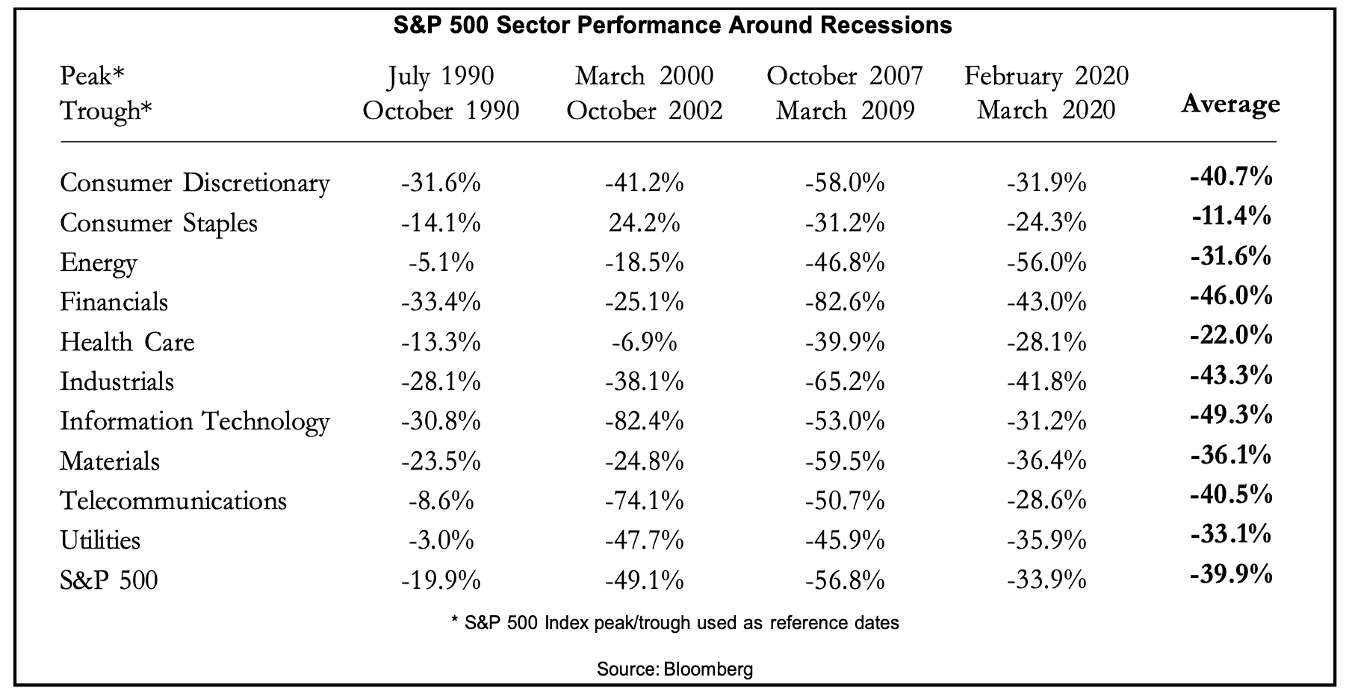

Understanding that “defensive” equities offer little protection in bear markets is critical to meaningful capital protection. The table below (courtesy of Gary Shilling) shows what happened to different sectors and the S&P 500 index overall during past recessions.

Trying to hold through deep declines is hard; most people understandably panic after they have sustained big losses. The final capitulation selling of all those who bought and held ‘high’ brings cycle bottoms, but that ‘deleveraging’ process typically takes 12 to 24 months to complete. We are currently just a few months into this downturn.

Trying to hold through deep declines is hard; most people understandably panic after they have sustained big losses. The final capitulation selling of all those who bought and held ‘high’ brings cycle bottoms, but that ‘deleveraging’ process typically takes 12 to 24 months to complete. We are currently just a few months into this downturn.

Proactive loss-avoidance requires steering clear or stepping away from bubbles before your capital implodes. We must be mature and sober enough to avoid/minimize our exposure to bubbles to miss out on the losses too.

As lovely as your investment adviser may be, the finance sector exists to sell products at every price and keep people holding the bag regardless of the risk-reward prospects for the individual client. Minimizing/avoiding losses takes counter-culture thinking and discipline, but it can be done with independence and a lot of focus.

As noted last week by insolvency counsellor Scott Terrio: “In matters of personal finance, avoidance is a huge protection, but it takes proactive decision-making and good advice. And there seems to be less and less good advice either on the internet or in terms of peer pressure. Avoidability.”

The cycle-savvy insights below are worthwhile.

DoubleLine CEO-CIO and Founder Jeffrey Gundlach joins CNBC’s Closing Bell with Scott Wapner on April 7, 2025, to discuss the recent reciprocal tariffs announced by President Donald Trump, emphasizing the significant widening of credit market spreads. He also expresses concern about the potential for leveraged investors to go bankrupt, stating, “This type of thing usually ends with forced liquidations.” Mr. Gundlach suggests maintaining a defensive position and holding cash due to expected continued volatility. In addition, he highlights rising recession probabilities, the Federal Reserve’s challenges in balancing inflation and recession risks, and the potential impact of tariffs on foreign investment in the U.S. Here is a direct video link.