In every market cycle, once everyone who can or will buy has bought, only sellers remain.

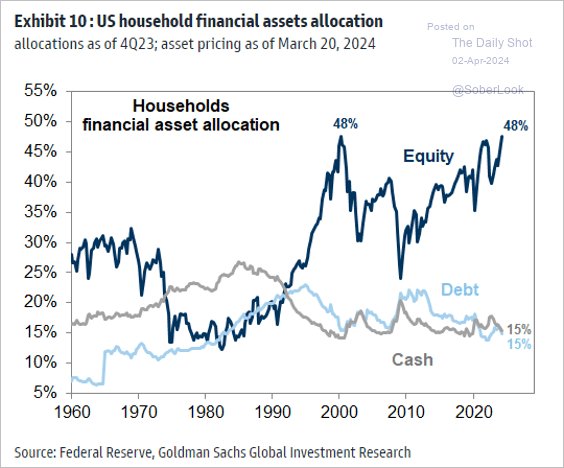

Today, households have a record 48% of their financial assets allocated to equities, the same level as the tech top in March 2000 and above the cycle peaks in early 2008 and 2022 (shown below, courtesy of The Daily Shot). We are running low on greater fools.

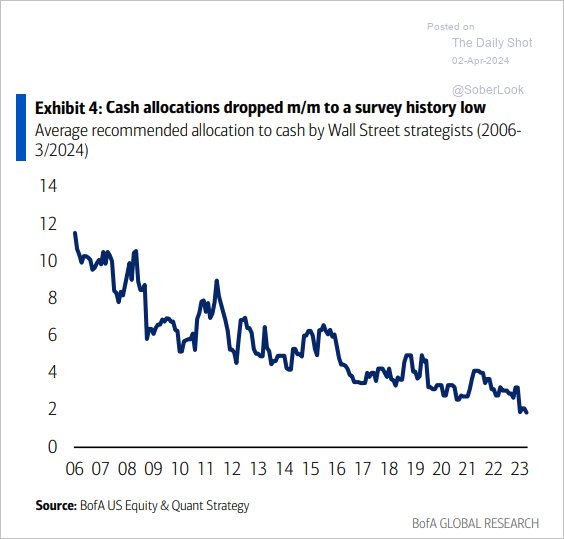

Wall Street strategists work for companies that sell securities and fee-generating investment products to the public. Unsurprisingly, then, they are not in the business of suggesting that people hold cash equivalents. As shown below, strategist recommendations have become increasingly fee-maximizing since 2006, with average cash allocations falling to 2% in the third quarter of 2024. What dry powder??

Wall Street strategists work for companies that sell securities and fee-generating investment products to the public. Unsurprisingly, then, they are not in the business of suggesting that people hold cash equivalents. As shown below, strategist recommendations have become increasingly fee-maximizing since 2006, with average cash allocations falling to 2% in the third quarter of 2024. What dry powder??

