China’s Caixin purchasing managers’ index unexpectedly fell in May to 48.3 (sub-50 signals contraction) as US tariffs took a toll on smaller exporters. The consensus had expected the gauge to improve, not worsen.

At the same time, US manufacturing activity contracted further in May to the lowest level since November. The Institute for Supply Management (ISM) purchasing managers’ index of manufacturing activity fell to 48.5 in May, from 48.7 in April. It was last above 50 in January and February, though that followed 26 consecutive months of contraction.

New orders and backlog of orders indices declined at slower rates than in April, though new export orders at 40.1 from 43.1 in April were lows only seen in the 2008-09 and 2020 recessions. Excluding the pandemic period, new export orders were at their lowest reading since 2009.

The downturn in Canada’s manufacturing economy continued in May (below since 2011) with output and new orders both lower, while manufacturing employment decreased at the fastest rate in nearly five years. The OECD’s latest Economic Outlook projects global growth slowing from 3.3% in 2024 to 2.9% in both 2025 and 2026 — the first growth rates under 3% since 2020.

The OECD’s latest Economic Outlook projects global growth slowing from 3.3% in 2024 to 2.9% in both 2025 and 2026 — the first growth rates under 3% since 2020.

US growth is projected to slow from 2.8% in 2024 to just 1.6% in 2025 and 1.5% in 2026. Only in the harshest recessions (2008-09, 2001-02, 1990-91 and 1974-75) has US GDP growth averaged 1.5% in back-to-back years. At the same time, the OECD expects that higher inflation will prevent the Federal Reserve from cutting rates in 2025.

Globally, the slowdown is expected to be most concentrated in the United States, Canada, Mexico and China, with smaller downward adjustments in other economies. The negative impact on Canada’s economy is projected to be among the most severe (shown below).

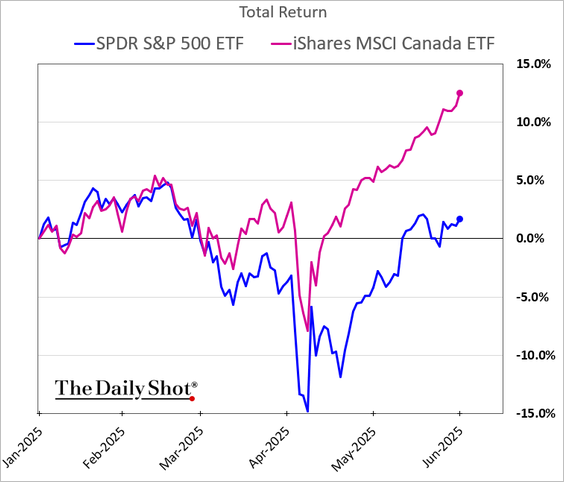

Meanwhile, Canada’s TSX Composite stock index has rebounded to all-time highs since April, up 2.6% since December 5, 2024, and outperforming the S&P 500’s 2% decline since then (both shown below year-to-date).

Meanwhile, Canada’s TSX Composite stock index has rebounded to all-time highs since April, up 2.6% since December 5, 2024, and outperforming the S&P 500’s 2% decline since then (both shown below year-to-date).

It is typical for the TSX to outperform late in market cycles before drawing down sharply during central bank easing efforts heading into recessions.

As the OECD points out, climbing stock prices with contracting economic growth is a counter-productive and foreboding financial setup:

“Historically elevated” equity valuations are increasing vulnerabilities to negative shocks in financial markets. A long spell of weak investment has compounded the longer-term challenges facing OECD economies, and this is further sapping the growth outlook. “Despite rising profits, firms have shied away from fixed-capital investment in favour of accumulating financial assets and returning funds to shareholders,” the OECD said. “Boosting investment will be instrumental to revive our economies and improve public finances.”