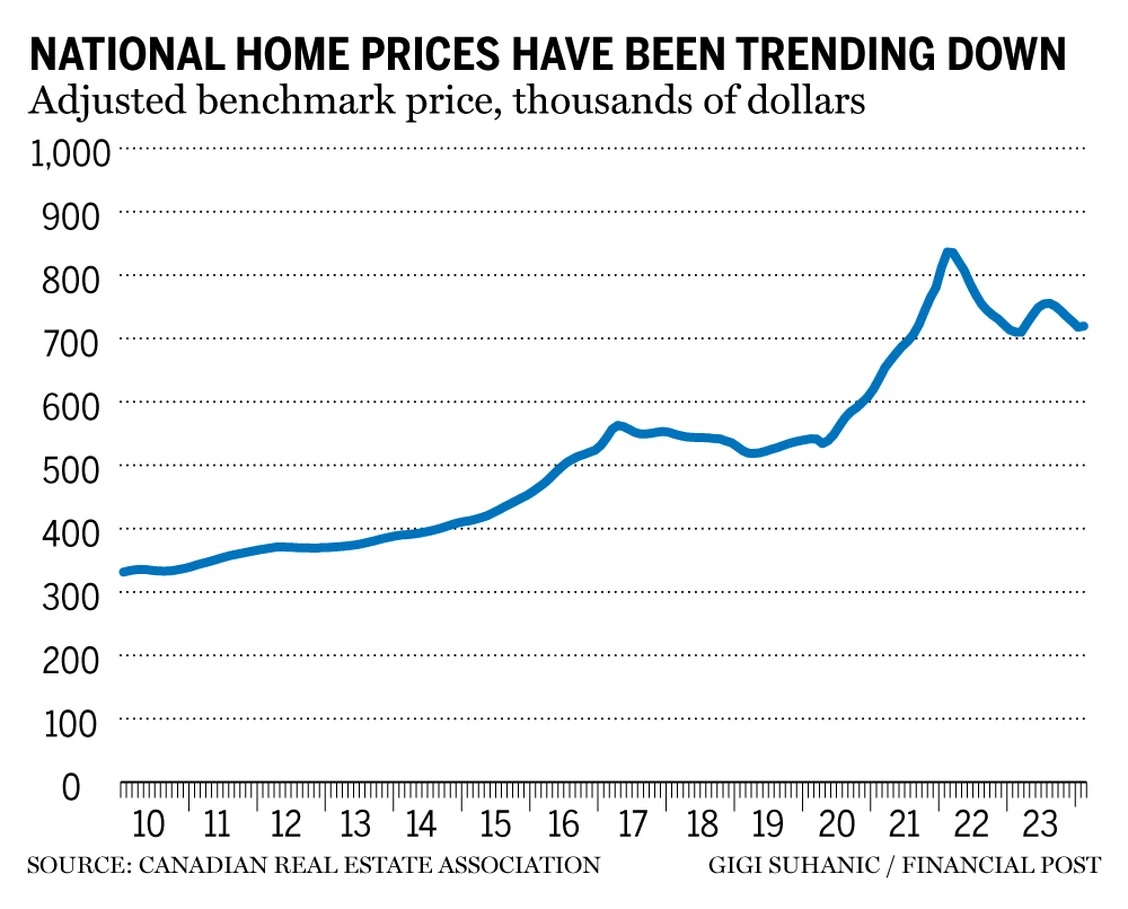

Nationally, the average Canadian home sale price in February 2024 was $719,400, -11.9% from the cycle peak of $816,720 in February 2022.

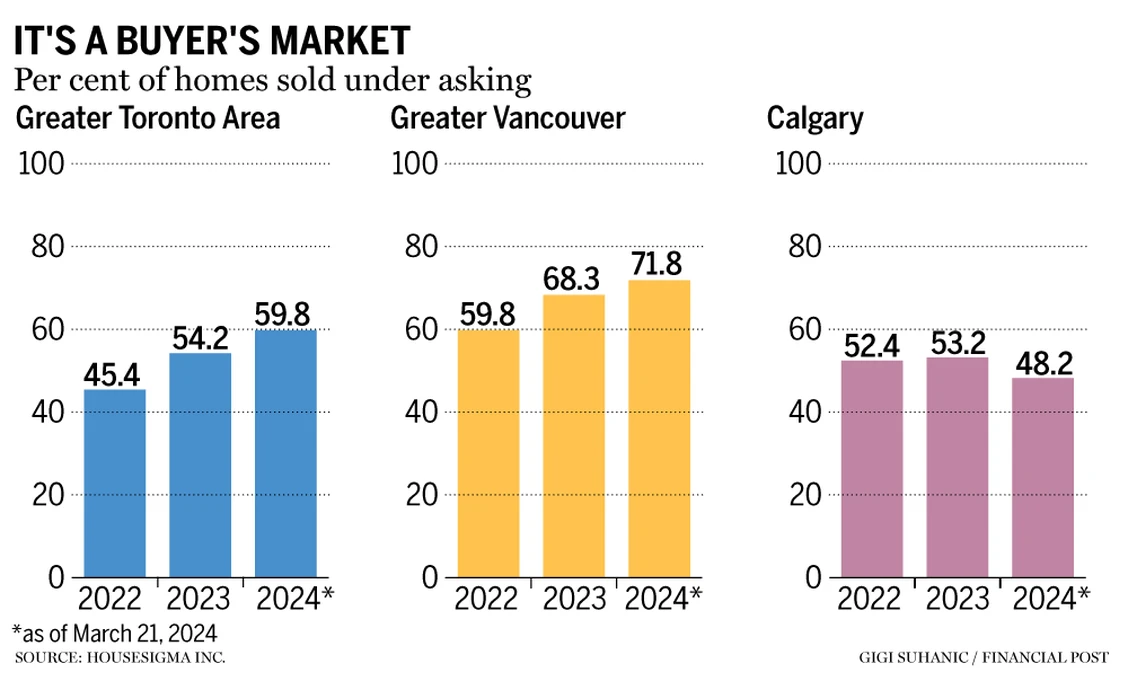

Year-to-date, sixty percent of homes in the Greater Toronto Area sold below their asking price, 71% in Vancouver, and 48% in Calgary (the trend over the past three years is shown below). The average number of days a property spends on the market in the GTA rose 13.6% over the past year (TREB).

Year-to-date, sixty percent of homes in the Greater Toronto Area sold below their asking price, 71% in Vancouver, and 48% in Calgary (the trend over the past three years is shown below). The average number of days a property spends on the market in the GTA rose 13.6% over the past year (TREB).

Bidding wars are less common than when interest rates were lower, and conditions like property inspections and financing approvals are once again typical. Still, most markets are considered balanced in terms of sellers and buyers so far, with properties priced to sell seeing offers. See: Home sellers forced to confront new market realities this spring.

Bidding wars are less common than when interest rates were lower, and conditions like property inspections and financing approvals are once again typical. Still, most markets are considered balanced in terms of sellers and buyers so far, with properties priced to sell seeing offers. See: Home sellers forced to confront new market realities this spring.

With sales edging down and new listings up 1.6% month over month in February, the national sales-to-new listings ratio was 55.6%. A sales-to-new listings ratio between 45% and 65% is generally considered a market where supply and demand are balanced, with readings above 65% favouring sellers and below 45% favouring buyers.

“If you price your property at what you want and it makes sense in the marketplace, you’re selling within seven days,” he said. “And the main reason for that is there’s such a low inventory out there that buyers don’t want to waste their time with sellers who are playing games. Buyers appreciate sellers who are pricing homes at what makes sense on paper, and are going through with the sale if everything checks out.”