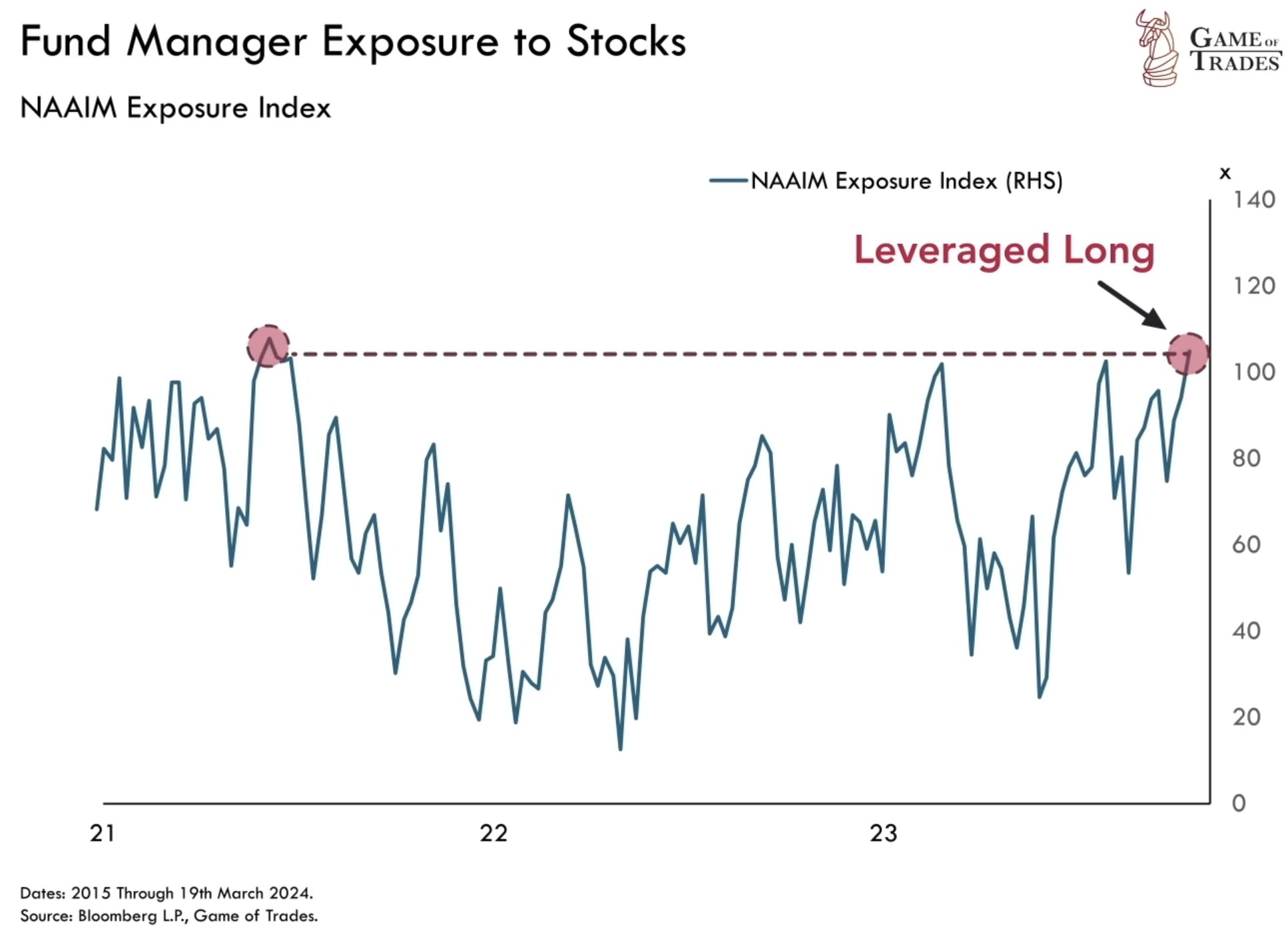

Next are asset managers trained to buy every dip with any cash. Once all capital under management is in stocks, some borrow to magnify exposure further. As shown below (courtesy of Game of Trades), in 2024, at the highest equity valuations since 2021, 2000, and 1929 before that, fund managers borrowed to increase equity allocations above 100%.

Next are asset managers trained to buy every dip with any cash. Once all capital under management is in stocks, some borrow to magnify exposure further. As shown below (courtesy of Game of Trades), in 2024, at the highest equity valuations since 2021, 2000, and 1929 before that, fund managers borrowed to increase equity allocations above 100%.

Think fund managers are managing downside risk to unitholder savings? Quite the opposite! What risk management? Once unit holders start requesting redemptions, managers have no choice but to borrow more or sell holdings to raise cash. As asset prices start to fall, this ensures a negative loop unfolds where selling forces more selling.

And since ten companies make up a record 30% of large-cap indexes like the S&P 500, index-following equity allocations are similarly concentrated in the same mostly tech-centric growth stocks.

And since ten companies make up a record 30% of large-cap indexes like the S&P 500, index-following equity allocations are similarly concentrated in the same mostly tech-centric growth stocks.

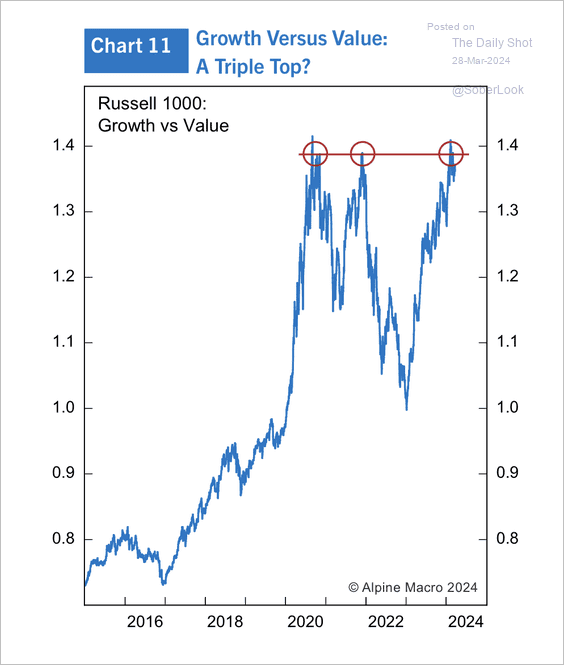

The Russell 1000 Value Index is composed of large and mid-capitalization U.S. equities trading at relatively cheaper valuations than their peers. As shown below, growth names in the Russell 1000 recently triple topped at 1.45x the market price of so-called “value” names. While this suggests growth stocks are overvalued, the metric is relative. Value stocks are cheaper than growth, but that does not mean that value is cheap.