According to the latest Canadian Association of Insolvency and Restructuring Professionals, 2024 saw a 15-year high in Canadian business and consumer insolvencies—about 375 daily. The group expects pressure on companies and consumers to continue in 2025 amid threats from potential tariffs and mortgage renewals. See, Insolvencies in Canada rose 12.1% in 2024, led by business filings:

The Bank of Canada has lowered its benchmark interest rate to three per cent, down from a high of five per cent, as the economy has weakened.

However, homeowners renewing mortgages in 2025 are likely still facing higher monthly payments than when they last locked in a rate, and prices on many everyday necessities are still more expensive than they were a few years ago.

Businesses are also under pressure.

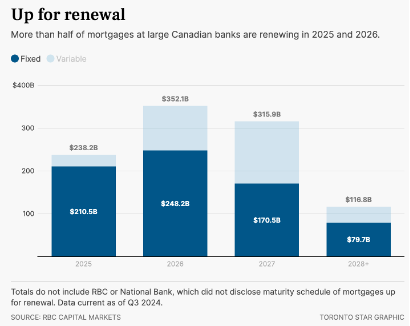

Of the 1.2 million Canadian mortgages that renew in 2025, around 85% were contracted when the Bank of Canada’s overnight rate was at or below 1% compared with 3% now. Those with fixed rate terms have not yet had to confront the payment leap compared with pandemic-era interest rates (dark blue bars below, courtesy of Toronto Star):

While Canadian mortgage rates have decreased from more than 6% in late 2024 to around 4% today, payments on renewal are significantly higher than when rates were in the 2% range four and five years ago.