Four months ago, Fed Fund Futures had priced in the expectation of 6 to 8 US rate cuts (150 to 200 basis points) by the end of 2024. Today, that expectation has retreated to just 40 bps, with a 17% chance of a 25 bp cut in June, down from 50% on Monday.

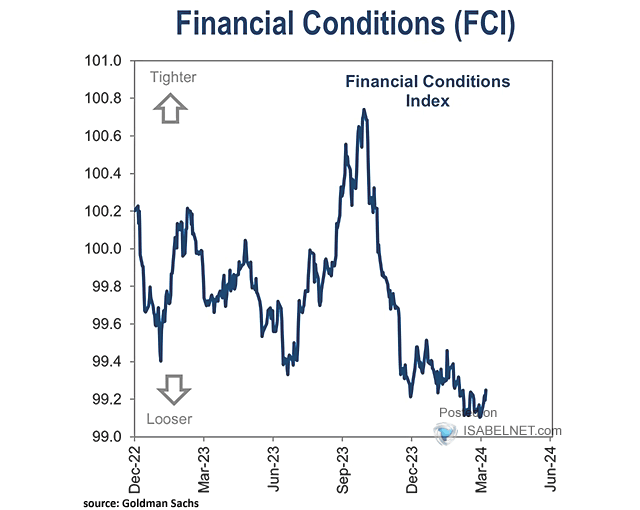

A significant factor at work here is the rebound in animal spirits and corporate security prices since last fall. Equity and junk debt markets have once more priced out any possibility of economic weakness, and this has worked to loosen financial conditions for public corporations by the equivalent of 100 basis points (shown below since December 2022, courtesy of Isabelnet.com). At the same time, US and Canadian central banks have held base rates in the banking system above 5%—the tightest level in 17 years–intensifying stress on all indebted households and private companies that access financing through banks.

At the same time, US and Canadian central banks have held base rates in the banking system above 5%—the tightest level in 17 years–intensifying stress on all indebted households and private companies that access financing through banks.

Leaping auto insurance, medical costs, oil prices, and highly guestimated ‘owner-equivalent rents’ have buoyed US services CPI. At the same time, US fiscal support has driven spending on roads and highways, new factories for electric vehicles, batteries, and semiconductor chips, and initiatives to combat climate change.

Inflation and growth readings have seen no such surge in Canada, China and the Eurozone.

Canadian GDP per capita has been negative for the past six quarters (yellow line below since 2019 vs. the US in blue). With billions in mortgages up for renewal every month, the Bank of Canada’s room for staying at 17-year rate highs is shrinking.

As government bond prices have dipped this month, interest rates are rising further for the masses. The pain is widely evident with debt delinquencies, bankruptcy filings, and job losses increasing at a pace only seen in past recessions.

As government bond prices have dipped this month, interest rates are rising further for the masses. The pain is widely evident with debt delinquencies, bankruptcy filings, and job losses increasing at a pace only seen in past recessions.

Canada’s largest investment bank, RBC, forecasts the BoC will blink and lower its overnight rate by 113 bps by year-end and 163 bps by the end of 2025. This would open a larger than typical gap between US and Canadian interest rates (shown below since 2000).

The Canadian economy is smaller, more cyclical, and less self-sustaining than America’s. It’s typical for the US economy to look stronger longer, heading into global slumps.

The Canadian economy is smaller, more cyclical, and less self-sustaining than America’s. It’s typical for the US economy to look stronger longer, heading into global slumps.

By the time central banks cut interest rates, economic downturns are accelerating and contagious. Risk assets are typically dumped as a dash for cash spreads.

The US dollar has strengthened against the loonie since late December. It’s also strengthening against the Euro, Yen, and the Pound, driving the US dollar index (DXY) above 105, the highest it has been since last November.

Back then, high debt costs and a strong greenback were recognized as negatives for the masses, exerting downward pressure on corporate earnings and global growth. Stock and high-yield debt markets responded with another nervous breakdown. This time, how long risk markets can defy financial gravity remains to be seen.