The fourth year of a presidential cycle is all about promising. The first year of a presidential cycle is about trying to deliver on all the promises.

At the start of President Trump’s last term in 2017, the U.S. government deficit to GDP was 3% versus 6% today. The federal debt as a percentage of GDP was 100% versus 130% today. The Fed’s overnight lending rate was 40 basis points then versus 4.75% now. The 10-year Treasury yield was 2.38% versus 4.28% now.

U.S. Household debt (below since 2004), was at $12 trillion in the fall of 2016 and is over $18 trillion now. The U.S. 30-year fixed mortgage rate was 3.57% versus 6.8% now.  In November 2016, the U.S. unemployment rate was 4.7% and downcycling from a 10% peak in October 2009. Today, the US unemployment rate at 4.1% is upcycling from a 3.4% historic low in January 2023. Unemployment has always continued to rise throughout Fed easing cycles. The Fed started this easing cycle only two months ago.

In November 2016, the U.S. unemployment rate was 4.7% and downcycling from a 10% peak in October 2009. Today, the US unemployment rate at 4.1% is upcycling from a 3.4% historic low in January 2023. Unemployment has always continued to rise throughout Fed easing cycles. The Fed started this easing cycle only two months ago.

The number of unemployed Americans was falling from 2016 through 2020. Today, the number has been rising again since January 2023. The over 1.6 million Americans unemployed for more than 27 weeks in October, was a rate of change commenserate (red circles courtesy of Global Markets Investor) with the onset of past recessions (grey bars below since 1975). Job posting service ZipRecruiter this week warned of a protracted labour market downturn with falling demand from small and medium-sized businesses. (The companies that borrow money through banks and private lenders).

Job posting service ZipRecruiter this week warned of a protracted labour market downturn with falling demand from small and medium-sized businesses. (The companies that borrow money through banks and private lenders).

As Federal Reserve Chair Powell noted yesterday, the labour market has more excess capacity now than before the Pandemic. The unemployment rate, already expected to rise in 2025, will do so at an accelerated pace if the Trump team delivers the government spending cuts it campaigned on.

