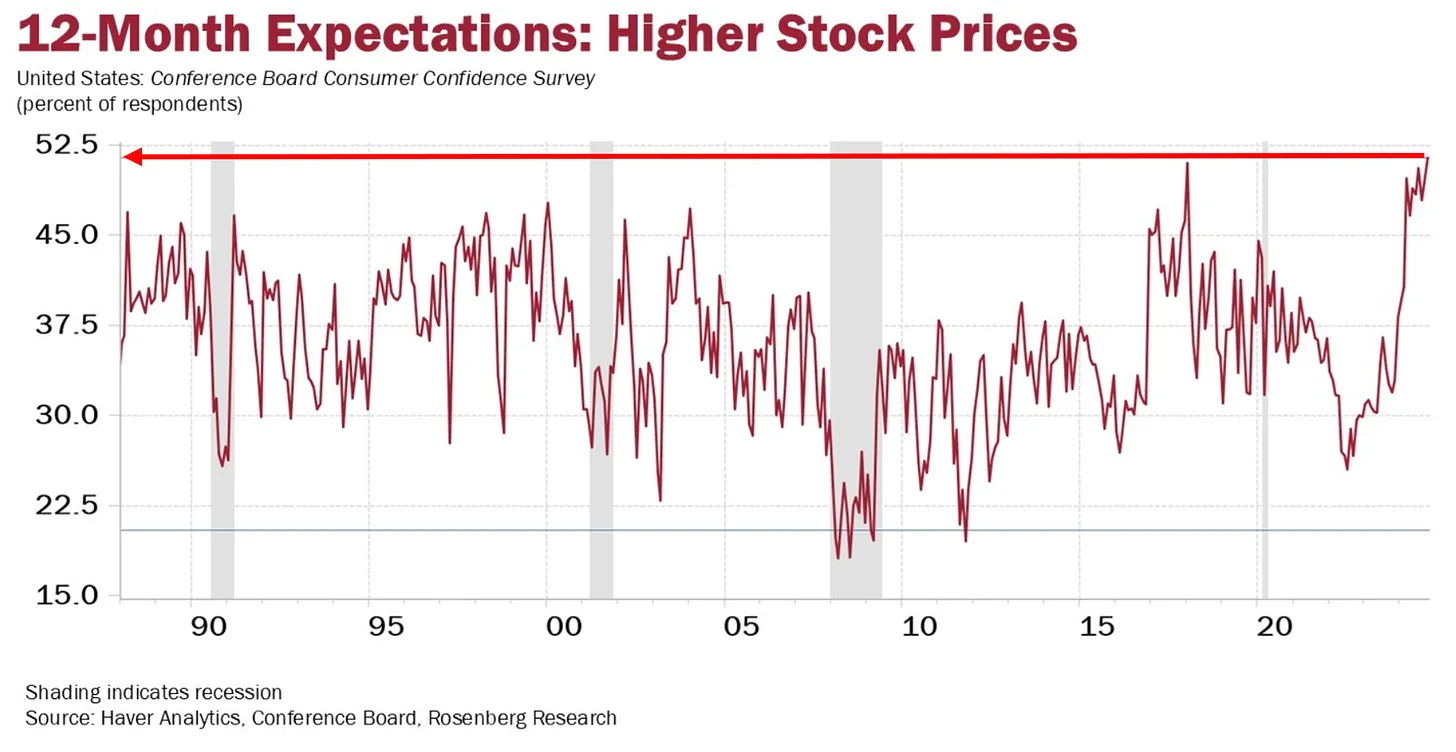

The S&P 500 is on track for its biggest election-year gain in 88 years. Still, according to the latest Conference Board Consumer Confidence Survey, the share of US consumers expecting stocks to rise further over the next 12 months has doubled over the last year to the highest percentage since this question was first asked in 1987 (chart below courtesy of Global Macro Investors and Rosenberg Research).

