Yesterday, the US Federal Reserve held its policy rate steady at 4.25%–4.50%, as Chair Jerome Powell admitted he doesn’t know whether rising inflation or surging unemployment will hit hardest.

In the meantime, indebted businesses and consumers feel the pressure of interest rates near multi-decade highs.

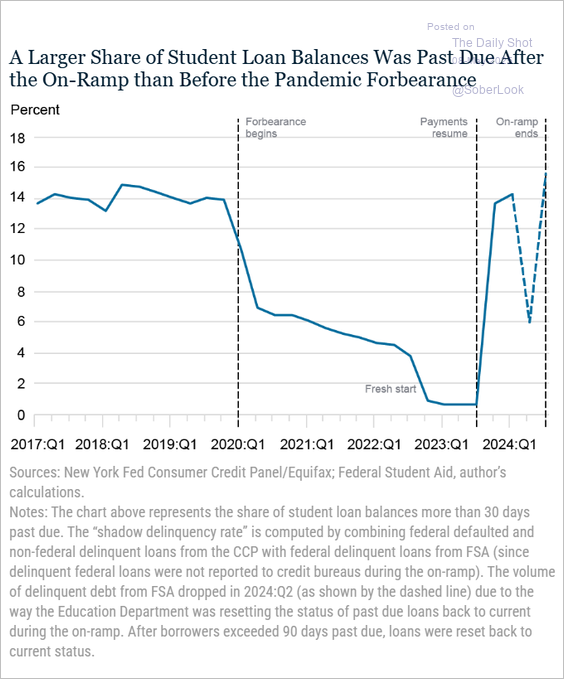

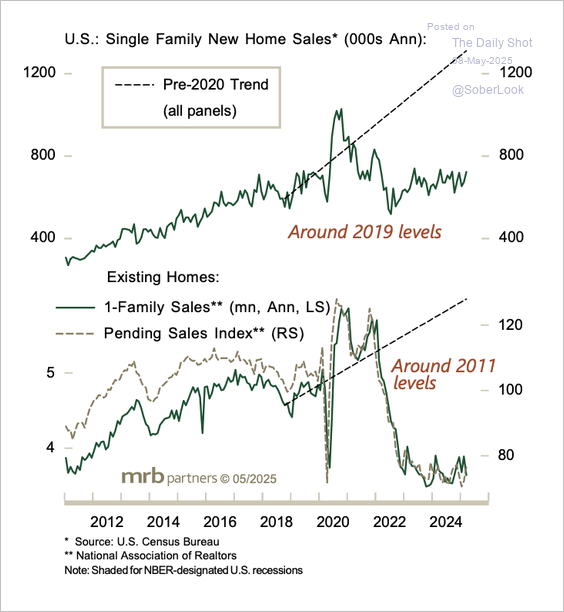

A larger share of student loan balances are past due now than before the pandemic forbearance began (below since 2017, courtesy of The Daily Shot), and the Trump administration resumed collection efforts on Monday after a roughly five-year hiatus. See: Trump administration to garnish wages of 5.3 million defaulted student loan borrowers this summer. As US 30-year fixed mortgage rates hover around 6.76%, new US home sales have fallen to 2019 levels, and existing home sales to a 14-year low.

As US 30-year fixed mortgage rates hover around 6.76%, new US home sales have fallen to 2019 levels, and existing home sales to a 14-year low. Canadian real estate boards report that home resales fell significantly in April from a year ago in most markets (blue below with new listings in yellow). The MLS Home Price Index fell again in several markets, including the Toronto region, Hamilton, Kitchener-Waterloo, Cambridge, Vancouver and Fraser Valley—extending months-long negative streaks. Even the Calgary index recorded its first year-over-year decline in five years. See RBC: Canada’s housing markets crack.

Canadian real estate boards report that home resales fell significantly in April from a year ago in most markets (blue below with new listings in yellow). The MLS Home Price Index fell again in several markets, including the Toronto region, Hamilton, Kitchener-Waterloo, Cambridge, Vancouver and Fraser Valley—extending months-long negative streaks. Even the Calgary index recorded its first year-over-year decline in five years. See RBC: Canada’s housing markets crack. Many people alive today did not think that home prices could go down. They also erroneously believe that central banks will not ‘let’ stock markets fall. The truth is that central banks do not have the power to bail out a world full of reckless and wilfully blind financial decisions, especially with asset prices still at uneconomically high levels and revenues in retreat.

Many people alive today did not think that home prices could go down. They also erroneously believe that central banks will not ‘let’ stock markets fall. The truth is that central banks do not have the power to bail out a world full of reckless and wilfully blind financial decisions, especially with asset prices still at uneconomically high levels and revenues in retreat.

DDB offered lucid updates on the many moving parts yesterday. Worth a listen.

Danielle DiMartino Booth, CEO of QI Research and former Fed advisor, joins Jeremy Szafron to break down why she believes the Fed is missing clear signs of recession and a credit crunch already hitting Main Street. Here is a direct video link.

QI Research CEO and chief strategist Danielle DiMartino Booth discusses China’s stimulus plan and the Federal Reserve’s interest rate strategy on ‘Making Money.’ Here is a direct video link.