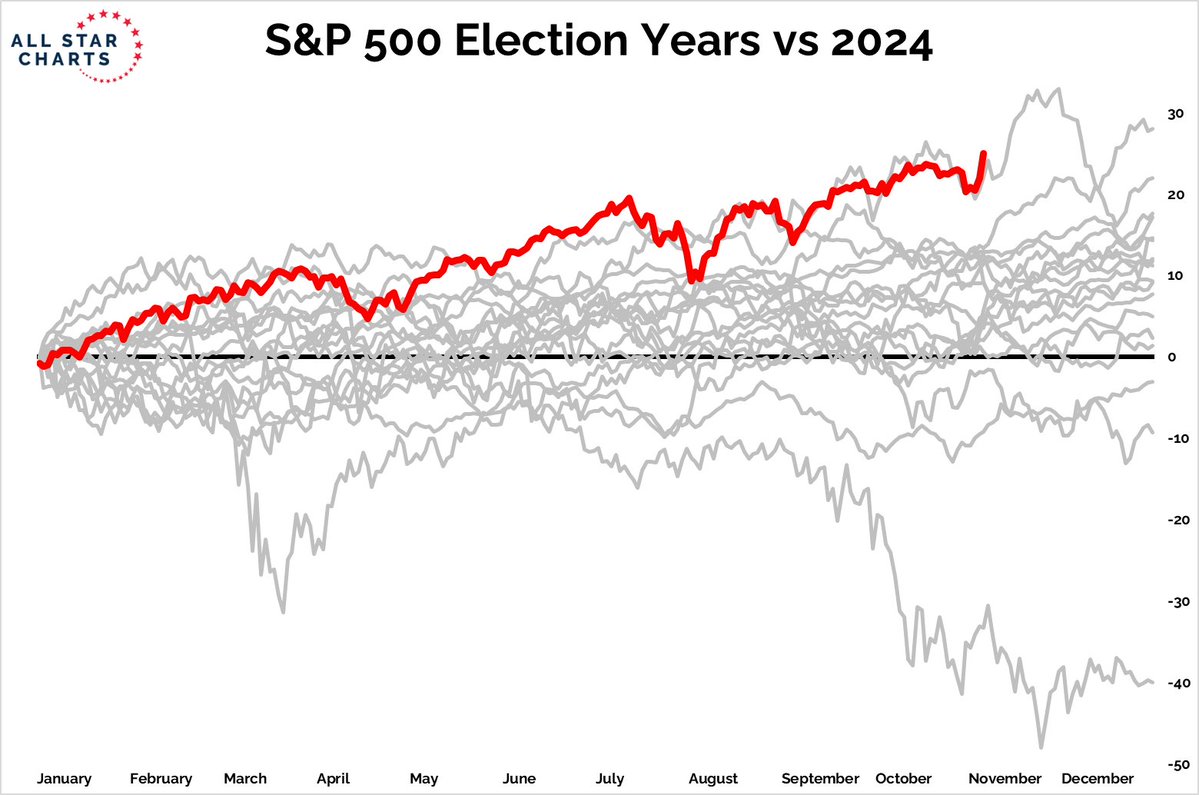

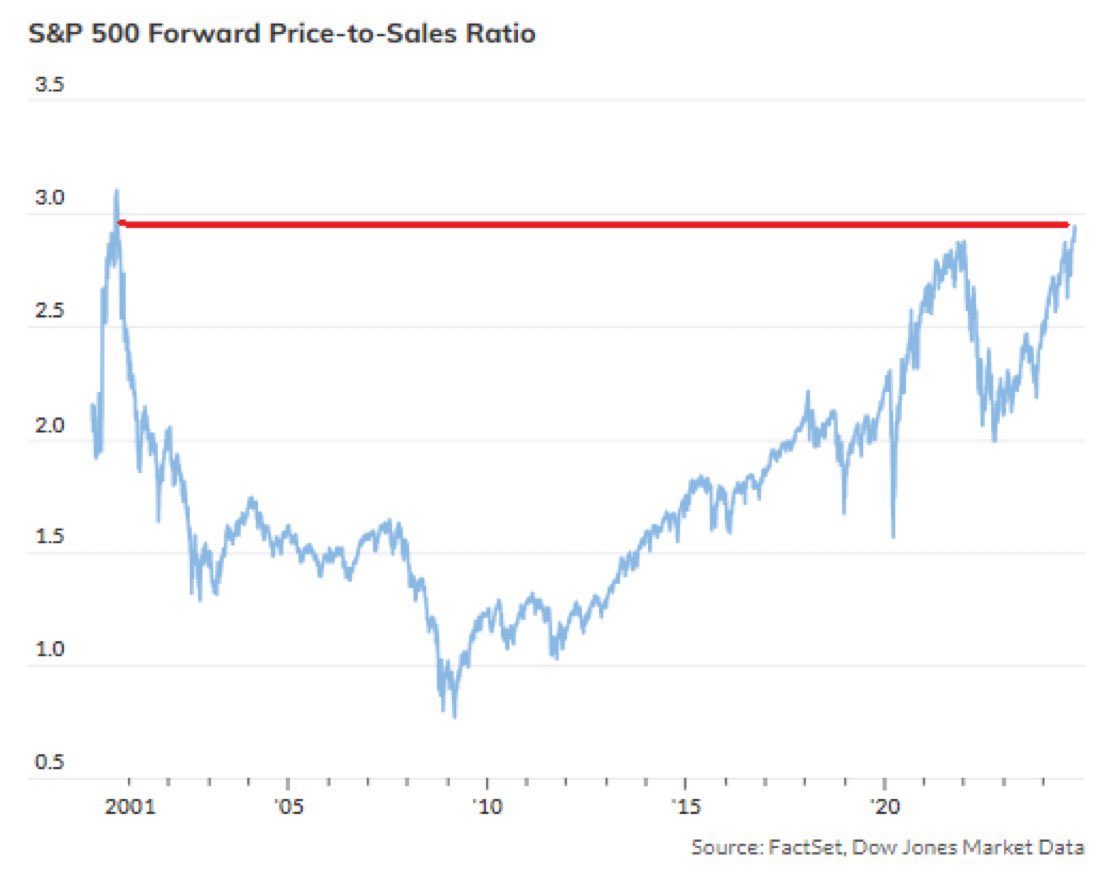

Last, but not least, Trump is returning to the Oval Office after the largest pre-election valuation ramp for the S&P 500 of any election year of the last century.  The price now 22x forward earnings compares with 16x in the fall of 2016 when the dividend yield was 2% compared with barely over 1% now. Stocks priced an eye-watering 3x forward sales estimates, near double the ratio of 2016, are tied for the all-time most inflated since just before prices crashed in the fall of 2021 and March 2000.

The price now 22x forward earnings compares with 16x in the fall of 2016 when the dividend yield was 2% compared with barely over 1% now. Stocks priced an eye-watering 3x forward sales estimates, near double the ratio of 2016, are tied for the all-time most inflated since just before prices crashed in the fall of 2021 and March 2000. Given where we are in this business, debt, demographic, climate and market cycle, whoever came into power at this juncture would have a tough time serving all the free lunches wanted. 2024 is going to be a very tough act to follow.

Given where we are in this business, debt, demographic, climate and market cycle, whoever came into power at this juncture would have a tough time serving all the free lunches wanted. 2024 is going to be a very tough act to follow.