The S&P 500 (26% concentrated in the five most expensive tech companies) is trading at 38x smoothed 10-year earnings, just marginally below the all-time high of 43x briefly seen at the 2000 tech bubble top and much higher than the previous bubble top in 1929 (Shiller PE ratio below since 1870).

But then, most are oblivious, and those who know or should care have become convinced that the price multiple paid doesn’t matter. If that is true, it would be a first.

But then, most are oblivious, and those who know or should care have become convinced that the price multiple paid doesn’t matter. If that is true, it would be a first.

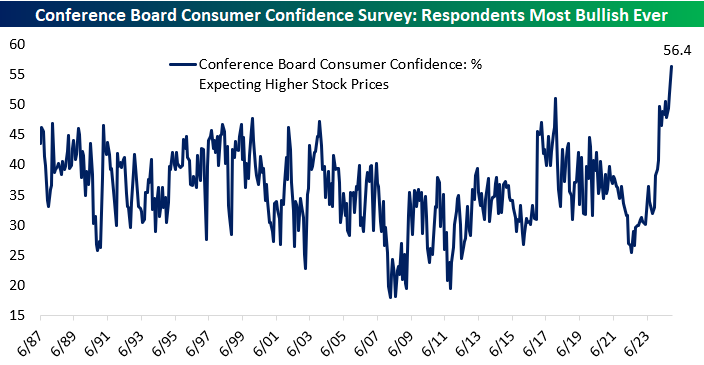

Feeding on the frenzy, the financial sector has rolled out endless products of mass destruction for retail buyers. Things like leveraged single-stock ETFs (weekly flows below since 2020) are wildly popular.  Following an epic rebound since last fall, those expecting ever higher stock prices in the next year have reached the most since the survey began in 1987 (Conference Board Survey respondents below, courtesy of Bespoke)!

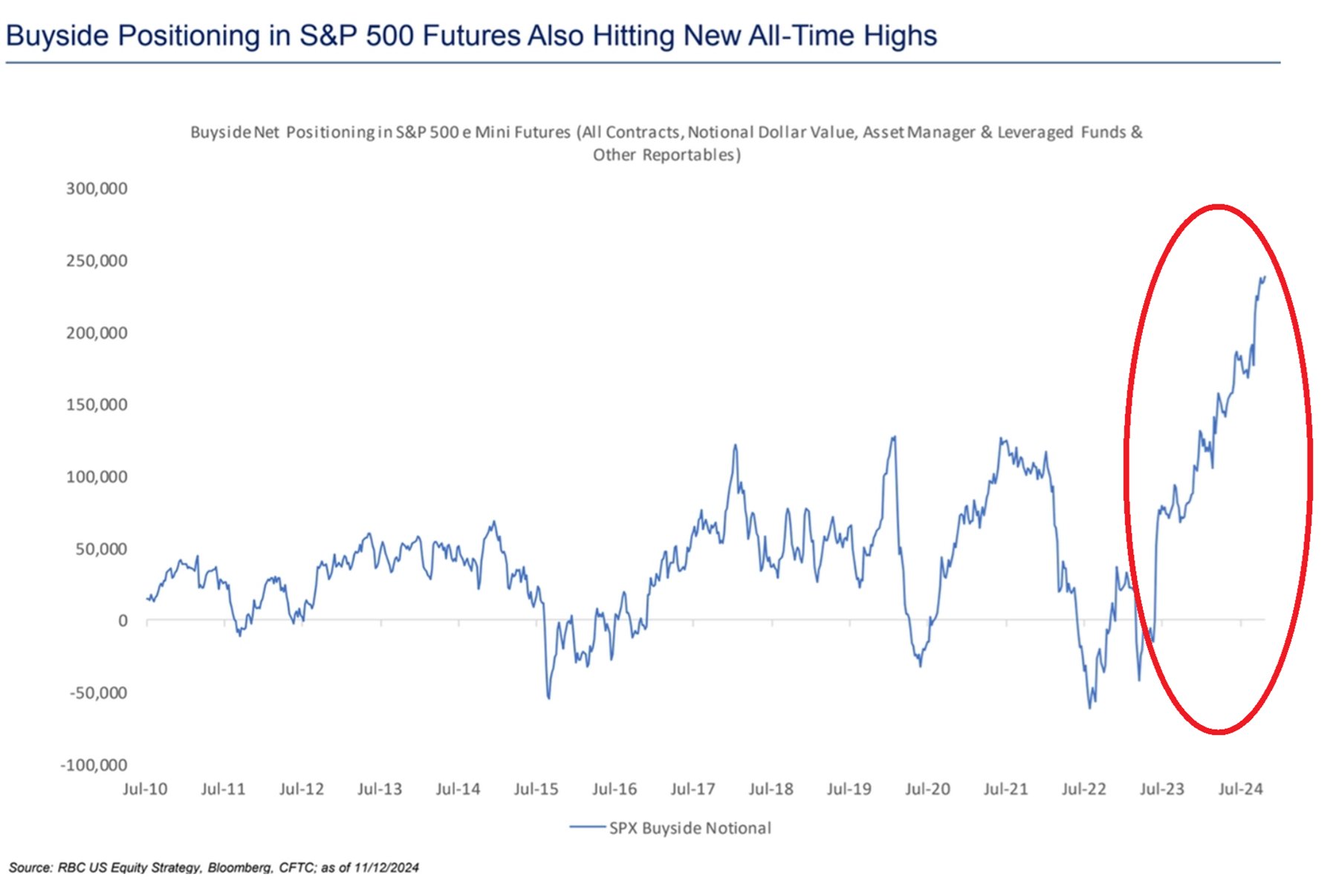

Following an epic rebound since last fall, those expecting ever higher stock prices in the next year have reached the most since the survey began in 1987 (Conference Board Survey respondents below, courtesy of Bespoke)! It is not just the retail crowd; institutional investors are all in and then some (buy-side positioning below since 2010, courtesy of Global Markets Investor).

It is not just the retail crowd; institutional investors are all in and then some (buy-side positioning below since 2010, courtesy of Global Markets Investor).

![]()

Record leverage betting on ever-expanding prices and an endless flow of math-blind buying, what could possibly go wrong?