Nancy Lazar, Piper Sandler global chief economist, joins ‘Money Movers’ to discuss whether Tuesday’s economic data changes any of the economists’ forecasts, whether the Federal Reserve has room to focus on its employment mandate, and more. Here is a direct video link.

Also, see, Investors return to bonds as recession fears stalk markets:Investors are piling back into bonds as recession replaces inflation as markets’ main fear, and fixed income proves its worth as a hedge against the recent stock market chaos.

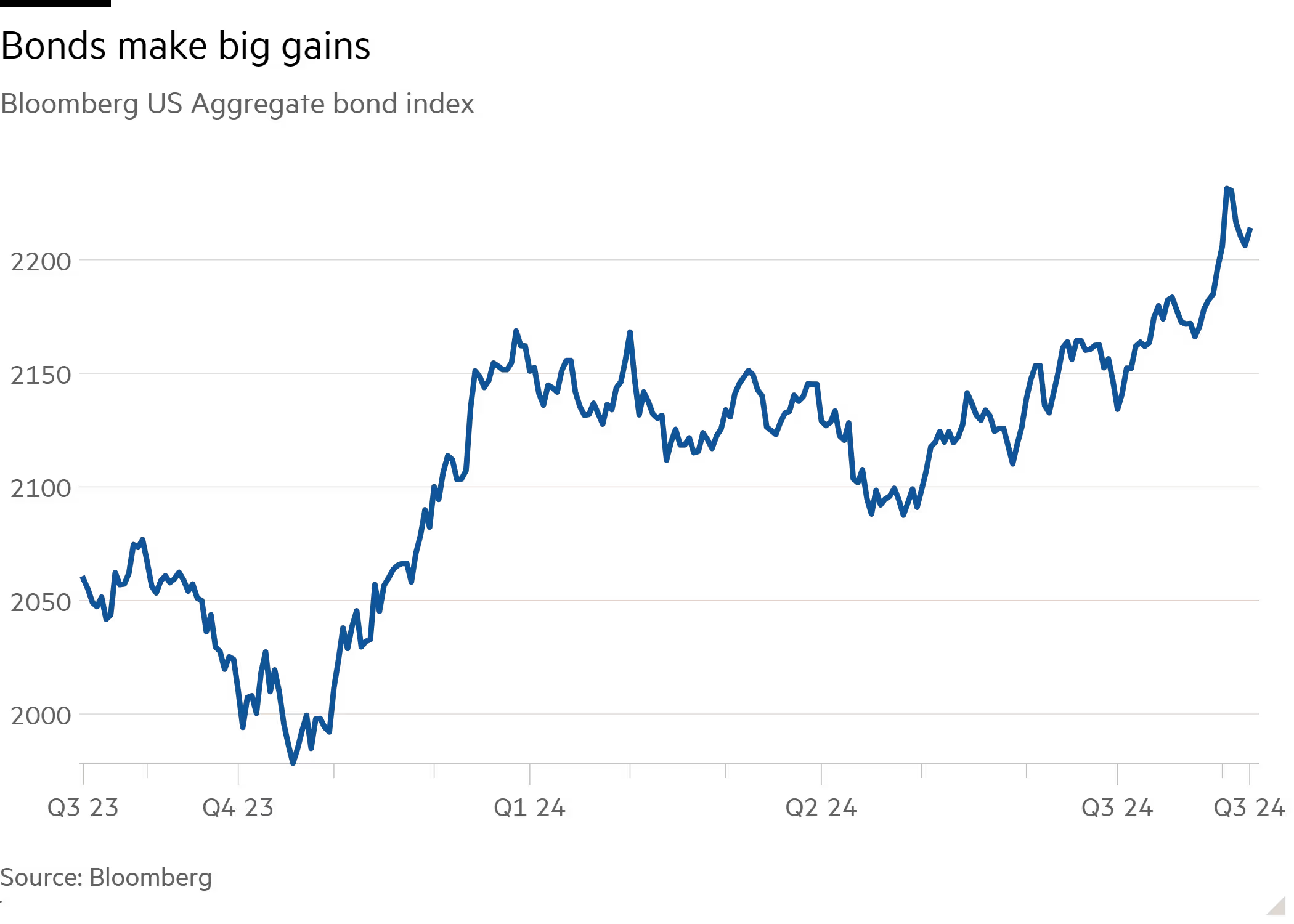

US Treasuries and other highly rated debt staged a powerful rally during last week’s equity rout, pulling yields to their lowest level in more than a year. While the sharpest moves subsequently reversed, fund managers say they underscored the appeal of bonds in an environment where growth is slowing, inflation is falling and the Federal Reserve — along with other major central banks — is expected to deliver multiple cuts in interest rates by the end of the year.

…“The best protection against a downside scenario like a recession is Treasury bonds,” said Robert Tipp, head of global bonds at PGIM Fixed Income.

“The arguments for fixed income are really strong. Sometimes people need a shove to move out of cash. The drop-off in employment has really made that [happen],” said Tipp.

A Bloomberg index that tracks both US government and high-quality corporate bonds has gained 2 per cent since late July, contrasting with a 6 per cent loss for the S&P 500. The biggest gain for bonds came on the day of the employment report when stocks sank sharply.

Follow

____________________________

____________________________

Danielle’s Book

Media Reviews

“An explosive critique about the investment industry: provocative and well worth reading.”

Financial Post“Juggling Dynamite, #1 pick for best new books about money and markets.”

Money Sense“Park manages to not only explain finances well for the average person, she also manages to entertain and educate while cutting through the clutter of information she knows every investor faces.”

Toronto SunSubscribe

This Month

Archives

Log In