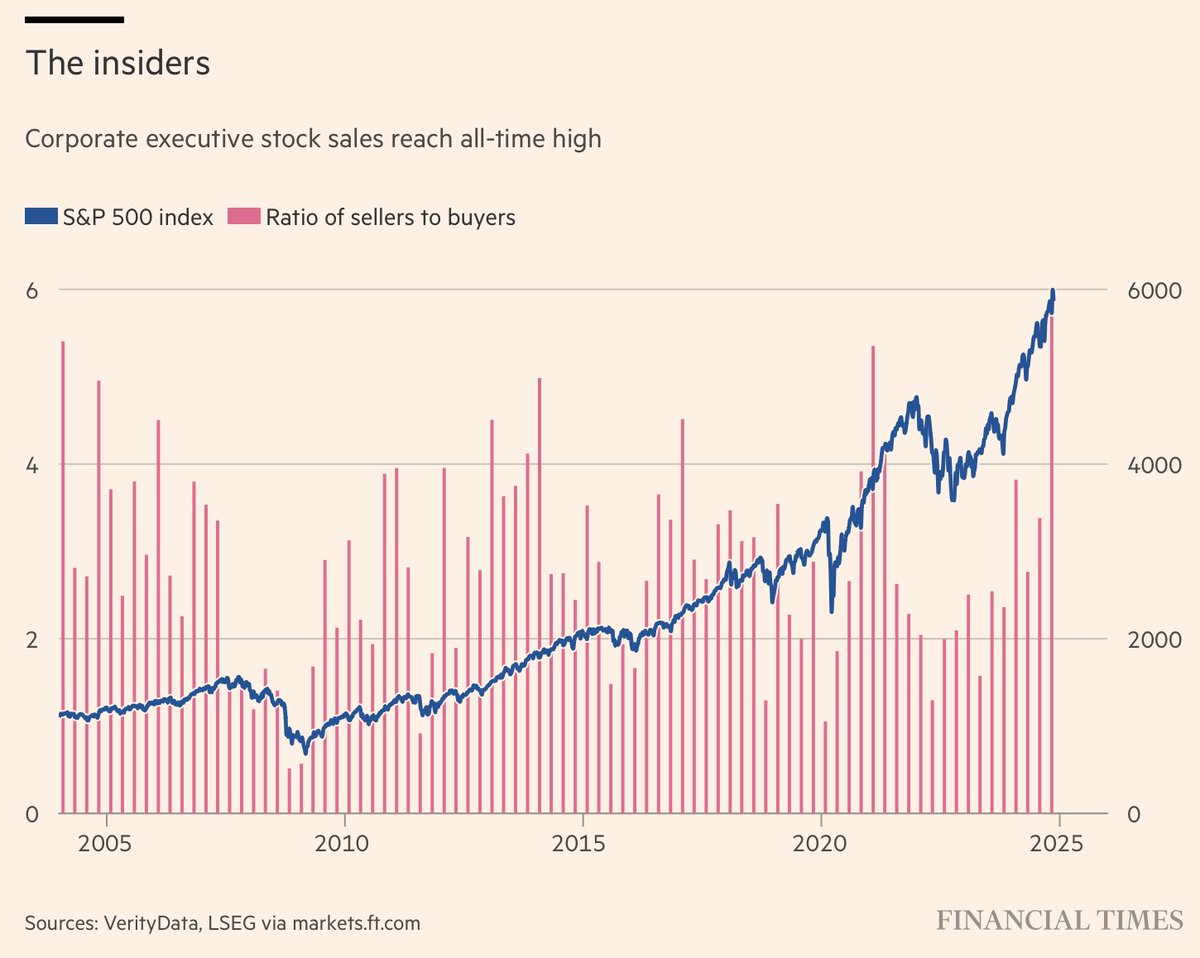

Meanwhile, corporate executive insider stock selling as a ratio of buying also reached an all-time high this month; see Corporate Insiders cash in on the post-election US stock market surge (chart below since 2000). Executives selling their holdings into the flows of their company share buybacks ought to be illegal, but this form of insider trading has become routine.

Meanwhile, corporate executive insider stock selling as a ratio of buying also reached an all-time high this month; see Corporate Insiders cash in on the post-election US stock market surge (chart below since 2000). Executives selling their holdings into the flows of their company share buybacks ought to be illegal, but this form of insider trading has become routine.

Unfortunately, high hopes among retail observers have regularly presaged portfolio losses. Most trying to ‘trade’ or buy and hold securities fall victim to extreme volatility and emotions, adding more capital as prices leap and liquidating after losses.

Unfortunately, high hopes among retail observers have regularly presaged portfolio losses. Most trying to ‘trade’ or buy and hold securities fall victim to extreme volatility and emotions, adding more capital as prices leap and liquidating after losses.

Real-world return data confirm that most individuals do better steering clear altogether. But at times like this, doing the right thing can feel hard to do.