Risk markets are staging another bear market bounce on Trump’s latest statement that he does not intend to fire Fed Chair Powell. They are also negotiating with China. These things pass as good news today, but the macro picture continues to deteriorate.

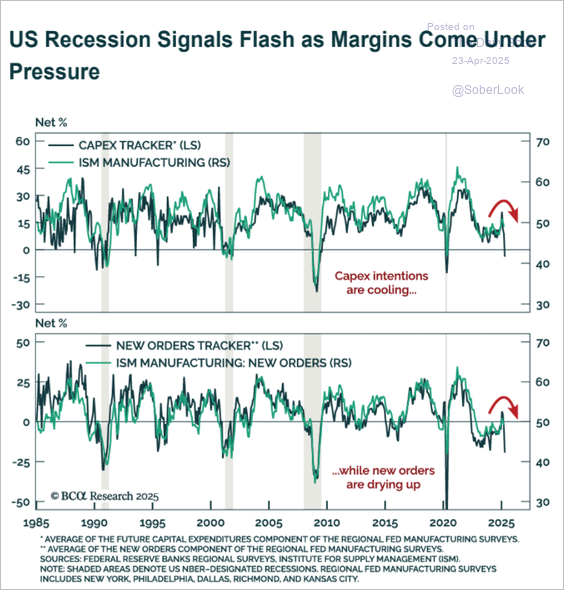

US capital expenditure plans and new orders (black lines below since 1985, courtesy of The Daily Shot) have contracted to levels that coincided with the recessions of 2020, 2008, 2001, and 1990 (grey bars).  A recent Federal Reserve Board of San Francisco report notes spreading recession evidence, Assessing the Recent Rise in Unemployment:

A recent Federal Reserve Board of San Francisco report notes spreading recession evidence, Assessing the Recent Rise in Unemployment:

“Recent transition rates and unemployment duration patterns are similar to historical patterns around the onset of several past recessions.”

“The increase in the unemployment rate since 2023 has mostly been associated with the decline in the job-finding rate, similar to pre-pandemic recessions. Consistent with this, we also find that the median duration of unemployment has increased notably.”

“The recent increase in the overall unemployment rate has been much more gradual than in pre-pandemic recession onsets. However, our findings suggest that unemployment flows—especially the job-finding rate—show a pattern qualitatively similar to past recession onsets and should be closely monitored for signs of rising recession risk.”

According to data compiled by Bloomberg Intelligence, analysts have cut their estimates for first-quarter S&P 500 earnings-per-share growth to 6.9% from 11.4% at the start of the year. See, US Profit Outlook Rarely this Sour.

