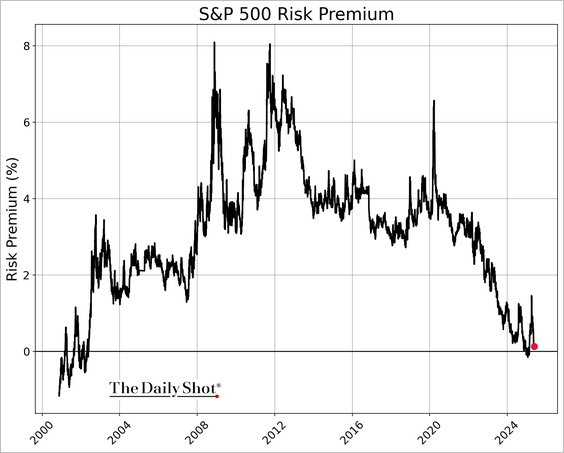

The S&P 500 risk premium—forward earnings yield minus the 10-year Treasury yield—is once again about zero (below since 2000, via The Daily Shot). Such dismal equity risk-reward prospects have only been seen once in the last quarter century and that was coming out of the 2000 bubble top.  The large cap S&P 500 went on to crash 45% from March 2000 to October 2002 and did not recover its 2000 cycle high until July 2007, whereafter it crashed 56% into March 2009. It would not be until January 2013 that the S&P 500 durably reclaimed its 2000 secular high. Decade + periods of negative returns are the typical aftermath of extreme overpricing periods. Believe it or not.

The large cap S&P 500 went on to crash 45% from March 2000 to October 2002 and did not recover its 2000 cycle high until July 2007, whereafter it crashed 56% into March 2009. It would not be until January 2013 that the S&P 500 durably reclaimed its 2000 secular high. Decade + periods of negative returns are the typical aftermath of extreme overpricing periods. Believe it or not.

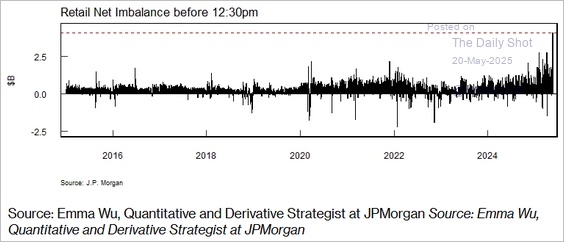

Heavy participation from retail bagholders ‘investors’ is typical of market tops. Retail dip-buyers purchased a record $4.1 billion in US stocks during the first three hours of Monday’s trading session (shown below since 2014).

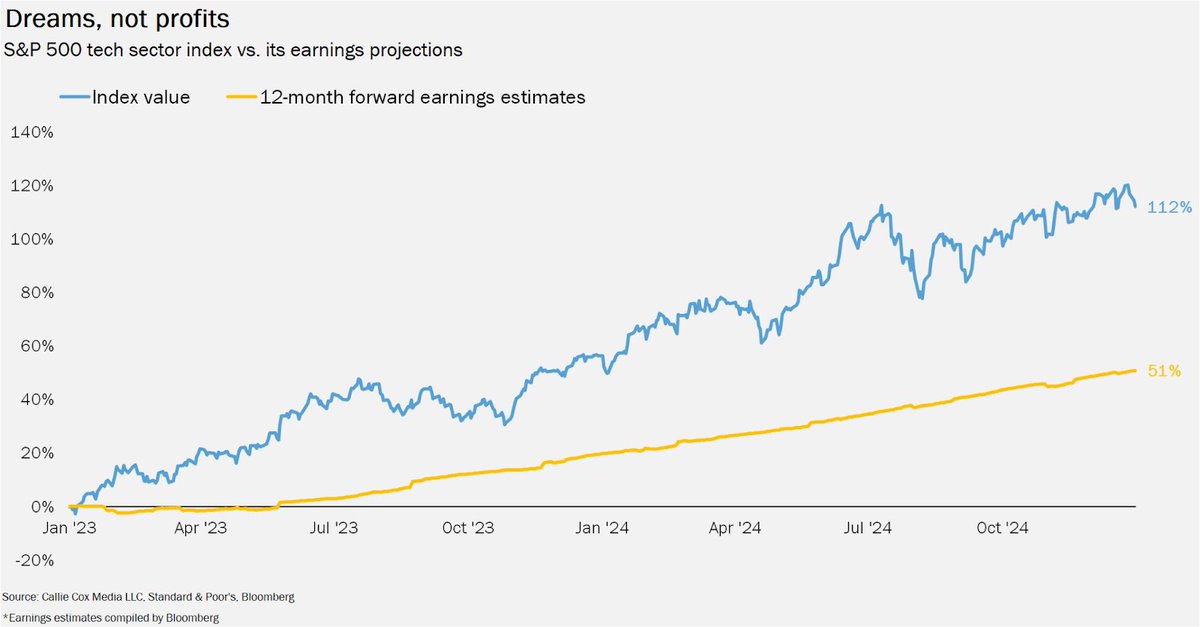

Finance-funded media has sucessfully fuelled another round of market mania in the past few years and enabled prices to dramatically overshoot earnings growth.

Finance-funded media has sucessfully fuelled another round of market mania in the past few years and enabled prices to dramatically overshoot earnings growth.

This is true even in the highest growth tech space. S&P 500 tech companies’ estimated earnings (yellow line below since 2023) grew an impressive 50% from 2023-2024 but their share prices (in blue) jumped an average of 112% (chart via @callieabost). Just as real estate owners are finding out the hard way (again), buying assets at uneconomical prices may seem busy and smart in the near-term, but mean reversion periods inevitably take back unearned winnings.

Just as real estate owners are finding out the hard way (again), buying assets at uneconomical prices may seem busy and smart in the near-term, but mean reversion periods inevitably take back unearned winnings.

Bear markets, it is said, are periods when assets are returned to their rightful owners–strong hands take back from weak. And so it goes, cycle after cycle. This time is not going to be different.