S&P 500 during a Fed pause period has been about 9%. This cycle, a 30% concentration in the ten most expensive stocks has powered the S&P 500 15% higher since last July. The 30% level of big-name concentration has only been seen thrice in 1929, 1973, and 2000. All were secular market tops followed by multi-year 50%+ drops.

At the same time, Canada’s TSX just managed to reclaim its pre-tightening high from 24 months ago, while the economically sensitive Russell 2000 has been negative since December 2021.

The economy is weak, unemployment is rising, and corporate profit expectations are at all-time highs. Only three times did a Fed tightening cycle not trigger a profit recession and bear market for stocks: the mid-1960s, 1980s, and 1990s–in all three ‘soft-landing’ incidents, the Fed had stopped tightening before it inverted the yield curve, and stocks entered the tightening cycle at below-average valuations; no such luck this time.

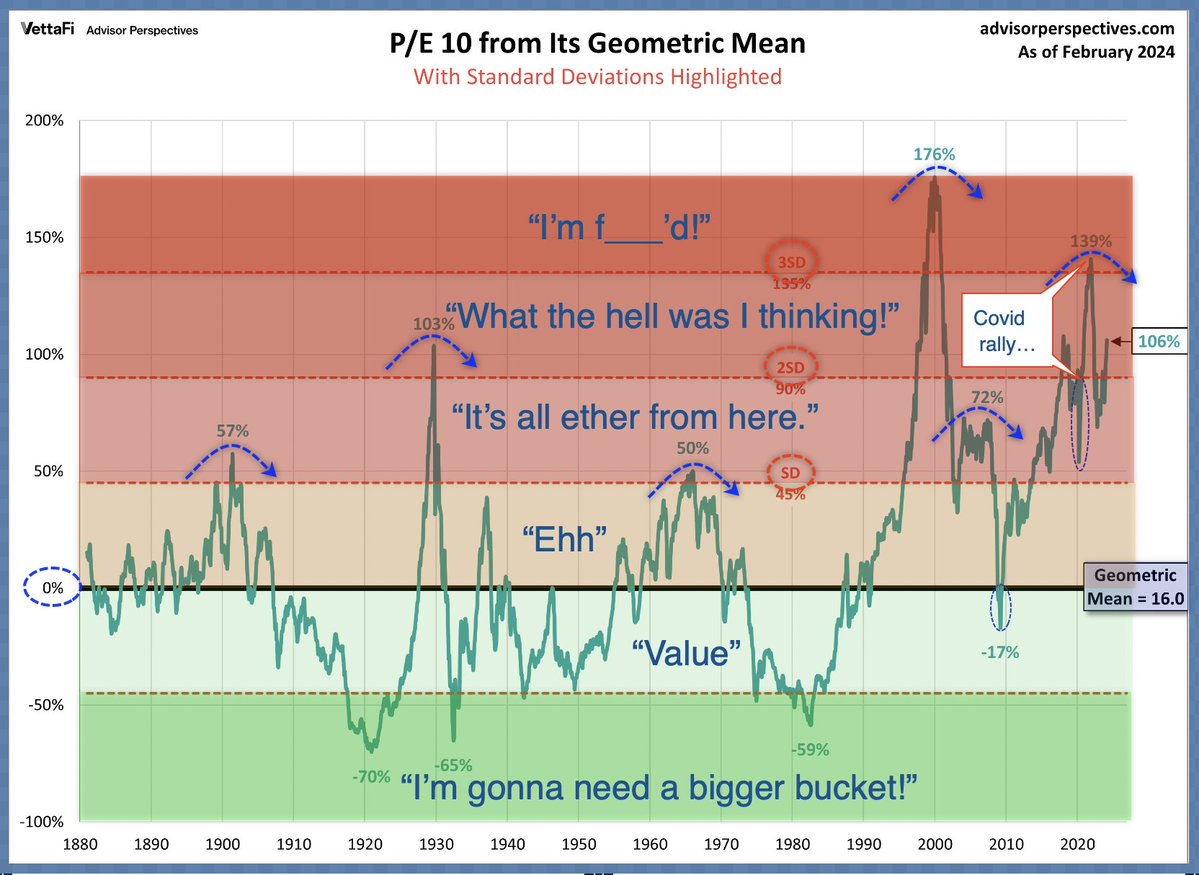

Central banks tightened for months after the yield curve inverted this cycle, and began when the smoothed 10-year price-to-earnings ratio for US stocks (S&P 500 below since 1880) was the second most overpriced level in the last 144 years (139% above the long-term mean as shown below courtesy of Advisor Perspectives). Financial pain will compound as obscene asset prices fulfill their downward destiny. At that point, many people will realize that they are worse off than they previously understood, and civil unrest will likely rise in many countries.

Financial pain will compound as obscene asset prices fulfill their downward destiny. At that point, many people will realize that they are worse off than they previously understood, and civil unrest will likely rise in many countries.

The more indebtedness and inflated asset prices entering into this down cycle, the worse the fallout will be and the more people will discover they are poorer than they thought; see: Secret RCMP report warns Canadians may revolt once they realize how broke they are. Proactive efforts at capital preservation are the rational, opportunistic response.