This morning, the first quarter 2025 US GDP estimate disappointed with a -0.3% annualized contraction (vs. -0.2% annualized estimate). At the same time, US consumer confidence surveys show future expectations at a 14-year low (below via Bloomberg, see US consumer confidence slumps). All three expectation components — business conditions, employment prospects, and future income — deteriorated sharply.

All three expectation components — business conditions, employment prospects, and future income — deteriorated sharply.

We also learned that private US employers added 62,000 jobs in April, significantly below economists’ expectations of around 115,000, marking the smallest gain since July 2024. See US Firms Add 62,000 Jobs, Smallest Gain Since July in ADP Data.

Corporate executives have signalled concerns that the recent plunge in confidence will filter through into weaker demand while warning that consumers can expect higher prices because of tariffs.

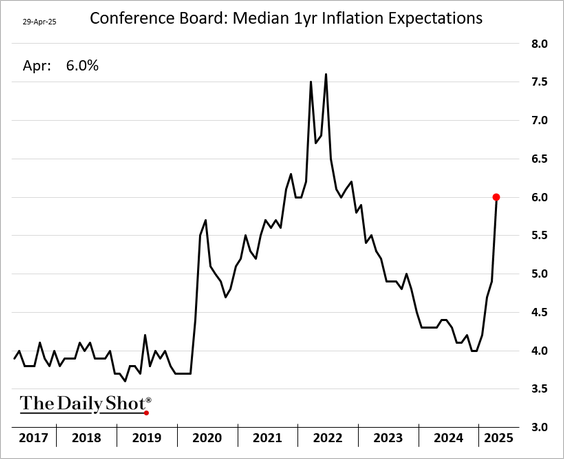

The latest Conference Board report for April shows that median 1-year consumer inflation expectations rose to 6%—the highest since November 2022 (below via The Daily Shot).  This is a tough spot for the US Fed, which has the dual, conflicting mandate of maintaining price stability and full employment. So far, they have chosen a tighter monetary stance against inflation risks over a deteriorating job market.

This is a tough spot for the US Fed, which has the dual, conflicting mandate of maintaining price stability and full employment. So far, they have chosen a tighter monetary stance against inflation risks over a deteriorating job market.

Risk assets are in revolt, unaccustomed to being left without a bailout from their own reckless excesses.

At the same time, amid cancelled and delayed shipments, China’s official manufacturing purchasing managers’ index contracted to 49 in April, the weakest level since December 2023. See China’s manufacturing activity shrinks as US tariffs take effect.

China’s National Bureau of Statistics noted that there were “no winners in trade wars” and pointed to pressure on manufacturing data in other large economies.

China Beige book offers a pulse on the world’s second-largest economy in the segment below. In a blinking contest between the US and Chinese presidents, China will likely have more pain tolerance.

Shehzad Qazi, China Beige Book COO, joins ‘Squawk Box’ to discuss the impact of tariffs on China’s economy, the impact on Chinese exports and manufacturing activity, what China’s pain tolerance is for tariffs, what the endgame is in the U.S.-China trade war, and more. Here is a direct video link.