For a year now, overnight interest rates have been above 5% in Canada and America, while the Consumer Price Index (CPI) has been falling. This has resulted in the highest real interest rates (overnight rate – CPI) in at least 23 years. While very hard on debtors, it’s favourable for savers and it’s long overdue.

Still, asset allocators have acted like the 20-fold increase in base rates since 2022 never happened. Momentum-following capital flows have continued to fund casino-quality risk bets. Concerns about capital losses are out of style. Portfolios hold a record concentration in stocks and minuscule weights in bonds and cash.

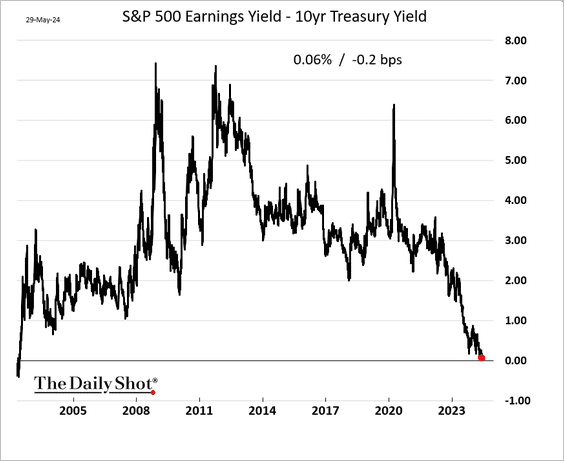

In the process, the compensation for owning equity risk (earnings yield 4.8%—4.572% 10-year treasury yield)–has fallen below zero (-.2 bps) for the first time since 2002 (shown below courtesy of The Daily Shot).

Over the past year, stock prices have risen four times faster than earnings growth, with the price-to-forward earnings ratio for the S&P 500 leaping from a rich 18x last fall to an eye-watering 21x now.

Over the past year, stock prices have risen four times faster than earnings growth, with the price-to-forward earnings ratio for the S&P 500 leaping from a rich 18x last fall to an eye-watering 21x now.

An inverted yield curve and Leading Economic Indicators (LEI) contracting have warned of an incoming recession for months, but the consensus remains sanguine. Starting this week, stock bulls outnumbered bears three to one.

Fundamentals be damned, risk management is passé. Running bulls need no thinking.