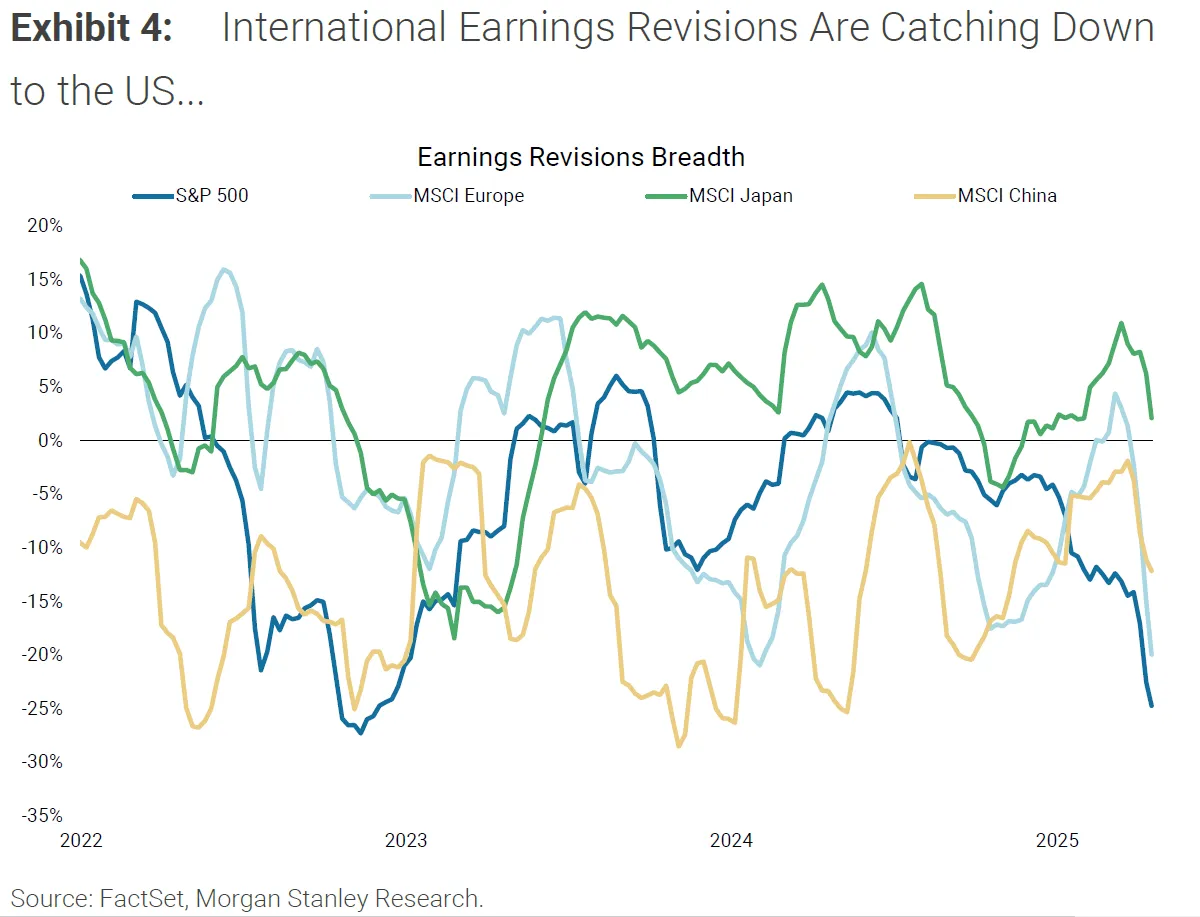

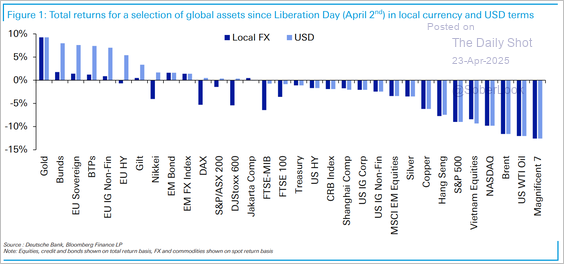

While other developed countries have held up better than US markets year to date, international earnings revisions (green, yellow and light blue below since 2022) are now catching down to America (dark blue).  Nearly every global asset class has tumbled in April (dark blue below in local currency terms, light blue in USD terms). Equity losses have been significant, but still nowhere close to the average 34% decline that has unfolded in past US recessions.

Nearly every global asset class has tumbled in April (dark blue below in local currency terms, light blue in USD terms). Equity losses have been significant, but still nowhere close to the average 34% decline that has unfolded in past US recessions.

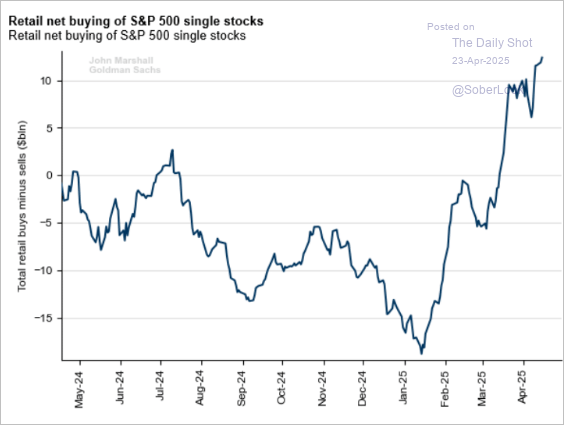

So far, retail continues to buy (S&P 500 single stock buys since last May). At bear market bottoms, retail is liquidating with both hands and feet. There is no capitulation sign here yet, either.

So far, retail continues to buy (S&P 500 single stock buys since last May). At bear market bottoms, retail is liquidating with both hands and feet. There is no capitulation sign here yet, either.