A stream of big companies are guiding down their outlook this week with reference to distressed consumers pulling back. See: Long-predicted consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’s:

Starbucks announced a surprise drop in same-store sales for its latest quarter, sending its shares down 17% on Wednesday. Pizza Hut and KFC also reported shrinking same-store sales. And even stalwart McDonald’s said it had adopted a “street-fighting mentality” to compete for value-minded diners.

For months, economists have been predicting that consumers would cut back on their spending in response to higher prices and interest rates.

On the earnings call yesterday, McDonald’s CEO Chris Kempczinski noted that the weakness is global:

“It is clear that broad-based consumer pressures persist around the world. Consumers continue to be even more discriminating with every dollar that they spend as they face elevated prices in their day-to-day spending…It’s worth noting that in [the first quarter], industry traffic was flat to declining in the U.S., Australia, Canada, Germany, Japan and the U.K.”

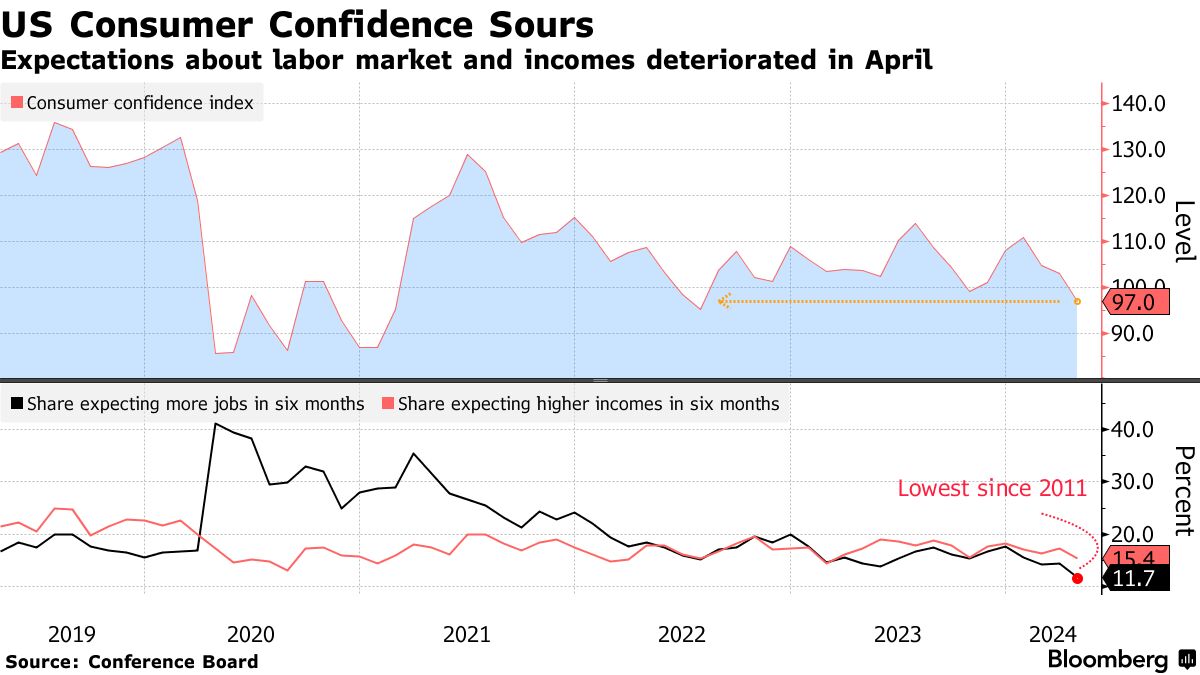

At the same time, the Conference Board’s measure of US consumer confidence in April declined for the third consecutive month to its lowest level since mid-2022 as consumer views on the labour market and economy deteriorated. See US Consumer Confidence Slumps to Lowest Level Since July 2022.  Consumers drive the majority of economic activity in developed economies. With household saving rates at cycle lows, spending is piling up on credit card balances where interest rates are north of 20%.

Consumers drive the majority of economic activity in developed economies. With household saving rates at cycle lows, spending is piling up on credit card balances where interest rates are north of 20%.

Many who bought or refinanced real estate and vehicles when interest rates were at historic lows and prices near cycle highs (2020-2022) are increasingly looking to sell as a cash crunch spreads. A plunge in short-term vacation bookings is intensifying the pressure. See Florida real estate struggles as ‘motivated’ sellers flood market:

“It’s also coming at a time when HOA (homeowner association) fees are going up and insurance costs are going up, and people don’t want to pay these higher property taxes,” Fairweather said. “More new listings are coming on the market right now, too.”

There are more than 5,600 active listings in Florida that include the keyword “motivated” in the description on Zillow.

Similar trends are evident in many areas, with over-leveraged owners needing to slash carrying costs while willing and able buyers are limited.

In Canada, the average sale price in March was $855k, some 14.7% lower than the cycle peak in March 2022. In the most populated provinces, Ontario and BC, the average price was -17.7% and -9.3% lower than in March 2022, respectively. Yet, with asking prices still some 30% higher than in March 2020 and Canadian mortgage rates around 5% (over 7% in America), properties remain wildly unaffordable for most.

Payment delinquencies are exploding across all loan types. And it’s not just households falling behind. See Office-loan defaults near historic levels with billions on the line:

Defaults are reaching historic levels in the office market, as a growing number of owners capitulate to persistently high interest rates and weak demand.

More than $38 billion of U.S. office buildings are threatened by defaults, foreclosures or other forms of distress, according to data firm MSCI. That is the highest amount since the fourth quarter of 2012 in the aftermath of the 2008-2009 financial crisis.

Selling pressure, payment defaults, job losses and price declines are likely to intensify in the months ahead as mania from the ultra-easy money era (2010-2022) now unwinds.