Mindless capital allocation leads to wasted resources and bad investment outcomes. We’ve just come through a decade of some of the dumbest financial choices in history–that’s been very expensive.

In the midst of a housing supply crisis, thousands of condos in Canada’s largest cities are sitting empty. Most, experts say, are less than 500 square feet. Andrew Chang explains why there’s been an explosion of these so-called ‘shoebox’ condos, and why they’re suddenly struggling to sell. Here is a direct video link.

And it’s not just something that has happened in the entry-level condo market…

National house prices are down 14% across Canada but the losses are not spread evenly. The luxury housing market, which depends on foreign capital, is really struggling, particularly for luxury condos in Vancouver and Toronto. Calgary’s real estate market continues to outperform. Here is a direct video link.

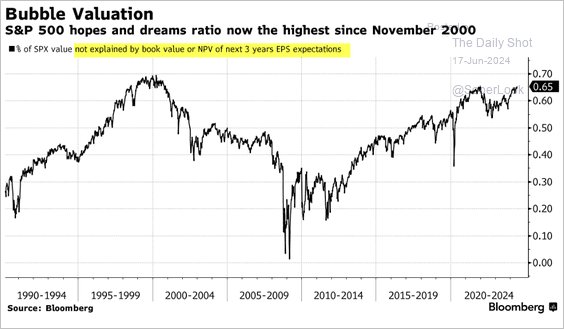

Now, about that AI mania and fear of missing out priced into stock markets…As shown below, 65% of the S&P 500’s current valuation is not explained by tangible items like book value or the net present value of the next three-year earnings per share expectations.

At least condos can provide some physical shelter…inflated security prices, no such luck.

At least condos can provide some physical shelter…inflated security prices, no such luck.